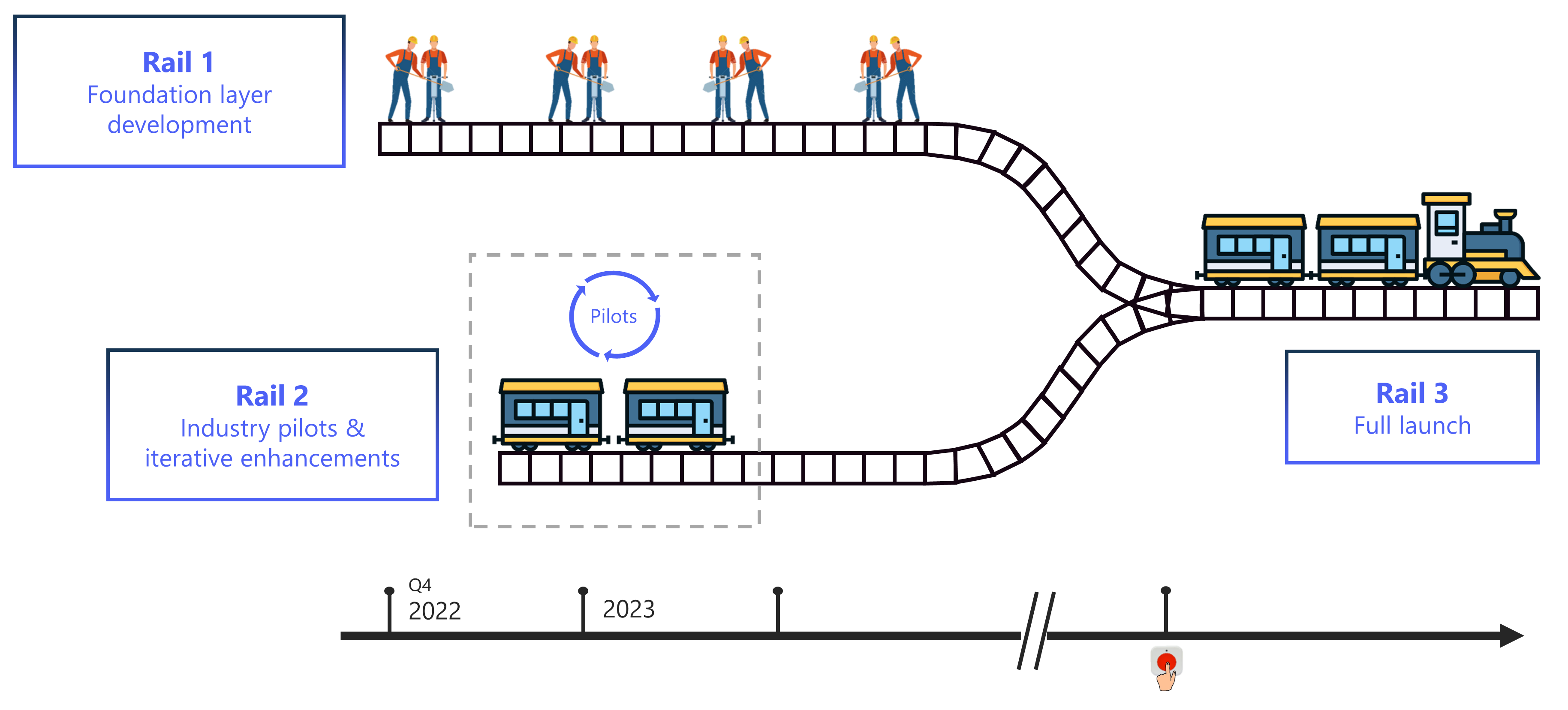

In March 2024 the HKMA launched Project Ensemble, a new wholesale central bank digital currency (wCBDC) project, to support the development of the tokenisation market in Hong Kong. Project Ensemble seeks to explore innovative financial market infrastructure (FMI) that will facilitate seamless interbank settlement of tokenised money through wCBDC. The project will initially focus on tokenised deposits, which is a digital representation of commercial bank deposits. With wCBDC as the foundation, tokenised deposits can be used for tokenised asset transactions.

At the core of Project Ensemble is the Project Ensemble Sandbox (Sandbox) that will be launched in 2024 to further research and test tokenisation use cases, including, among others, settlement of tokenised real world assets. It could potentially forge a new FMI that bridges the existing gap between tokenised real world assets and money in transactions. If the Sandbox garners sufficient interest from the industry, the HKMA will consider conducting a “live” issuance of wCBDC at an appropriate time.

For general enquiries about Project Ensemble, please contact us via ensemble@hkma.gov.hk . For enquiries about the Sandbox, please reach out to us via ensemble_sandbox@hkma.gov.hk .

To help set industry standards and a future-proof strategy, the HKMA formed the Project Ensemble Architecture Community (the Community) in May 2024. Please refer to the relevant section below for more details of the Community.

Project Ensemble Architecture Community

The Community aims to develop a set of industry standards to support interoperability among wCBDC, tokenised money and tokenised assets. It will make recommendations on specific topics, initially focusing on setting up a mechanism to support seamless interbank settlement of tokenised deposit through wCBDC for tokenised asset transactions.

The formation of the Community is based on a range of careful considerations, including the members’ expertise in contributing to the development of the tokenisation market in Hong Kong, experience and competency in relevant fields and innovative capability. The HKMA will be working closely with the industry, and review the size and composition of the Community from time to time as and when deemed appropriate.

For enquiries about the Community, please contact us via ensemble_ac@hkma.gov.hk .

List of Community Members (by alphabetical order for each category)

List of Community Members (by alphabetical order for each category)

Project Ensemble Sandbox

The HKMA has completed the building and setup of the Sandbox, which is designed to facilitate interbank settlement using experimental tokenised money, focusing on transactions involving tokenised assets. Through the Sandbox, the HKMA seeks to examine technical interoperability among tokenised assets, tokenised deposits and wCBDC, while enabling industry participants to conduct end-to-end testing of tokenised asset transactions in practical business scenarios.

After thorough consideration of industry interest, prevailing market trends and potential innovative impact, the initial round of experimentation will cover tokenisation of both traditional financial assets and real-world assets, focusing on four main themes: fixed income and investment funds, liquidity management, green and sustainable finance, and trade and supply chain finance. The HKMA will continue to actively engage with the industry to gauge interest in tokenisation, develop new themes and identify further use cases for tokenisation.

Four main themes and their corresponding use case categories to be tested on the Project Ensemble Sandbox

Four main themes and their corresponding use case categories to be tested on the Project Ensemble Sandbox

.jpg)