Payment and Transfer

General Banking Services

Notes and Coins

Hong Kong as an International Financial CentreFintechBond Market DevelopmentFinancial Market InfrastructureStored Value Facilities and Retail Payment SystemsStablecoin IssuersSoft InfrastructureInternational & Regional Financial Co-operationCentre for Green and Sustainable FinanceHKMA Infrastructure Financing Facilitation OfficeCross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay AreaGlobal Financial Leaders' Investment SummitHKMA – BIS High-Level Conference

Hong Kong as an International Financial CentreFintechBond Market DevelopmentFinancial Market InfrastructureStored Value Facilities and Retail Payment SystemsStablecoin IssuersSoft InfrastructureInternational & Regional Financial Co-operationCentre for Green and Sustainable FinanceHKMA Infrastructure Financing Facilitation OfficeCross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay AreaGlobal Financial Leaders' Investment SummitHKMA – BIS High-Level Conference

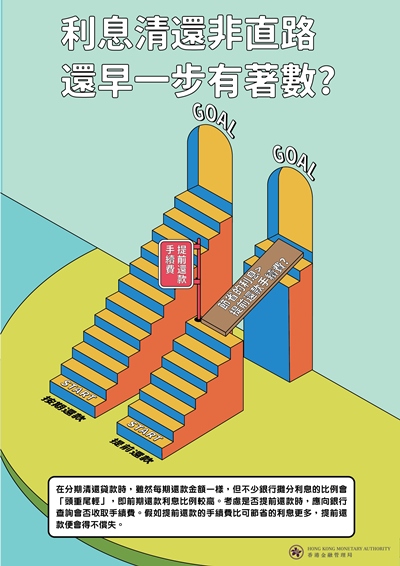

-and-the-Points-to-Note-for-Early-Repayment.jpg)