(Translation)

Over 600 political and business leaders gathered at the Great Hall of the People in Beijing to attend a seminar entitled “Strategies and Opportunities under the Belt and Road Initiative - Leveraging Hong Kong's Advantages, Meeting the Country's Needs”, held by the Government of the Hong Kong Special Administrative Region last Saturday (3 February). I participated in the first thematic session with a theme of “Riding on Hong Kong's capital market when taking forward the Belt and Road developments”. During the discussion, I pointed out Hong Kong’s strategic position of “leveraging the Mainland while engaging the world”. In my opinion, this strategic position, which has remained unchanged for more than a hundred years since the opening up of Hong Kong in 1842, will not be changed for the years to come.

Hong Kong evolved from a small fishing village into an entrepot in the nineteenth century. Foreign merchants and Chinese compradors gathered at this small place to conduct various trading and purchasing activities. Hong Kong acted as an entrepot, importing goods into the Mainland and exporting goods overseas. Demand for trade finance arose on the back of the flourishing trading activities. In the past, as goods needed to be shipped to their destinations, it could take several months or up to a year from purchasing goods, on-selling to customers, to receiving proceeds by merchants. This gave rise to demand for intermediary financing, attracting foreign banks to commence business in Hong Kong, in addition to local banks. The co-existence of foreign and Chinese businesses and banks was the early model of “leveraging the Mainland while engaging the world” for Hong Kong.

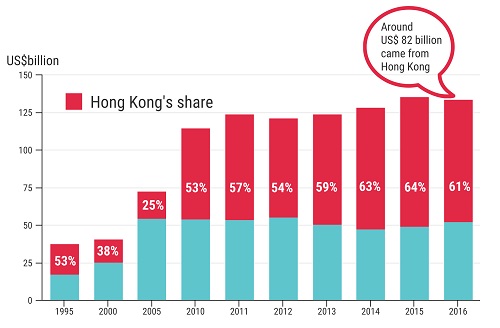

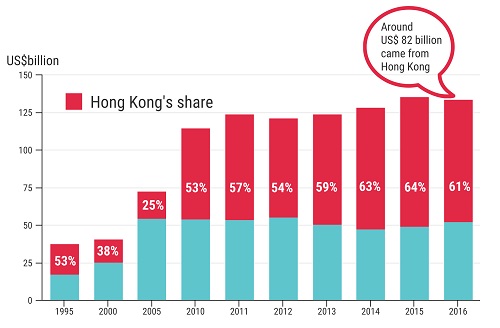

China began its economic reform in the late 70s. With the advantage of “leveraging the Mainland”, Hong Kong succeeded in transforming away from reliance on low-skill light industries, which was gradually losing competitiveness, in the 60s and 70s. Throughout the four decades of reform and opening up in China, Hong Kong has served as the main source of and springboard for channeling “funds” and “technology” into the Mainland, accounting for 50-60% of all foreign direct investment (FDI) flows. In 2016, China’s total FDI amounted to US$133.7 billion, 61% of which was contributed by Hong Kong.

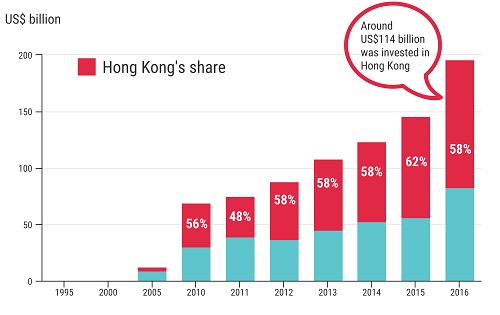

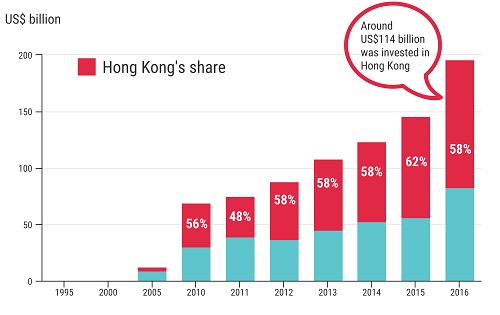

On the other hand, with years of economic reform and upgrading, Mainland enterprises have accumulated substantial amount of capital and are becoming competitive in the international arena. This in turn created opportunities for them to “go global”. China began to expand the size of outward direct investment (ODI) ten years ago. In 2016, its total ODI reached US$196.1 billion, nearly 60% of which was invested in Hong Kong or channeled to other regions for investment through Hong Kong. This reflects Hong Kong’s role as the hub and springboard for Mainland’s capital to “go global”.

Foreign Direct Investment

Outward Direct Investment

Have you ever considered why Hong Kong is the preferred gateway for Mainland capital to “go global”? In my view, compared with other international commercial and financial centres, Hong Kong has three unique advantages that attract Mainland enterprises to set foot in the city for developing their businesses and managing their overseas operations.

| (1) |

Geographic location: Hong Kong’s geographic proximity to the Mainland allows easy access to the huge markets and population on the Mainland. At the same time, Hong Kong has comprehensive and efficient links to other major commercial and financial centres all over the world; |

| (2) |

One country, two systems: Under the “one country, two systems” principle implemented in Hong Kong, the Central Government fully supports Hong Kong in maintaining prosperity and stability. Enjoying the benefits of “one country, two systems”, Hong Kong is a hub for international trade, financial activities and modern services; |

| (3) |

The common law is applied in Hong Kong. This is conducive to international trade, investment and financing. Among all the places that practise common law, Hong Kong is the only place that truly applies a bilingual system with both Chinese and English as our official languages. This provides a unique legal and judicial system for international and Mainland enterprises. |

It is nearly impossible for other commercial and financial centres to duplicate or imitate the three advantages mentioned above. As of March 2017, there were nearly 4,000 Mainland enterprises in Hong Kong with total assets amounting to HK$20 trillion. Many of these Mainland enterprises have established their regional headquarters for overseas operations in Hong Kong. Recently, they have also set up their corporate treasury centres (CTCs) here to leverage on our advantages, including highly efficient financial markets, the world’s largest offshore renminbi (RMB) business centre, world-class financial and related professional talents, to enhance their operational efficiency and risk management standards.

Since the introduction of tax incentives for CTCs in 2016 through amendments to the Inland Revenue Ordinance, which lowered the tax rate for CTCs from 16.5% to 8.25%, the HKMA has been actively promoting Hong Kong as the preferred location for CTCs to multinational and Mainland corporates. Over 40 companies, many of which are among the Fortune 500 companies, are actively considering setting up or have already set up CTCs in Hong Kong.

In his keynote speech at the seminar, Mr Zhang Dejiang, Chairman of the Standing Committee of the National People’s Congress, said, “The Central Government strongly supports the important role of Hong Kong in implementing the ‘Belt and Road’ Initiative, which has been incorporated into the overall development plan for the country”. I believe that “Belt and Road” investments and RMB internationalisation will go hand in hand with positive interaction. It is because with China’s increasing foreign investment and trading activities with other jurisdictions, the use of the RMB will grow in tandem. Hong Kong is the world's largest offshore RMB business centre and payment and settlement hub. At present, around 70% of global RMB payment transactions are handled via Hong Kong, with its RMB Real Time Gross Settlement system’s turnover averaging RMB900 billion daily. Hong Kong can provide one-stop offshore RMB services, including conversion, settlement, lending, debt issuance, public listing, asset and risk management for all “Belt and Road” regions and stakeholders. Besides, as “Belt and Road” infrastructure investments and financing may be priced and transacted in RMB, the progress of RMB internationalisation will accelerate. RMB internationalisation and the “Belt and Road” Initiative therefore complement each other. Throughout the process, Hong Kong can ride on its strengths to continue to play a unique intermediary role and enjoy early-mover advantage.

Talking about the “Belt and Road” Initiative, I must mention the HKMA Infrastructure Financing Facilitation Office (IFFO). Since its establishment in July 2016, we have brought together 87 partners from the Mainland and overseas, including multilateral organisations, major institutional investors, infrastructure project developers and operators, professional service firms, etc, to jointly look for infrastructure investment and financing opportunities along the “Belt and Road” regions. The platform provided by IFFO can give full play to Hong Kong's edge in “leveraging the Mainland while engaging the world”. By facilitating more infrastructure investment and financing activities through the Hong Kong platform, more business opportunities will come to the city. With the support of the State-owned Assets Supervision and Administration Commission of the State Council, we are now in discussions with some Central State-owned Enterprises to explore opportunities for cooperation and joint investment, and there has been good progress. We look forward to some joint investment projects in the future to bring in international capital and achieve a win-win situation.

China is the most vibrant economy in the world. “Leveraging the Mainland while engaging the world” has always been the bedrock for Hong Kong’s economic and financial development, whether in the past, at present or in the future. Looking back, as long as Hong Kong sets its direction firmly and strive unremittingly, grasping the huge opportunities offered by the “Belt and Road” Initiative and the development of the Guangdong-Hong Kong-Macao Bay Area under the strategy of “Leveraging Hong Kong's Advantages, Meeting the Country's Needs”, we will be able to contribute to the country’s prosperity as well as our own.

Mr Norman Chan, Chief Executive of the HKMA speaks at the seminar entitled “Strategies and Opportunities under the Belt and Road Initiative - Leveraging Hong Kong's Advantages, Meeting the Country's Needs”.

Norman Chan

Chief Executive

Hong Kong Monetary Authority

8 February 2018