Payment and Transfer

General Banking Services

Notes and Coins

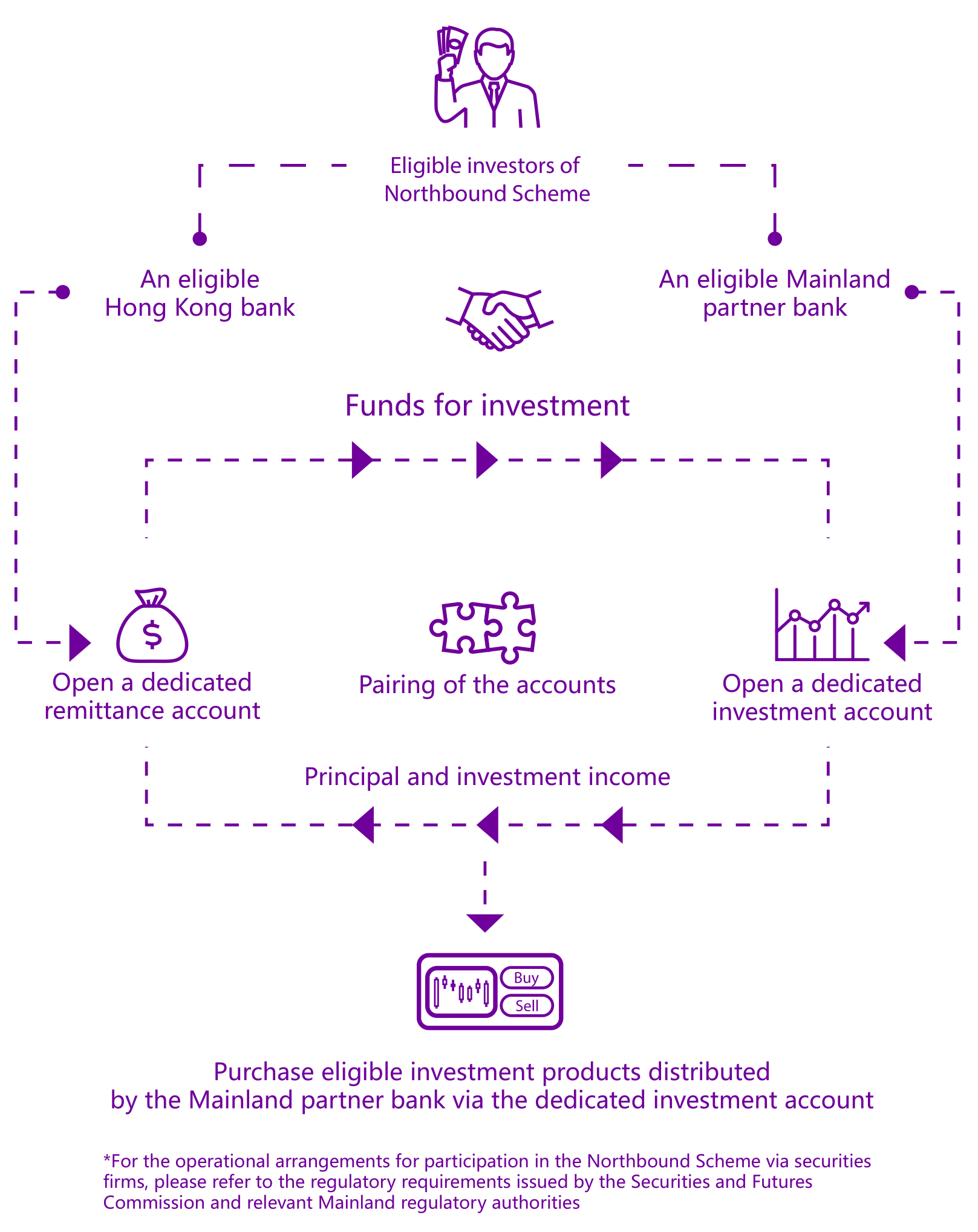

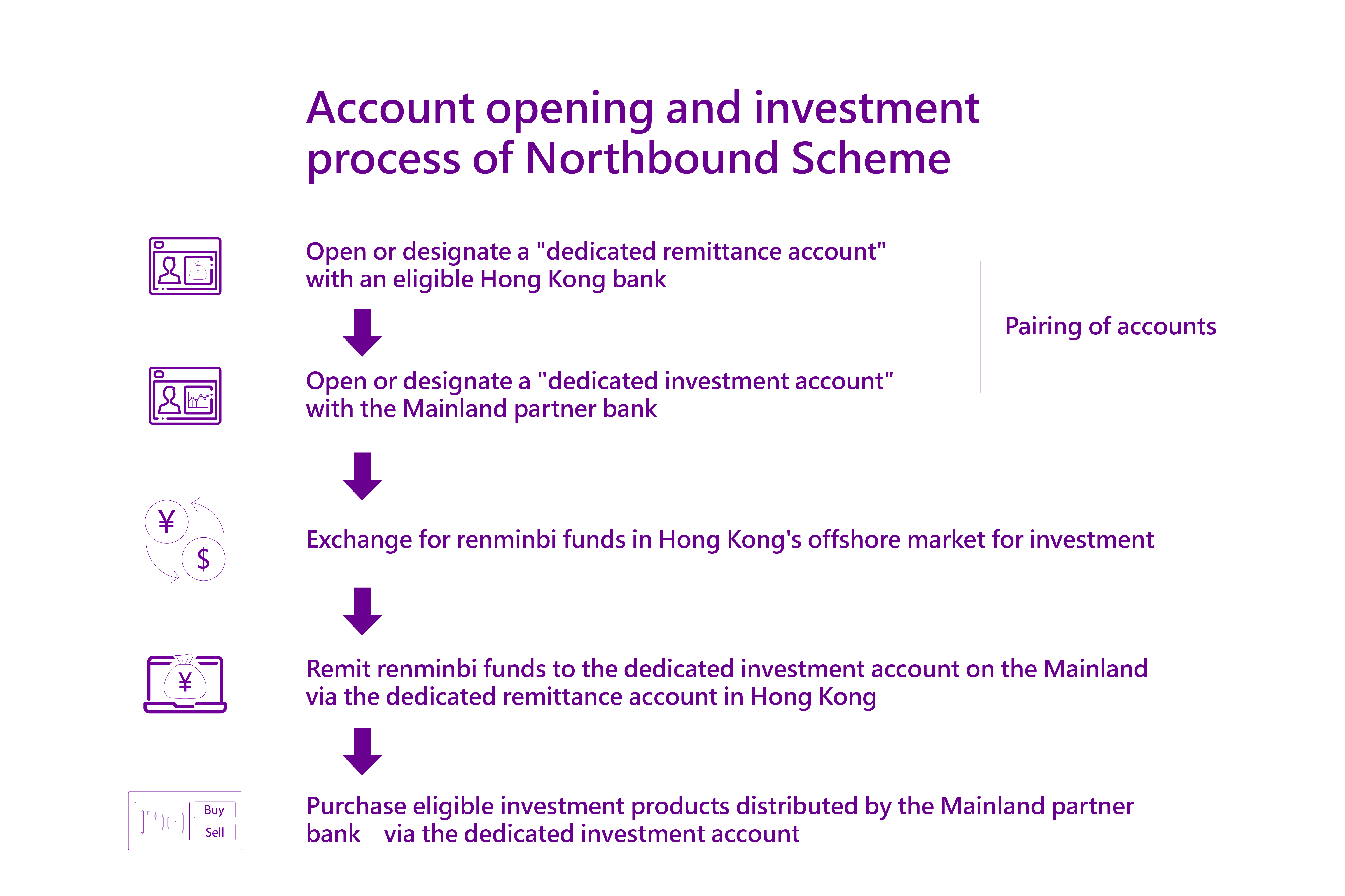

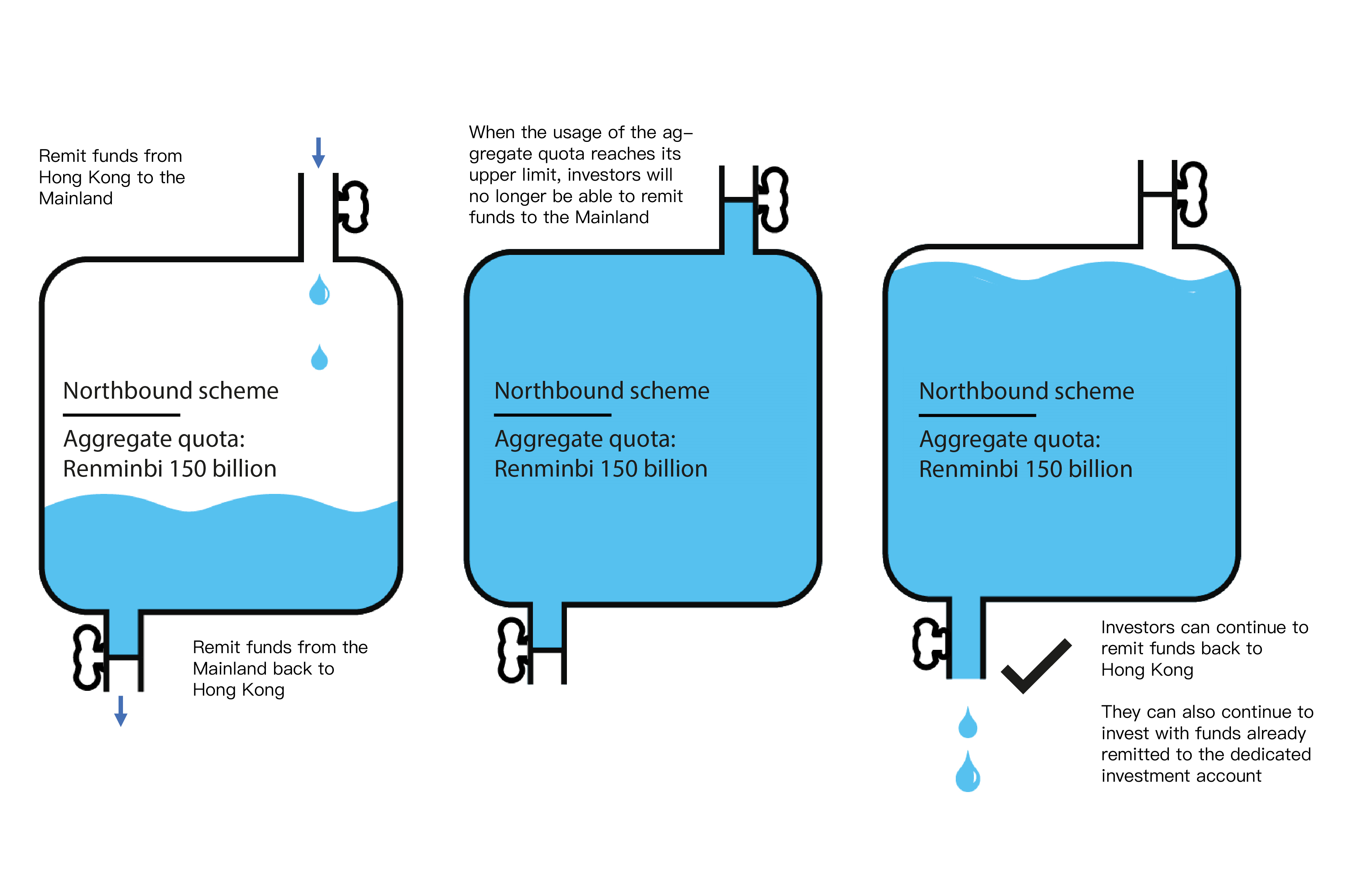

Hong Kong as an International Financial CentreFintechBond Market DevelopmentFinancial Market InfrastructureStored Value Facilities and Retail Payment SystemsStablecoin IssuersSoft InfrastructureInternational & Regional Financial Co-operationCentre for Green and Sustainable FinanceHKMA Infrastructure Financing Facilitation OfficeCross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay AreaGlobal Financial Leaders' Investment SummitHKMA – BIS High-Level Conference

Hong Kong as an International Financial CentreFintechBond Market DevelopmentFinancial Market InfrastructureStored Value Facilities and Retail Payment SystemsStablecoin IssuersSoft InfrastructureInternational & Regional Financial Co-operationCentre for Green and Sustainable FinanceHKMA Infrastructure Financing Facilitation OfficeCross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay AreaGlobal Financial Leaders' Investment SummitHKMA – BIS High-Level Conference