Loss-absorbing capacity (LAC) is an essential prerequisite to an effective application of the “bail-in” stabilization option. There must be sufficient financial resources to absorb losses and to recapitalise a failing financial institution (FI). Having sufficient LAC can ensure that where necessary, a failing FI can be restored to viability by imposing losses on shareholders and certain creditors of the FI, thereby:

- Mitigating risks to the financial system and ensuring the continued provision of critical financial functions by the FI; and

- Ensuring that shareholders and creditors – rather than taxpayers – will be the first to absorb any losses which is not only fairer than a bail-out by taxpayers, but also disincentivises excessive risk-taking by the FI.

In order to impose LAC requirements on authorized institutions (AIs), the Financial Institutions (Resolution) (Loss-absorbing Capacity Requirements – Banking Sector) Rules (LAC Rules) were enacted by the Legislative Council in late 2018, under the power sets out in section 19(1) of the Financial Institutions (Resolution) Ordinance (FIRO).

The Monetary Authority (MA) has also issued a FIRO Code of Practice chapter LAC-1 “Resolution Planning – LAC requirements”, which provides further guidance on the operation of certain provisions of the LAC Rules. In particular, the Code of Practice chapter LAC-1 provides guidance on how the MA intends to exercise certain discretionary powers under the LAC Rules such as variation of the composition of the LAC consolidation group, the capital component ratio or the resolution component ratio in an individual case. The definitive LAC requirements that will apply to a particular AI will be determined depending on institution-specific circumstances of that AI in a way which supports the preferred resolution strategy of the AI, and imposed in accordance with the LAC Rules, depending on institution-specific circumstances of that AI.

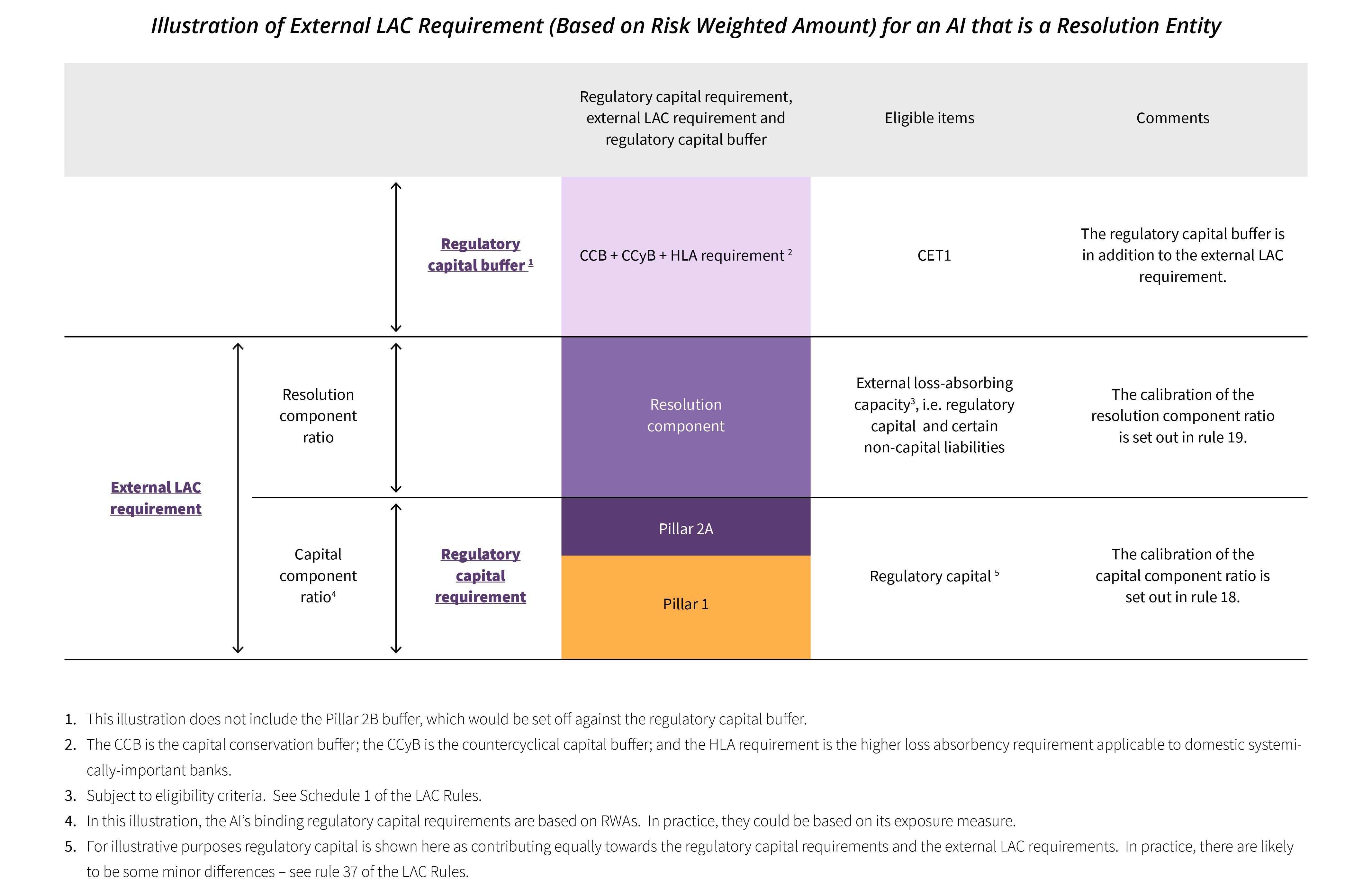

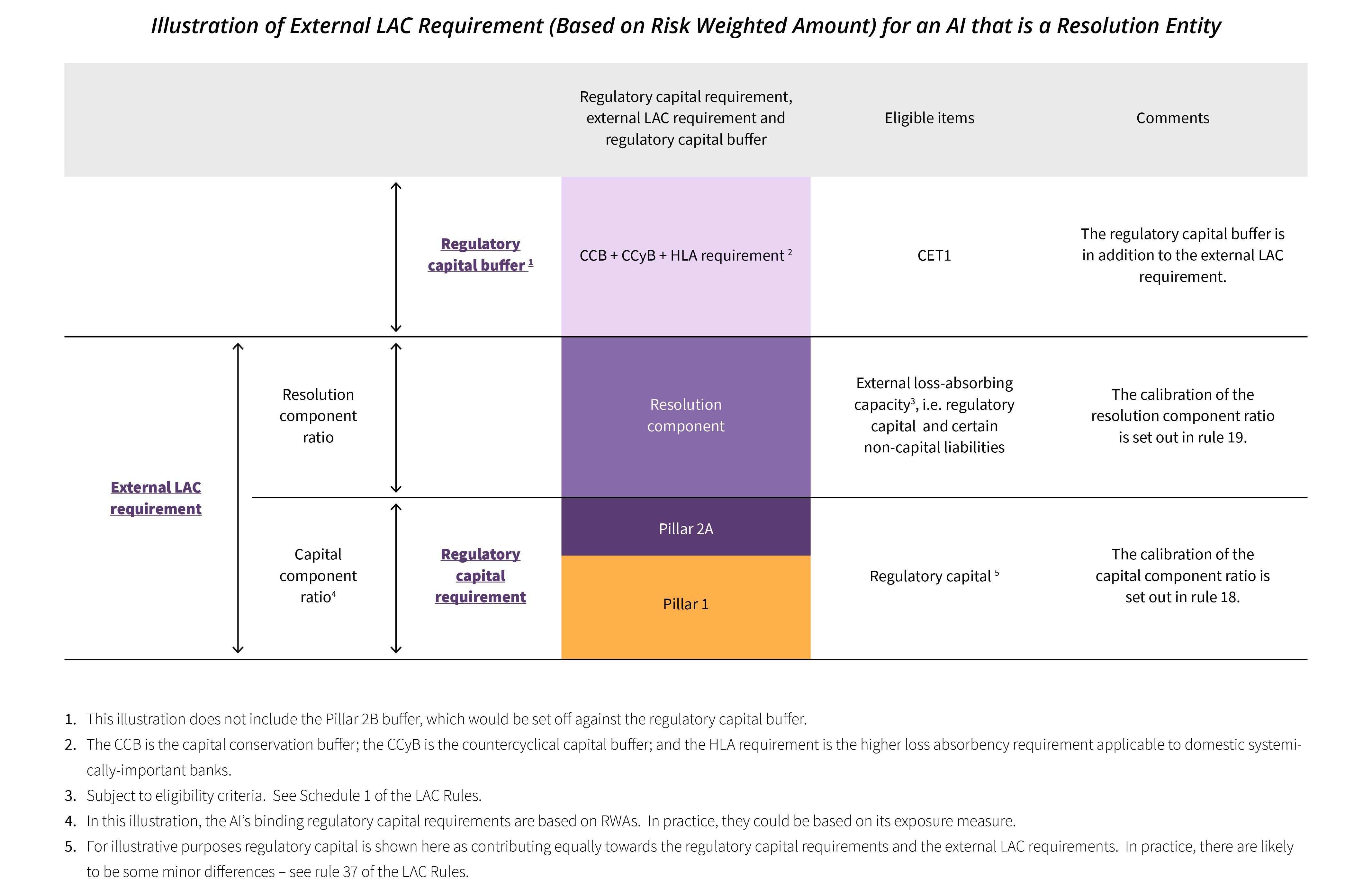

In February 2024, the HKMA published the Report on Loss-Absorbing Capacity Requirements Implementation in Hong Kong. This report provides an overview of the LAC requirements implementation programme in Hong Kong, outlines the progress made and summarises the HKMA’s observations and related policy expectations, including the LAC positions of AIs, issuances and features of LAC debt instruments, approaches to ensuring compliance with LAC Rules requirements, the interaction between LAC requirements and the capital regime, and other matters pertinent to the implementation.

(Click to enlarge)

Indicative Preferred Resolution Strategy, Resolution Component Ratio and

(Consolidated) LAC Requirements for Resolution Entities (RE) and Material Subsidiaries (MS)

(Assuming an Internal LAC Scalar of 75%)

| Relevant AI |

RE or MS |

Indicative preferred resolution strategy |

Indicative resolution component ratio |

Internal LAC scalar |

Indicative LAC requirement

(consolidated) |

|

D-SIB

|

RE

|

Whole bank bail-in

|

1 x capital component ratio

|

-

|

2 x capital component ratio

(external LAC)

|

|

MS

|

Contractual loss transfer

|

1 x capital component ratio

|

75%

|

1.5 x capital component ratio

(internal LAC)

|

|

Non-D-SIB locally-incorporated AI with total consolidated assets > HKD 300bn

|

RE

|

Bail-in, and/or (for smaller AIs) partial property transfer, whole bank transfer

|

0.5 – 1 x capital component ratio

|

-

|

1.5 – 2 x capital component ratio

(external LAC)

|

|

MS

|

Contractual loss transfer

|

1 x capital component ratio

|

75%

|

1.5 x capital component ratio

(internal LAC)

|