The Cross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay Area (“Cross-boundary WMC”) is one of the key initiatives under the mutual market access schemes between the capital markets of Hong Kong, Macao and the Mainland. The scheme was launched in September 2021, allowing eligible Mainland, Hong Kong and Macao residents in the Guangdong-Hong Kong-Macao Greater Bay Area (“GBA”) to invest in wealth management products distributed by banks in each other’s market through a closed-loop funds flow channel established between their respective banking systems. A major breakthrough of the Cross-boundary WMC is the considerable degree of flexibility given to individual retail investors to open and operate cross-boundary investment accounts directly, through a formal and convenient channel, and to choose their preferred products. In January 2024, enhancement measures for the Cross-boundary WMC were announced to refine the eligibility criteria of Mainland investors, expand the scope of participating institutions to include eligible securities firms, expand the scope of eligible products, increase the individual investor quota and further enhance the promotion and sales arrangements.

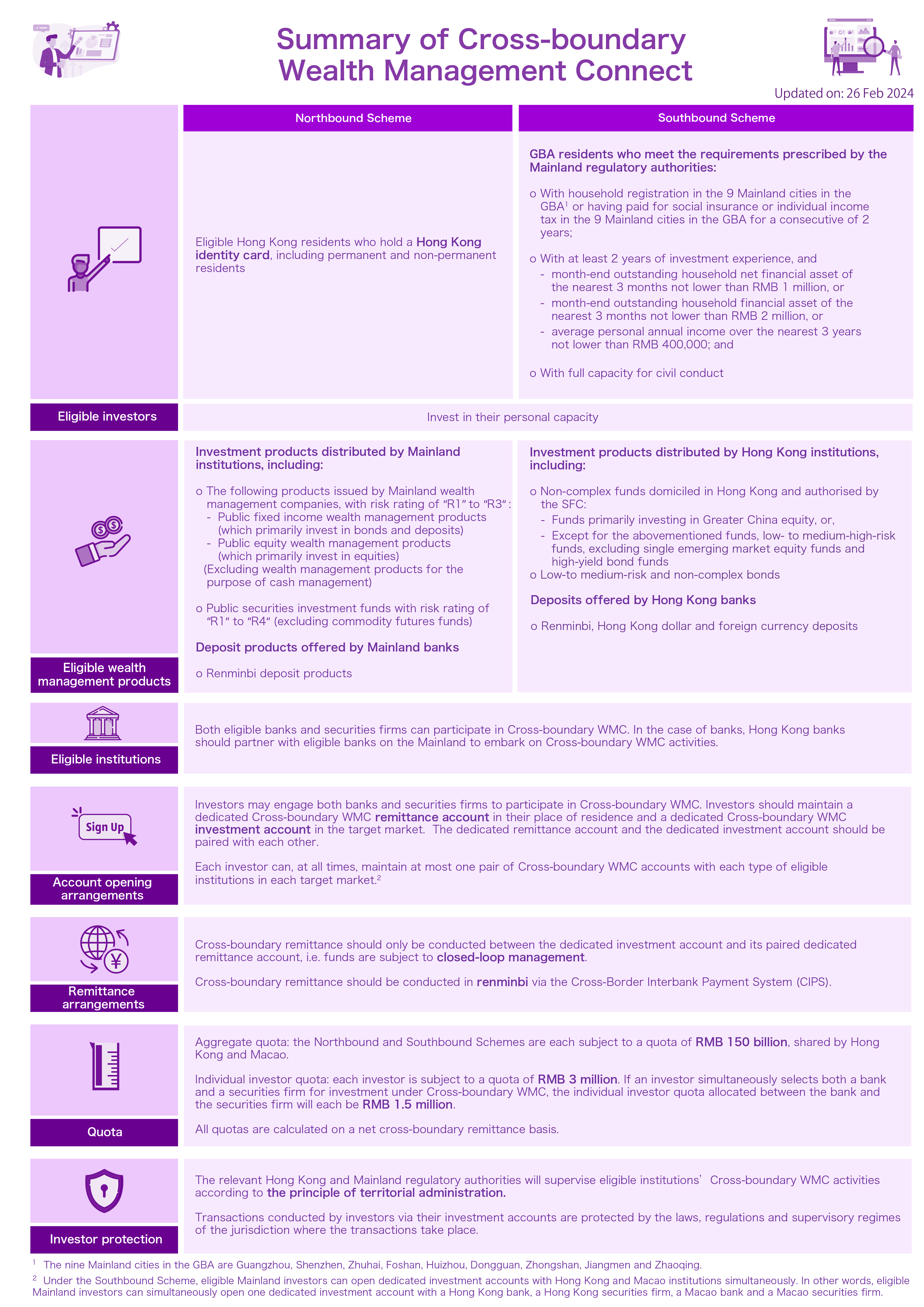

The Cross-boundary WMC consists of the Southbound Scheme and the Northbound Scheme. The Southbound Scheme refers to eligible residents in the Mainland GBA cities investing in wealth management products distributed by eligible financial institutions (banks and/or securities firms) in Hong Kong and Macao via designated channels. The Northbound Scheme refers to eligible residents in Hong Kong and Macao investing in wealth management products distributed by eligible Mainland financial institutions (banks and/or securities firms) via designated channels. Cross-boundary renminbi fund flows are subject to closed-loop and quota management.

The Cross-boundary WMC creates new business opportunities for the financial industries in the three places, and facilitates cross-boundary investment with more options of wealth management products provided to the GBA residents, thereby further promoting the cross-boundary circulation and use of renminbi.

According to the prevailing regulatory framework, the HKMA and the relevant Mainland authorities are primarily responsible for setting out the implementation arrangements for the Cross-boundary WMC between Hong Kong banks and Mainland banks. For details, please refer to this HKMA’s designated webpage of Cross-boundary WMC; while the SFC and relevant Mainland authorities are primarily responsible for setting out the implementation arrangements for the Cross-boundary WMC between Hong Kong licensed corporations (that is, Hong Kong securities firms) and Mainland securities firms. For details, please refer to the SFC’s webpage.

Please also refer to the relevant Chin Family webpage of the Investor and Financial Education Council (“IFEC”) and the dedicated webpage of the Guangdong Provincial Branch of the People’s Bank of China (“PBoC”) (available in Chinese only) for an overview of the Cross-boundary WMC.