(Translation)

| Mina: |

Ronnie, while you refused to tell me whether you had applied for iBond6 last time, I’m sure you are not old enough to apply for the HK$3 billion Silver Bond offered by the Government this time.

|

| Ronnie: |

Yes, you’re right, but what you’ve said is not informative at all. Let me ask you some questions about Silver Bond - do you have any idea of the age of the oldest applicant for the Silver Bond?

|

| Mina: |

Don’t tell me the applicant is a centenarian!

|

| Ronnie: |

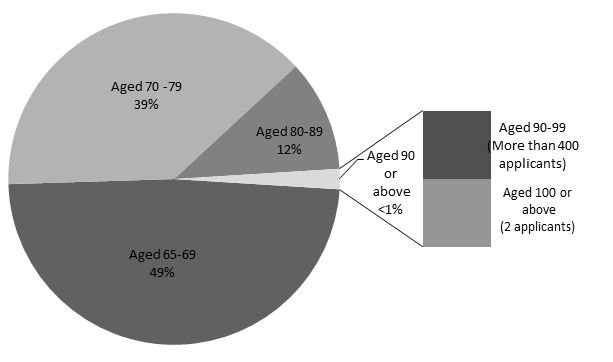

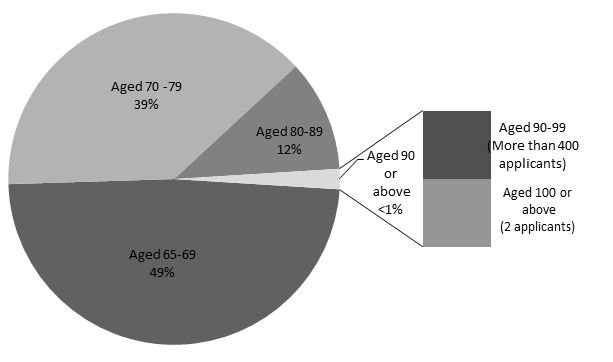

Well, about 76,000 senior residents aged 65 or above subscribed to the Silver Bond. Would you believe, the oldest applicant is 102 and the second oldest is 100. And, there are over 400 applicants aged between 90 and 99.

|

| Mina: |

I never imagined that senior residents aged over 90 would be so enthusiastic about the Silver Bond. How about the age distribution of the remaining applicants?

|

| Ronnie: |

The “youngest” applicants, aged between 65 and 69, accounted for nearly 50% of the total subscription amount, while those between 70 and 79 accounted for 40%.

|

| Mina: |

I remember the Financial Secretary saying that the aim of launching the Silver Bond was to provide senior residents with a capital-protected investment product with interest income. In the current investment environment, the Silver Bond, with its simple structure and guaranteed return of at least 2%, certainly appeals to the elderly. Indeed, it’s a pity I’m not old enough to qualify for the Bond!

|

| Ronnie: |

Let me tell you that the total subscription amount of the first Silver Bond reached HK$9 billion, three times the issue size of the Bond. This encouraging result reflects that the “silver market” has immense potential and the industry should actively consider tapping into it.

|

| Mina: |

In fact, around 10% of the applicants for past issues of iBonds were senior residents aged 65 or over. That means many of them are quite familiar with bond investments. Looking at the current Silver Bond subscription, do you see anything special about investments by senior residents?

|

| Ronnie: |

Well, on average, each applicant subscribed for 11.8 units, equivalent to HK$118,000, while less than 1% subscribed for just one unit. This reflects that senior residents are quite eager to invest if there are appropriate products. In addition, most of the applications were made at bank branches, suggesting that senior residents prefer personal contact with bank staff, rather than using phone or internet banking services. |

A comparison of the subscription results of the Silver Bond and iBond6

|

|

Silver Bond

|

iBond6

|

|

Number of applicants

|

76,009

|

507,978

|

|

Subscription amount (HK$ billion)

|

8.9

|

22.5

|

|

Average number of units applied for

|

11.8

|

4.4

|

*Application price per unit is HK$10,000

Silver Bond applicants by age group

Total number of applicants: 76,009

Note: Due to rounding, the sum of the percentages is greater than 100%.

Written by Ronnie and Mina, the two specially-assigned ‘Observers’ who go around the HKMA office in IFC, Central, collecting interesting facts and sharing them with you from time to time.