The Hong Kong Monetary Authority (HKMA) is dedicated to maintaining Hong Kong’s leading position as an international financial centre (IFC). To sustain the competitiveness of Hong Kong’s financial industry, the HKMA not only introduces forward-looking policies and services that keep abreast of the latest market trends, but also enhances financial infrastructure to maintain our robust foundation.

To support the development of Hong Kong’s bond market, the Financial Secretary announced in his Budget in February this year plans to develop the Central Moneymarkets Unit (CMU) into a major international central securities depository (ICSD) in Asia. To achieve this goal, the HKMA will further commercialise the CMU, and upgrade the system by phases in the coming three years so as to enhance this critical financial infrastructure which has served the financial industry of Hong Kong so well for more than 30 years. The enhanced CMU system will be able to provide safe, reliable and effective services supporting cross-border transactions and clearing, settlement and custodian operations, with a view to facilitating the connectivity between the Mainland and international financial markets and consolidating Hong Kong’s status as an IFC.

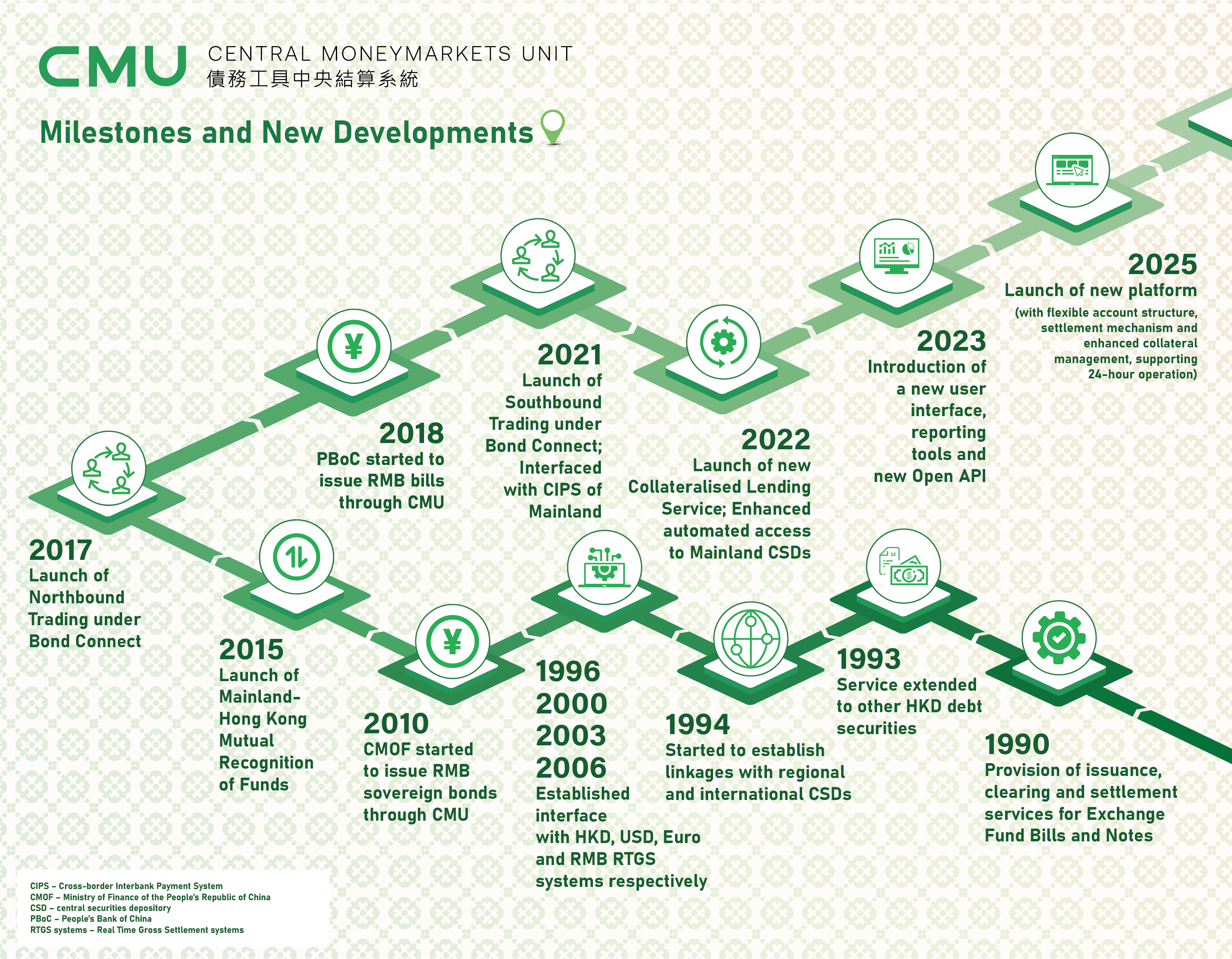

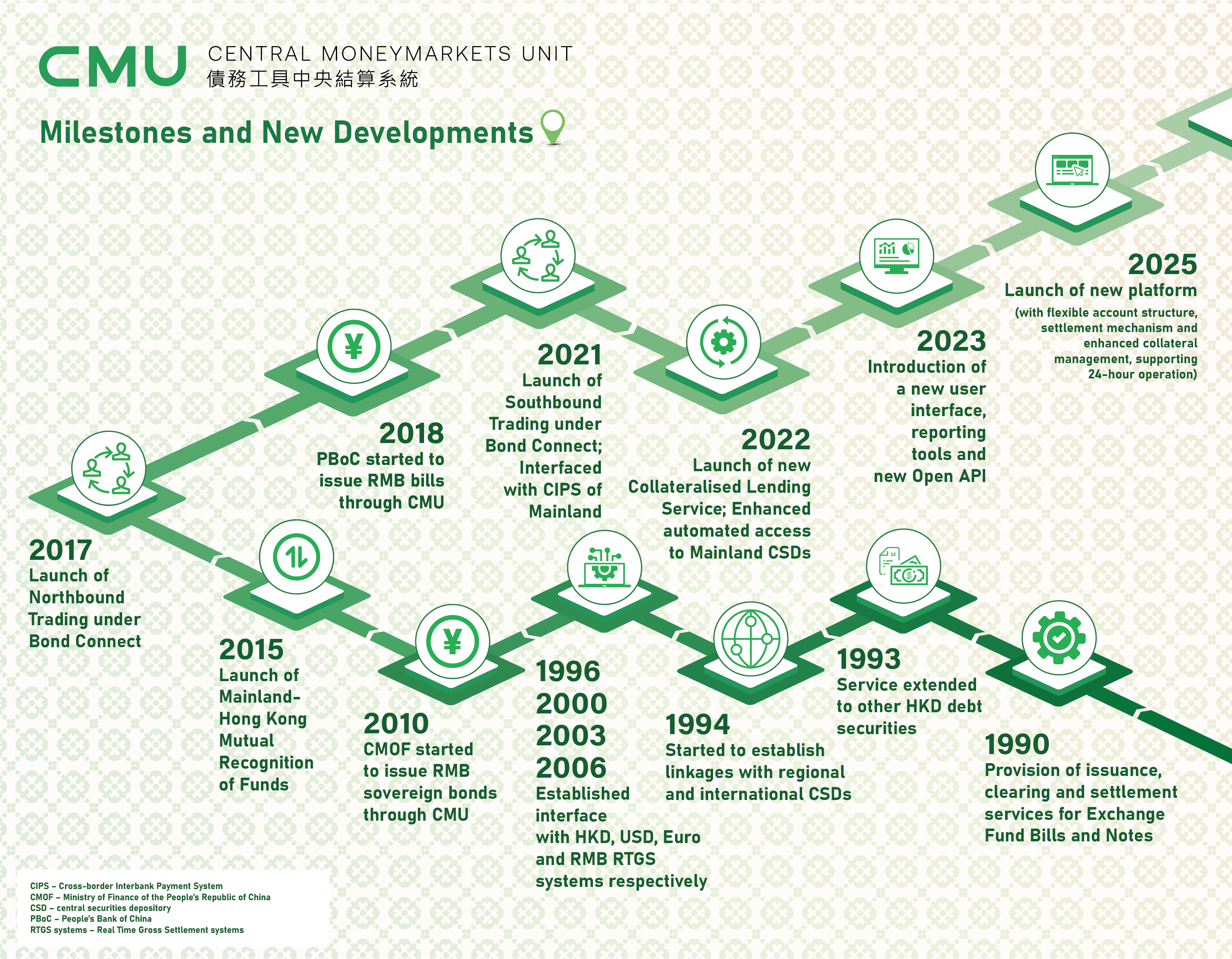

The CMU is an important central securities depository (CSD) in Hong Kong. Since its establishment in 1990, the CMU has been growing in step with Hong Kong’s financial markets and facilitating the development of our bond market. From its initial services to support the issuance, clearing and settlement of Exchange Fund Bills and Notes and Hong Kong Government bonds, the CMU has evolved to provide multi-currency settlement, clearing and custodian services to debt securities that are denominated in Hong Kong dollar or other currencies and are issued in Hong Kong. As early as 1994, the CMU began establishing linkages with regional and international CSDs, covering a wider spectrum of services and debt securities. Today, the CMU is the major CSD for debt securities ranging from bonds issued by the Hong Kong Special Administrative Region Government, including the retail green bond launched recently, to renminbi sovereign bonds issued by the Ministry of Finance of the People’s Republic of China and bills issued by the People’s Bank of China in Hong Kong. Moreover, Mainland municipal governments and corporates also issue renminbi-denominated bonds in Hong Kong through the CMU platform. As at the end of 2021, the outstanding amount of debt securities lodged with the CMU exceeded HK$2 trillion.

Since the launch of Bond Connect in 2017, the connectivity offered by the CMU has become pivotal in driving further development of Hong Kong’s bond market. The links between the Mainland and international markets supported by the CMU have successfully enabled investors from the Mainland and abroad to settle debt securities more conveniently via their preferred and trusted channel, and in turn lowered cross-border settlement costs. Bond Connect has so far attracted more than 3,500 institutional investors from 36 jurisdictions worldwide to participate, successfully drawing investors to the Mainland’s onshore financial markets. By the end of April 2022, the average daily turnover recorded via Bond Connect had exceeded RMB31 billion and the overseas holding of Mainland onshore bonds through the CMU was over RMB800 billion. Southbound Trading, officially launched in September 2021, has provided Mainland institutional investors with a convenient, efficient and secure channel to allocate their assets flexibly through the bond market in Hong Kong, thereby helping them to go global.

In recent years, the Asian international bond market has been rapidly expanding. The annual issuance of cross-border bonds had seen a six-fold increase from US$107 billion in 2006 to US$614 billion in 2021. Hong Kong, being the IFC in the region, plays an integral role in the Asian bond market. According to the International Capital Market Association, 34% of Asian international bond issuances were arranged in Hong Kong in 2021, while 22%, 17% and 5% were arranged in the United States, the United Kingdom and Singapore respectively.

Although the Asian bond market is very active, Asia has no ICSD on a scale comparable to Europe’s. This market vacuum, together with the continued bond market expansion in the region, creates an excellent opportunity for the CMU to pursue commercialisation. We will fully upgrade the CMU system and services so as to proactively seize market opportunities and to attract Mainland corporates and institutions to participate in Hong Kong’s bond market. This will also strengthen Hong Kong’s position as a bond hub. Leveraging its good foundation, the CMU will take forward three main upgrading tasks by phases in the next three years (see diagram).

- Enhance Efficiency and Risk Management

One of the competitive edges of ICSDs is the provision of collateral management. Users have the flexibility to allocate and obtain liquidity in many currencies by making use of the centralised and integrated collateral pool, such as debt securities and other financial products lodged with ICSDs. The CMU launched a new collateralised lending service on 1 April 2022 to provide free intra-day liquidity in currencies including Hong Kong dollar, renminbi, United States dollar and euro under repo arrangements. The initiative allows CMU members, including both banks and non-bank institutions, to manage their liquidity more effectively during the primary issuance process and minimise funding costs and settlement risks due to time-zone differences.

From 1 April 2022, the CMU also started waiving the lodgement fee for all new issues in order to encourage more issuers to lodge debt securities with the CMU, particularly for the issuance of green and sustainable bonds and eligible securities under Southbound Trading under Bond Connect.

- Upgrade System for Greater Flexibility

Another main feature of the CMU commercialisation is to become more user-oriented through the provision of flexible, quality and market-driven services. Enhancements to the CMU system have begun, using state-of-the-art financial technology to improve its functionality, efficiency and capacity. This process includes strengthening communication with the industry to understand market needs. Through progressive improvements of the CMU system, we hope users can conveniently obtain bond market information for data analysis and manage their CMU accounts with greater flexibility.

We also plan to launch a new dedicated website of the CMU in the third quarter of this year, which will provide the industry with a quick and convenient means of searching for useful bond market information. To further enable business automation and digitalisation, we will also develop a new user interface and reporting tools next year, and roll out a new Open API.

The most important stage of the CMU commercialisation will take place when the new CMU platform is launched in 2025. This platform will let users handle their accounts and carry out transactions more flexibly while allowing them to manage collateral comprehensively as the new CMU platform will be able to support a 24-hour mode of operation. All features will help users strengthen the management of their liquidity.

- More Cross-Border Links Through the CMU

To progress from a local platform to an ICSD, the CMU has to establish more linkages with CSDs in different regions in order to provide cross-border settlement, custodian and offshore bond issuance services. Through the launch of Bond Connect in 2017, the CMU has successfully demonstrated to the market the benefits of its super-connectivity and moved forward to becoming an ICSD. We will continue to improve the CMU’s connectivity to better support Bond Connect. Last year, we rolled out an interface with the Mainland’s Cross-border Interbank Payment System (CIPS) to facilitate Southbound Trading under Bond Connect transactions; in the third quarter of this year, we will enhance automated access to Mainland CSDs to facilitate daily Bond Connect transactions.

The HKMA will also carry out proactive market promotion to attract more international and Mainland issuers to issue bonds in Hong Kong, and explore opportunities to establish more cross-border linkages with different jurisdictions. These CMU linkages will allow Mainland investors to hold international bonds issued outside Hong Kong to support their global asset allocation, at the same time attracting more international investors to invest in the Mainland’s onshore bond market through the CMU. This will strengthen connectivity between the Mainland and international markets, and provide crucial support for the Mainland’s domestic and international circulations.

Rome was not built in a day. Our endeavour to establish a world-class financial market infrastructure is bound to be long and arduous. The HKMA team will maintain a close relationship with the industry and keep abreast of the latest market developments to refine and introduce services under the CMU as appropriate, so as to open up more avenues for Hong Kong’s bond market and build a more prosperous future.

Eddie Yue

Chief Executive

Hong Kong Monetary Authority

13 June 2022