- Recently, there have been some relatively large fluctuations in the Hong Kong dollar (HKD) interbank rates, which have attracted attention from the market and more widely in the community. Save for the brief hovering at high levels at the end of last year, the last time the HKD interbank rates were at such levels for an extended period was back in 2008, before the Global Financial Crisis. In this article, I will provide a more in-depth analysis of the factors affecting the HKD interbank rates and share some observations on the recent developments.

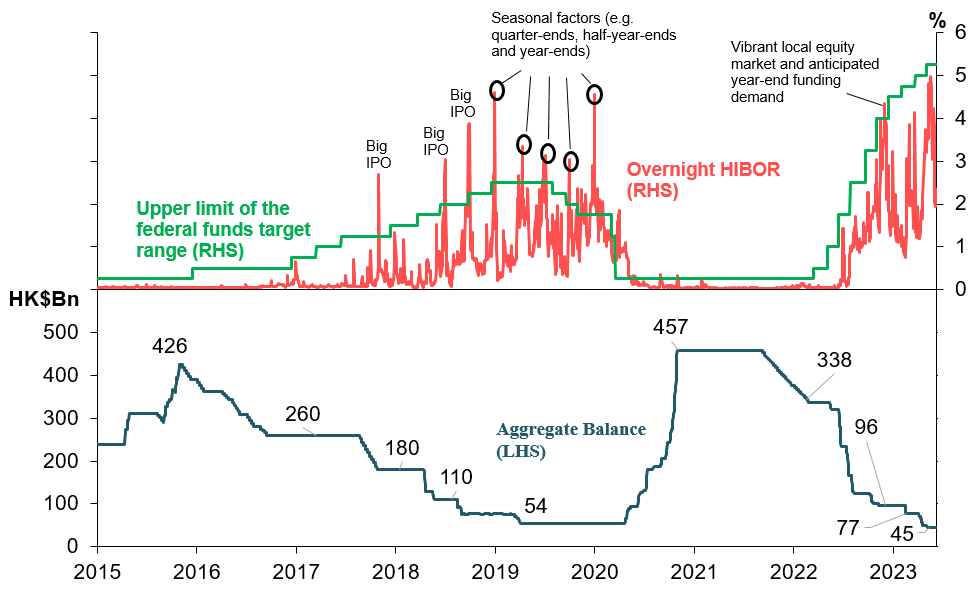

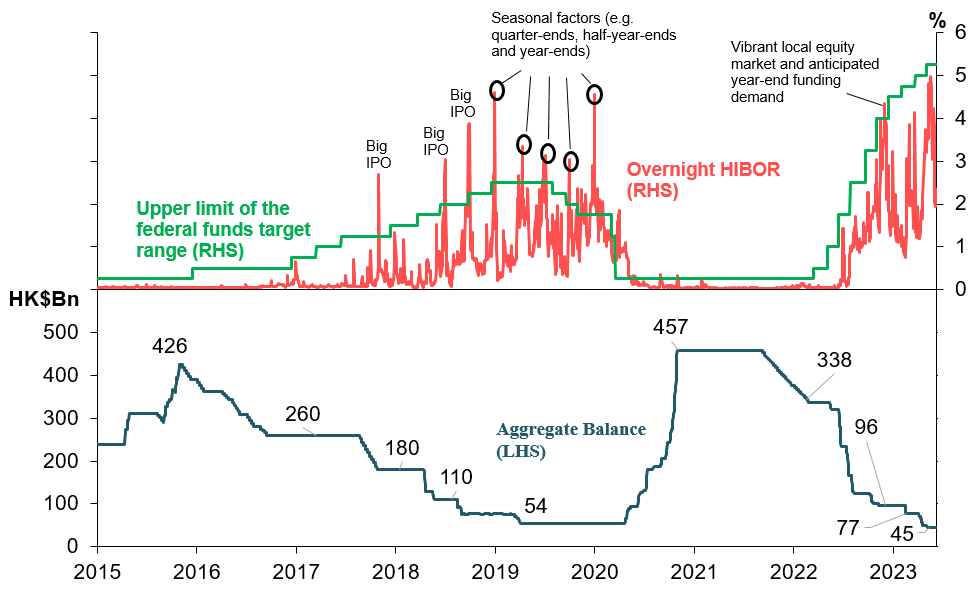

- In earlier inSight articles, I have shared that, since the US Federal Reserve (the Fed) began raising rates in March last year, the widening interest rate differential between the HKD and the US dollar (USD) has incentivised carry trades, which led to the selling of Hong Kong dollars and repeated triggering of the weak-side Convertibility Undertaking (CU). The corresponding decline in HKD liquidity has gradually driven up HKD interbank rates. This adjustment process is inherent in the design of the Linked Exchange Rate System (LERS) and exactly how we expect it to operate in practice. It is worth noting that, while the HKD interbank rates are affected by the trend of their USD counterparts, they are also influenced by the supply and demand in the local market for HKD funding. The HKD-USD interest rate differential may widen or narrow in line with variations in the supply and demand for short-term funding. The Aggregate Balance of the banking system (AB) has declined from over HK$300 billion a couple of years ago to the current level of around HK$45 billion. This smaller liquidity pool has made HKD interbank rates more sensitive to changes in HKD funding demand, leading to more frequent fluctuations. We saw the same thing in the previous cycle. Below is a more detailed analysis of how the supply and demand for HKD funding affect HKD interbank rates.

- Broadly speaking, there are two types of factor that affect supply and demand for HKD funding. The first relates to actual market activities, mainly in the capital markets, and seasonal factors such as year-ends, quarter-ends, and demand for funding arising from dividend payments by listed corporations. The second is more about the behaviour of HKD funding market participants.

Capital market activities

- HKD interbank rates are influenced by capital market activities. A vibrant stock market directly increases the demand for HKD payment and settlement, while also incentivising stock brokers to borrow more HKD to meet future transaction needs. Both effects drive up HKD interbank rates. For example, investors’ expectations of a resurgence in the Mainland's economy driven by relaxation of COVID-prevention measures led to capital inflows to Hong Kong’s stock market in the fourth quarter of last year. In the three months from November 2022 to January 2023, the daily average stock market turnover reached HK$140 billion, at times driving the overnight and 1-month HIBORs above 4% and 5% respectively. In addition, experience suggests that when there are big initial public offerings (IPO) in the local stock market, HKD funding demand increases in the few days between the IPO closing and actual listing date, leading to HKD interbank rates to rise before falling back again within a short period.

Seasonal factors

- As in other financial markets, interbank rates in Hong Kong are also affected by seasonal factors. For example, the demand for HKD from corporations, especially major listed companies, typically increases before quarter-ends, half-year-ends and year-ends as these companies prepare for disclosures in interim and annual reports. There is also a seasonal factor that is unique to Hong Kong, related to dividend payments by listed corporations. The peak season for dividend payments usually occurs in the middle of each year, especially around June to August. During this time, overseas or Mainland companies listed in Hong Kong need to stock up Hong Kong dollars for dividend payments. This funding demand places upward pressure on the HKD exchange and interbank rates. Experience shows that the HKD interbank rates usually stabilise after these seasonal factors have faded.

- The above factors may occur concurrently or separately, sometimes leading to volatility in HKD interbank rates. With the half-year-end approaching, coupled with the need to pay dividends, seasonal factors will continue to influence interbank rates in the coming few weeks or months. The possibility that HKD interbank rates will catch up with, or even overshoot, their USD counterparts on certain days cannot be ruled out. Similar situations happened around the end of 2022 and during 2019 to 2020 (See the graph for details).

Behaviour of HKD funding market participants

- The second category of factors affecting HKD interbank rates relates to the behaviour of participants in the HKD funding market. All licensed banks in Hong Kong maintain clearing accounts with the HKMA in the HKD Real Time Gross Settlement (RTGS) system for the purposes of payment and settlement with the HKMA and other banks in Hong Kong. The sum of balances of the clearing accounts is the AB, representing the total liquidity of the HKD payment and settlement system. In the past, the AB has stood at levels below HK$10 billion for extended periods. As long as banks manage their liquidity well, day-to-day interbank operations and settlement should carry on smoothly regardless of the level of the AB. That said, whenever the AB declines significantly due to triggering of the weak-side CU, it usually takes time for banks to adjust to the situation and rearrange their funding management, and this is sometimes reflected in fluctuations in short-term interbank rates. For instance, as the AB declined to around HK$45 billion on 5 May (Friday), the overnight HIBOR fixing once surged to 4.81% in the following week, even reaching an intraday peak of 5%. The rate then gradually retreated to 2% to 4%, before picking up again recently due to the half-year-end effect and dividend payments.

- In fact, the need for market participants to adjust to lower liquidity is not unique to Hong Kong’s financial market. A notable example in recent years was the funding stress in the US onshore money market in the middle of September 2019. At that time, the Effective Federal Funds Rate (EFFR) and the Secured Overnight Financing Rate (SOFR) increased consecutively on 16 and 17 September. The EFFR briefly breached the upper limit of the federal funds target range, while the SOFR edged up from 2.2% to as high as 5%. The Fed later published a report1 , which explained that the funding stress was due to a significant decline in banks’ reserves from a high level to a multi-year low. The decline in banks’ reserves2 was due to several reasons, including (1) the Fed’s balance sheet reduction policy; (2) funding demand arising from corporate tax payments; and (3) settlement needs for large amounts of newly issued US Treasury securities. As a result, market participants became more cautious and conservative in managing their funding. The demand for funding did not abate despite an increase in interest rates and, at the same time, market participants with excess funds were reluctant to lend because of uncertainty surrounding market conditions and cash flow trends.

- Although the recent gradual increase in HKD interbank rates is not exactly the same as the US funding stress in 2019, rates may stay relatively high in the near term, and occasionally experience some volatility. The HKMA continues to closely engage with banks, reminding them to properly manage their liquidity, including keeping in close touch with their large clients to understand their HKD funding plans and arrangements. This helps banks to plan and avoid any hoarding of Hong Kong dollars. The HKMA has also reminded banks not to worry about the perceived “stigma effect” of tapping our liquidity facilities. Banks should feel free to use the HKMA’s various liquidity facilities when they need to. The recent use of the Discount Window shows that banks are adapting to changing market developments and are willing to make good use of these liquidity facilities.

- This analysis relates to the recent developments in HKD interbank rates. It is difficult to tell whether banks’ retail interest rates will fluctuate in a similar way. Banks will decide when and by how much to adjust their lending and savings rates taking into account the structure of their funding costs and other relevant considerations. In fact, many banks have already raised their deposit and lending rates including the prime rates and the interest rate cap for newly approved mortgage loans as HKD interbank rates have risen. The public should prepare for fluctuations in lending rates, and carefully assess and manage the interest rate risks when purchasing property, taking out mortgages, or making other borrowing decisions. The HKMA will continue to closely monitor market developments, and maintain monetary and financial stability.

Eddie Yue

Chief Executive

Hong Kong Monetary Authority

14 June 2023

1 For details of the report, please see https://www.federalreserve.gov/econres/notes/feds-notes/what-happened-in-money-markets-in-september-2019-20200227.html

2 Reserves in the US banking system are different from the Hong Kong dollar’s AB, as their level is directly affected by the Fed’s monetary policy such as the quantitative easing and the tapering.