(This article may be read in conjunction with the inSight “Tokenised Bond: Huge Potential to be Unlocked” in 2023)

In 2021, the HKMA launched Project Evergreen to explore how distributed ledger technology (DLT) could potentially improve capital market processes and enhance market efficiency, liquidity and transparency. We focused initially on the bond market, and assisted the Government in issuing two successful tokenised green bonds, achieving groundbreaking developments and generating keen market interest.

Tokenisation has since gained much momentum. So far, market estimates suggest that over US$10 billion worth of tokenised bonds in total notional value have been issued in the last decade globally.1 We have also been giving this a lot of thought – what’s next for Project Evergreen? What more can we achieve?

Project Evergreen - the next phase

With two successful issuances, Project Evergreen has moved far beyond proof-of-concept for bond tokenisation. As we move on to the next phase, our goal should be to promote the wider adoption of what is viable, while pushing the boundaries of what is possible.

Driving broader adoption

For some bond issuers, there remain hurdles to adopt DLT, from the technical, operational, and legal perspectives. While the relevant additional costs may be reduced over time as DLT adoption becomes more commonplace in capital markets, at the current juncture, we believe additional incentive can help encourage take-up. This is what prompted us to introduce the Digital Bond Grant Scheme (Scheme) to support digital bond issuance in Hong Kong. The Scheme will start accepting applications today. A maximum grant of HK$2.5 million will be offered to each eligible issuance. Details of the Scheme can be found here.

Market participation also hinges on two important factors: accessibility and liquidity. Our second issuance under Project Evergreen adopted a “hybrid” model, which gave investors, in addition to direct participation via the digital assets platform, the additional option to indirectly access the digital bond via traditional market infrastructures – Hong Kong’s Central Moneymarkets Unit (CMU) and its linkages with overseas clearing houses. Through this indirect access option, “newcomers” were able to familiarise with the technology while maintaining existing workflows, which greatly lowered technical and operational hurdles. Some of these investors might gradually increase their degree of on-chain participation as they build up experience and expertise. Recently, we have seen other official sector and corporate issuers in different jurisdictions adopting similar hybrid investor access models for their issuances.

The second tokenised issuance was seven times larger than the first issuance, which also helped attract more institutional investors, and in turn, enhanced liquidity in the secondary market. For example, earlier this year, two banks executed a repo transaction using the Government’s digital bond as collateral, marking the first repo in Hong Kong involving digital bonds. With more secondary market and repo activities unlocked, digital bonds can go beyond “buy-and-hold to maturity” and offer more options for market participants like traditional bonds, which is conducive to growing the liquidity of digital bonds. To provide a steady supply of high quality issuances and encourage more investors to enter the market, we are also exploring more tokenised government bond issuances in Hong Kong.

Knowledge and awareness are also important accelerants to adoption. Throughout Project Evergreen, we have been documenting various aspects of the project in detail and actively sharing our experiences with the broader financial community. Last year, we published a blueprint of the key considerations and options of a tokenised issuance. To further enhance the industry’s awareness and understanding of digital bonds, we have recently launched EvergreenHub, a one-stop knowledge repository on digital bond transactions. As the digital bond market progresses, we will continue to collaborate with the industry to enrich the content of EvergreenHub.

Pushing the boundaries

To fully reap the potential of DLT, we need to keep pushing the boundaries and explore further innovation. Collaboration with the industry is core to the success of Project Evergreen – so far we have worked with the Bank for International Settlements Innovation Hub (BISIH), platform providers (Goldman Sachs and HSBC), as well as a good number of financial institutions and legal experts. Going forward, we will focus on the following areas:

- Interoperability. Market scalability often hinges on the extent to which different infrastructures and platforms can “talk” to each other. For example, a common, machine-readable language (e.g. the International Capital Market Association’s Bond Data Taxonomy) could pave the way for cross-system straight-through processing. At the infrastructure level, the integration of digital and existing infrastructures, which we will take further by supporting more digital bond issuances in Hong Kong via the digital assets platform partnership between CMU and HSBC, could foster cross-system connectivity too. At the same time, we are also exploring with other market participants in respect of connectivity across platforms and systems, with a view to linking up and integrating otherwise fragmented liquidity pools.

- Secondary market and collateral mobility. Marketability and demand of digital bond could be supported by secondary market use cases, such as mobilising digital bond as collateral for repo financing. To fuel a sufficient and steady supply of digital bonds, besides promoting more issuances, we will also look into the feasibility of tokenising existing, issued traditional bonds to expand the market’s collateral pool. To lead by example, we will explore starting with Government bonds.

- Retail market. Another key appeal of DLT is the ability to fractionalise ownership. This presents opportunity to enhance retail access to the bond market. The concept of a retail tokenised green bond had already been tested in our joint project with the BISIH, i.e. Project Genesis. Still, putting this concept into action would take additional time and effort, and involve considerable complexities in legal, technological, and operational aspects. Nonetheless, we will continue to explore various possible options with the industry and extend our new breakthroughs to the retail level.

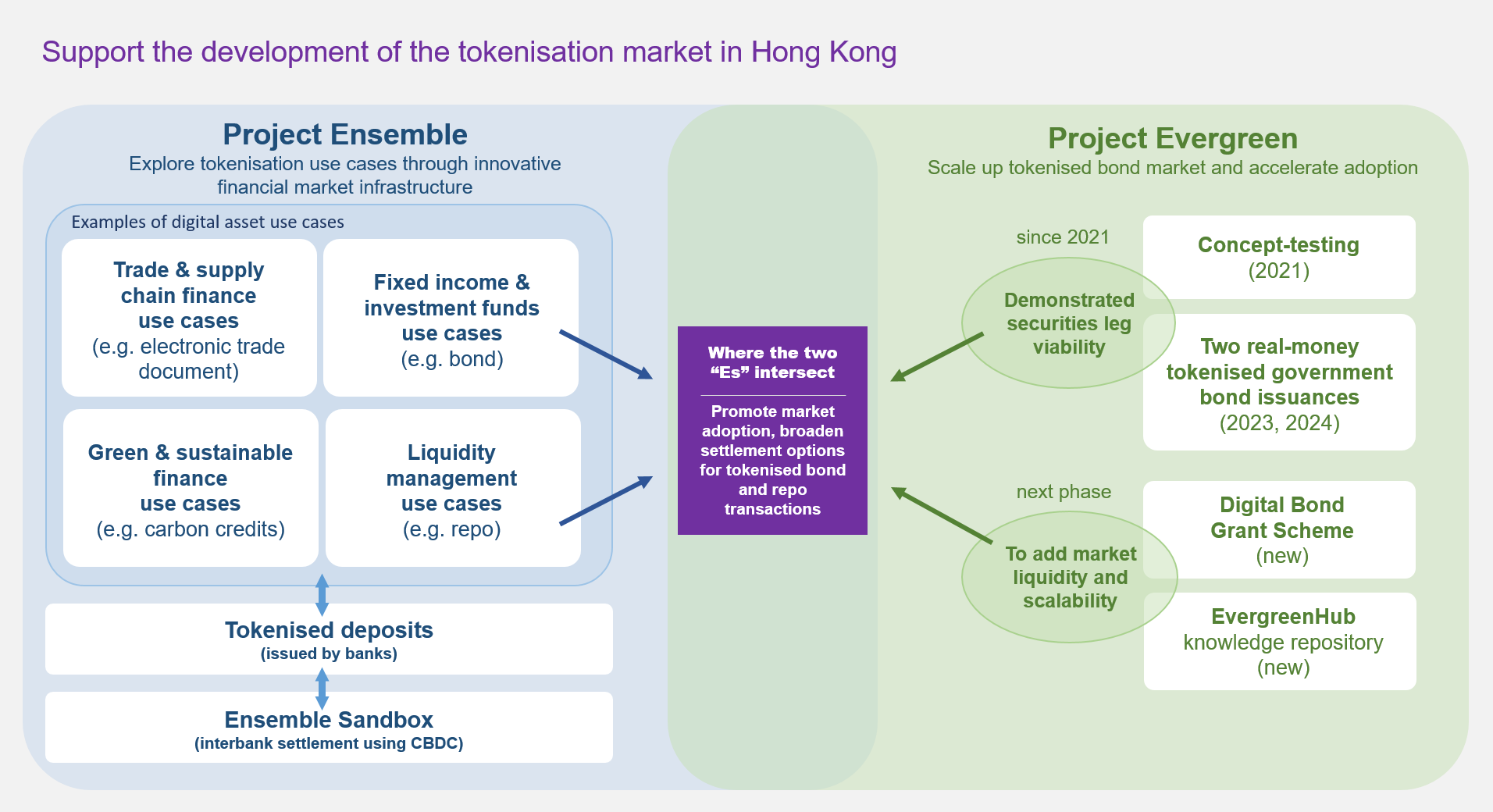

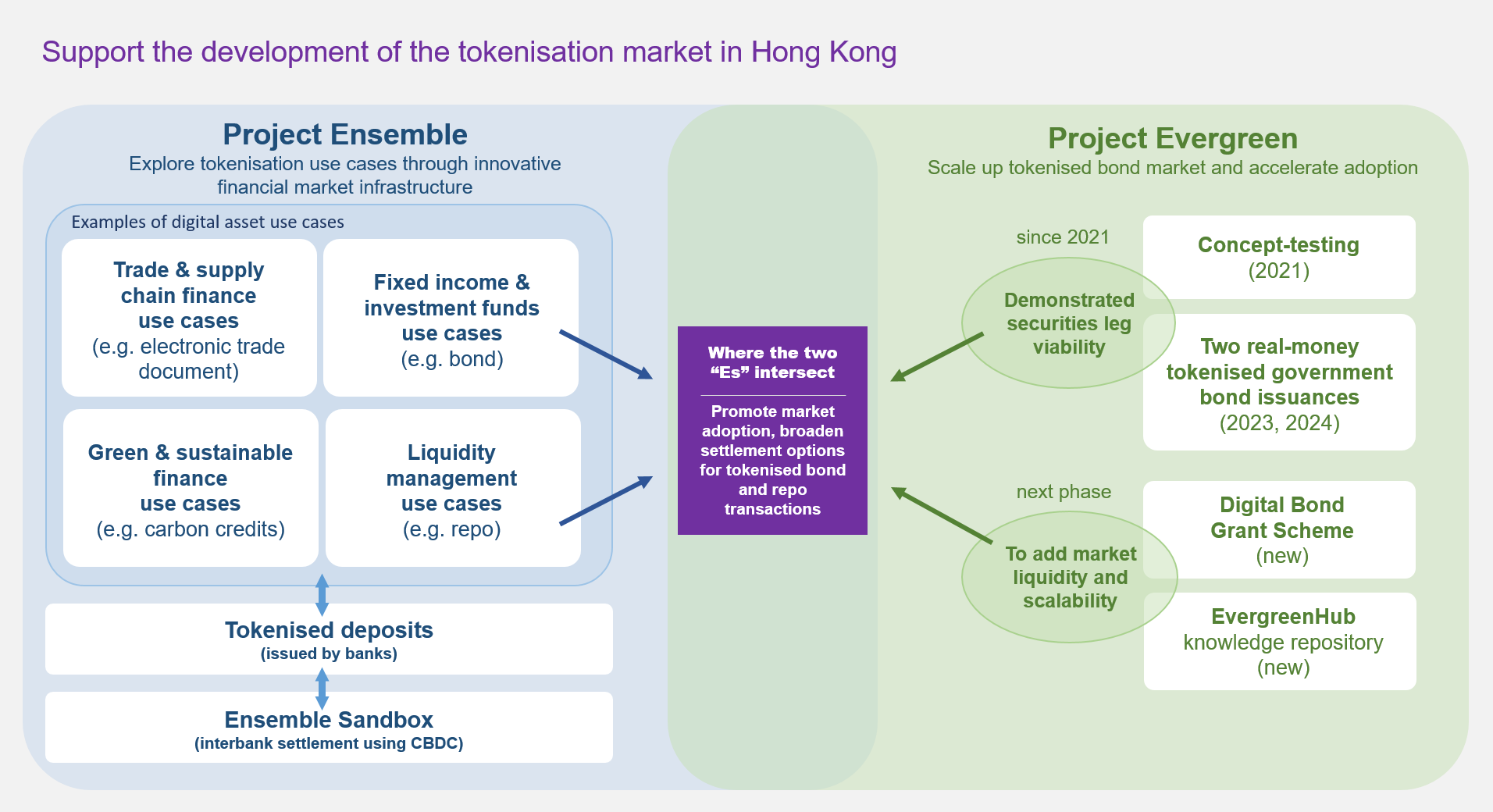

Where the two “Es” intersect

Those of you that keep a close watch of the HKMA’s work should be aware that we have two projects working on the commercial application of tokenisation – Project Evergreen and Project Ensemble. The two projects run in parallel and intersect, allowing us to more deeply and comprehensively explore the application of tokenisation across different fields, in order to fully unlock its potential. Project Evergreen focuses on a market that has shown early promise – the bond market. Project Ensemble, on the other hand, is supporting the development of tokenisation market in Hong Kong through an innovative financial market infrastructure, the Ensemble Sandbox, and exploration of tokenisation use cases with the industry. This includes use cases in the areas of fixed income and investment funds, liquidity management, green and sustainable finance, and trade and supply chain finance, with an initial focus on using tokenised deposits as the settlement means for tokenised asset transactions. As captured in the diagram below, there is synergy between the two projects. This is something that we will explore further.

I look forward to continuing this journey to enrich Hong Kong’s DLT ecosystem.