(Translation)

In my previous article I analysed the overall trends of financial markets in recent years - high volatility and unpredictability. While monetary policies and geopolitical developments in major economies were hard to predict, the market reactions to these developments were also unexpected. This article explains the strategies deployed by the Exchange Fund in this difficult environment – a combination of prudent and proactive approaches, two seemingly contradictory but actually complementary strategies.

Investment requires both offensive and defensive tactics, akin to those used in football matches. In the past two to three years, in view of the fast-changing and unpredictable external investment environment, the Exchange Fund has implemented a series of targeted defensive measures to enhance its resilience under different market conditions. First, it has reduced its holdings in long-term bonds and increased short-term bonds and cash to lessen the impact of anticipated US interest rate hikes on bond valuations. Secondly, it has substantially reduced its holdings of non-US dollar and non-Hong Kong dollar denominated assets (the share of assets denominated in those currencies was lowered to 12.6% at the end of 2015 from 17.5% at the end of 2014), to mitigate the negative currency translation effect on non-US dollar assets caused by a strong US dollar.

The key to a proactive approach – diversification

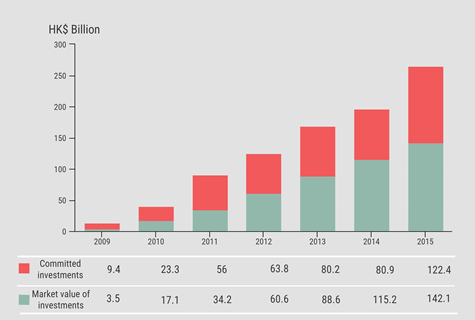

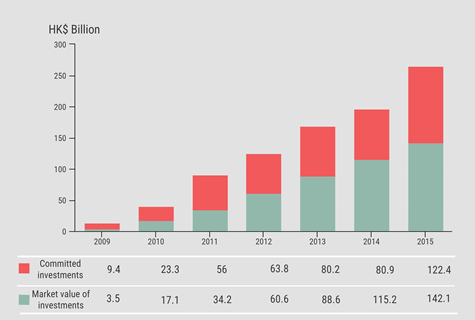

In addition to prudent defence, there is a need to be proactive. One major strategy of the Exchange Fund in recent years has been to accelerate the pace of investment diversification. In 2008, with the increase in asset size, the Exchange Fund embarked on investments in emerging markets. Then, in 2009, it began to invest in alternative assets, including private equity and overseas real estate, under the Long-Term Growth Portfolio (LTGP). Diversification of investments by markets and asset classes helps diversify the risks associated with traditional markets and asset classes, and achieve a more stable and better long-term return. The LTGP has grown steadily since its inception (see chart). At the end of 2015, the total market value of investments under the LTGP reached HK$142.1 billion, or about 9% of the Exchange Fund’s investable assets (i.e. not including the highly liquid Backing Portfolio that supports the Linked Exchange Rate System). If including the committed but not yet invested amount of HK$122.4 billion, the LTGP will account for a considerable share of the Exchange Fund. Investment under the LTGP has been capped at one-third of the accumulated surplus of the Exchange Fund, i.e. around HK$180 billion. However, in view of the need to allocate part of the HK$220 billion worth of the Future Fund to long-term assets, there is room for the LTGP to expand further. Readers who are interested to learn more about the background, philosophy and operation of the LTGP can refer to my inSight articles1 last year.

The LTGP has grown steadily since its inception

The investment return of the LTGP has been satisfactory. However, with more and more investors joining the alternative asset bandwagon, quality investment opportunities have become more difficult to come by. This has in turn exerted pressure on the return. Therefore, we are actively exploring new frontiers, which include:

- Industries that benefit from structural changes (like ageing and medical technology innovation), e.g. medical and health care;

- Industries that can counter inflationary pressures, have a low correlation with traditional asset return, offer good potential for growth, and provide a continuous cash flow, e.g. infrastructure; and

- Emerging markets (including Asia), especially private equity and credit investment.

In addition to the LTGP, we have taken full advantage of the Exchange Fund’s strength as a long-term investor to search for investment diversification opportunities for the Investment Portfolio, which primarily invests in traditional equities and bonds. We are prepared to forego some liquidity as appropriate in return for better long-term returns. Going forward, we will further expand the Investment Portfolio’s asset classes, e.g. increasing investment in credit assets (including corporate bonds and high-quality asset-backed securities), inflation-linked investment products and emerging market assets. The objective is to, within acceptable risk levels, increase our allocation to assets with a better return but with less liquidity or higher volatility to enhance the overall investment performance.

Exercise prudence and robust risk management

The search for higher returns must not be achieved by compromising Hong Kong’s monetary and financial stability. We must exercise prudence and robust risk management and control. Diversification itself has the benefits of lowering and diversifying risks, thereby reducing the volatility of investment returns of the Exchange Fund. However, as the diversification process gathers pace, risk management will inevitably become more challenging. Therefore, in line with the practice of some leading asset management firms, we have introduced Risk Factor Analysis (RFA) into our investment process. Put simply, the performance of various assets is subject to inflation, interest rate movements and other risk factors, just as foods are composed of different types of nutrients. To maintain good health, we have to pay attention to the nutritional components of foods to ensure balanced nutrition. Similarly, based on data and modelling, the RFA entails in-depth analyses of risk factors affecting various assets, and assessments of assets' returns and risks under different macroeconomic conditions. This, combined with projections for future macroeconomic conditions, will help derive optimal asset allocation within acceptable risk levels, enhance the portfolio’s overall return, and increase its robustness in different market conditions.

Interest payments based on the investment returns of the Exchange Fund are a source of income for the Government and some statutory bodies which place their reserves with the Exchange Fund. Since 2007, the rate of interest payment in a particular year has been calculated based on the average of the annual investment returns of the Investment Portfolio over the previous six years, subject to a floor of zero percent as a “capital preservation” arrangement. As the Investment Portfolio recorded relatively high returns before 2010, the Government and the relevant statutory bodies enjoyed an annual rate of interest payment of 5-6% in the past few years. However, in 2016 the rate dropped to 3.3% due to the inclusion in the formula of relatively lower investment returns in recent years. As we enter the post-quantitative easing era, the investment outlook has become highly unpredictable. The short-term return of the Exchange Fund (no matter on a quarterly or annual basis) will be subject to greater pressure and may even record short-term loss, which may further lower the rate of interest payment. After all, the main purpose of the Exchange Fund is to safeguard the stability of the Hong Kong dollar and the financial system of Hong Kong. It is therefore necessary to focus on the Fund’s overall performance over a medium- and long-term horizon.

The outlook is far from sanguine. We will continue to adhere to the investment principle of "Capital Preservation First, Long-Term Growth Next". While remaining prudent, we will also be flexible and proactive in managing the Exchange Fund with a view to achieving a better long-term return for the wealth of the Hong Kong people.

Eddie Yue

Deputy Chief Executive

Hong Kong Monetary Authority

10 January 2017

1 inSight articles:

“The Long-Term Growth Portfolio of the Exchange Fund - Focusing on Future, Striving for Growth (1 of 2)” (published on 14 December 2015) and “The Long-Term Growth Portfolio of the Exchange Fund - Focusing on Future, Striving for Growth (2 of 2)” (published on 16 December 2015)