(Translation)

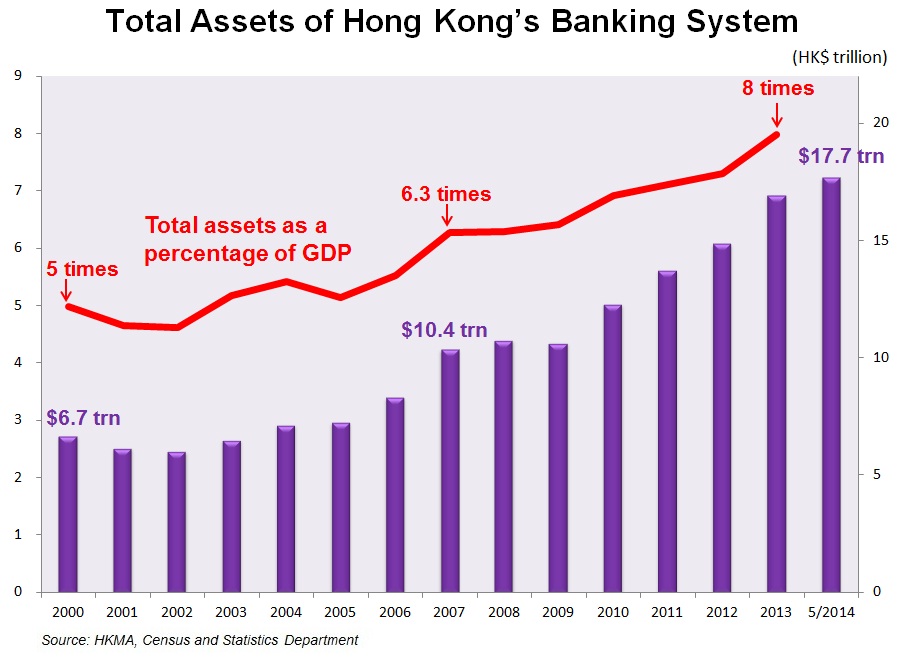

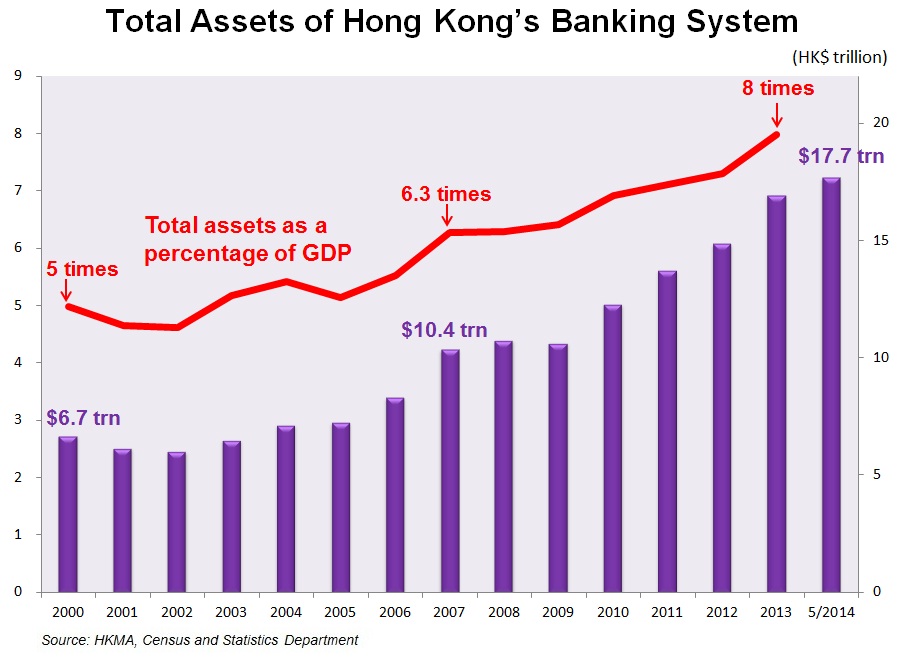

Hong Kong is the premier international financial centre in Asia. Our banking sector has grown steadily in recent years. Seventy of the largest 100 banks in the world now have a presence here, and the total assets of the banking system have grown significantly, from HK$6.7 trillion in 2000 to HK$17.7 trillion at the end of May this year. The size of the banking system increased from five times of Hong Kong’s GDP in 2000 to around eight times in 2013, indicating that the banking industry is growing at a faster pace than the economy as a whole. (Please refer to Chart 1 for details.)

With such a vast amount of banking assets at stake (exceeding HK$17 trillion), much of which is funded by deposits of corporations and members of the public, banking supervision with a view to protecting the safety of these assets is of utmost importance. In order to ensure the safety of customer deposits, the HKMA requires banks to conduct their business prudently, maintain adequate capital buffers and manage their credit, liquidity and other risks properly to minimise the risk of bank failures. During the 1960s and again in the 1980s, Hong Kong experienced a number of bank failures, resulting in seven banks being either closed or taken over by the Government. While there has been no bank failure in Hong Kong since the 1991 case involving the Bank of Credit and Commerce International, the operating environment for banks in Hong Kong has not been all “smooth sailing”. The global financial crisis in 2008/09 demonstrated clearly that even mega international banks can and did get into serious difficulties as a result of improper risk management; and Hong Kong banks cannot be immune from the volatile international financial environment even if they are operating in a sound and prudent manner.

Having learnt these valuable past lessons, the HKMA has been actively participating in international discussions in recent years on banking reforms, mainly led by the G20 and the Financial Stability Board. We are also committed to implementing the latest international regulatory standards in Hong Kong, such as the capital requirements and liquidity coverage ratio under Basel III, by introducing legislative amendments and new supervisory measures.

There was a time before the global financial crisis, when the general belief among the banking sector, particularly in the US and Europe, was that banks should make the best use of their capital to expand their risk assets (including off-balance sheet assets) in order to maximise the returns for shareholders and management. Not only was this a misguided approach, it was also very dangerous. Because the banks’ source of funding largely comes from customer deposits, blindly pursuing profits without proper understanding and regard to the associated risks could jeopardise not only the safety of the banks concerned but also the stability of the banking system and society as a whole.

We are fortunate that banks in Hong Kong did not and still do not compete on their ability to make maximum returns for shareholders by taking excessive risks, but rather on their conservative and sound operations. Banks in Hong Kong have not followed the aggressive practices employed in the past by many banks in the US and Europe. Indeed, the HKMA did not and will not allow banks to operate with capital ratios just at the minimum level required by international standards. In addition to the HKMA’s stringent day-to-day supervision, the fact that Hong Kong’s banks have all along maintained capital buffers higher than most of their counterparts in the US and Europe also contributes to the confidence depositors and the public have in our banks. A high capital adequacy ratio provides banks with buffers to absorb bad debts and other losses when necessary. Therefore, I cannot subscribe to the notion that banks in Hong Kong would be placed at a competitive disadvantage compared with other banks because the HKMA imposes additional or higher regulatory requirements on top of the international minimum standards under Basel III. Competition among banks should focus on quality of services and safety of the institutions rather than maximising profits with the lowest possible capital adequacy ratio.

Universal Banking – Moving with the Times

If the banks are managing their on- and off-balance sheet risks prudently and ensuring protection for customer deposits, this begs the question – does it mean that the HKMA has fully fulfilled its supervisory function? The short answer is no. Why? Because the HKMA is responsible for approving applications for banking licences in Hong Kong and the Monetary Authority’s supervisory powers and responsibilities under the Banking Ordinance cover all aspects of the banks’ operations. The banking regime in Hong Kong allows universal banking, that is, banks can operate like “financial supermarkets”. Once an account is opened with a bank, in addition to enjoying basic banking services, the customer will be able to conduct various financial transactions including equities, bonds, funds, insurance and other wealth management products. Although banks in some overseas jurisdictions still practice segregated banking, that is, they only offer banking services and are not allowed to provide securities and other wealth management services, universal banking has become an international trend. More and more jurisdictions are adopting this regime since it offers customers the convenience of a one-stop service to meet the needs for investment and other wealth management services of today’s customers.

However, a fundamental problem arises with the “financial supermarket” business model, and it stems from the special trust that exists between banks and their customers. In modern times, people rarely store their wealth at home because it is both unsafe and inconvenient. And, wealth sitting at home cannot generate returns over time. So, most of us place our liquid financial assets with banks that we trust, which allows banks to have an overall picture of customers’ income, size of deposits and the wealth bracket to which they belong. This unique relationship, which is based on special trust, makes it easier for banks to market various wealth management and financial products to their customers. As we have learnt from the Lehman incident, some banks and their employees may, under intense competitive pressure for market share and profits, resort to improper practices in selling wealth management products, without due regard for the customers’ interests. Drawing on these lessons, the HKMA has since 2009 required banks to implement various new measures, such as selling wealth management products only in areas segregated from general banking service counters, audio-recording of the selling process, and introducing a cooling-off period. The aim is to strengthen protection for bank customers engaged in wealth management activities. Some industry sources have described these measures as being over and above the requirements for non-bank financial institutions (for example, securities dealers and insurance intermediaries and brokers) selling similar products, thus creating “unfair” competition. So, is this “unfair”? Not really. Why? Because the special trust and unique relationship between banks and their customers set them squarely apart from non-bank institutions, which warrant additional measures to protect bank customers. Having said that, however, the HKMA will, without compromising investor protection, move with the times and constantly review the actual implementation, effectiveness and necessity of the relevant measures. We will also work in consultation with the industry on any appropriate way of streamlining or enhancing the existing practices to facilitate banks and their customers.

Prior to the Lehman incident, the HKMA’s supervisory resources were heavily directed towards two aspects: (i) monitoring and assessing the balance sheet risk management of banks; and (ii) amending and enhancing existing banking prudential supervisory policies and regulations. In the aftermath of the incident, the HKMA was suddenly inundated with more than 20,000 complaints of alleged mis-selling. To cope with the extra workload, a temporary workforce, which at one stage peaked at around 200, was hired on contract to help with the investigations and necessary follow-up actions.

Strengthening Supervision of Conduct and Practices

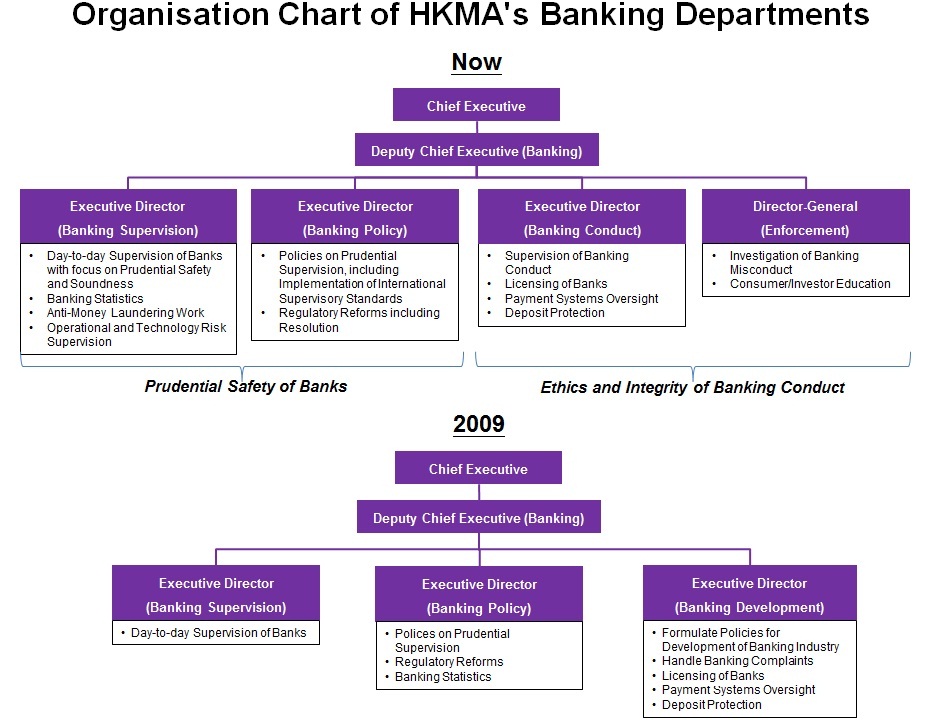

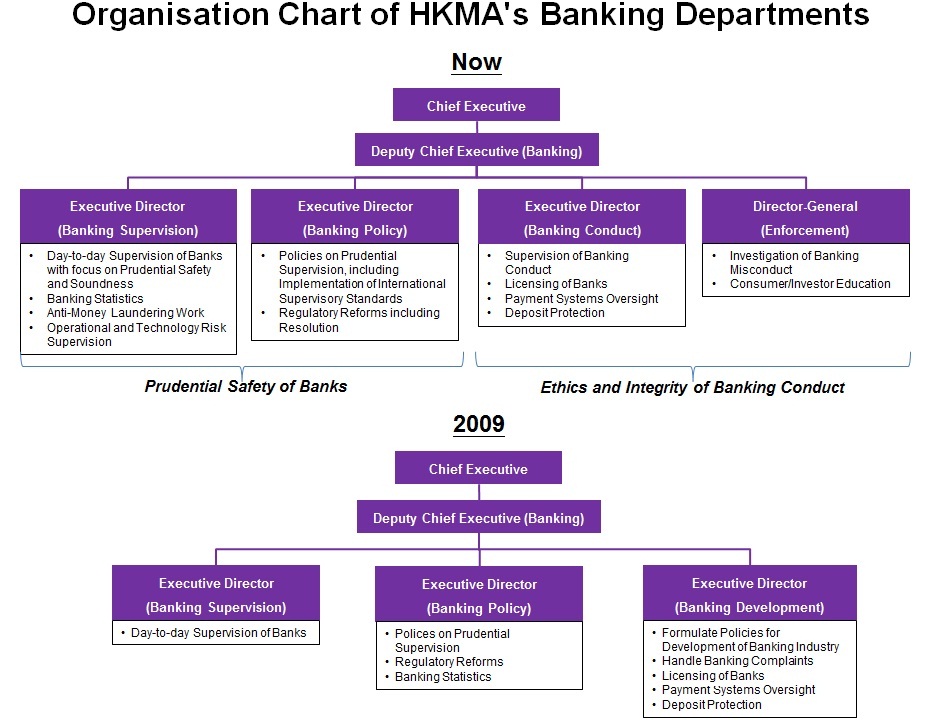

In the midst of this additional work being shouldered by the HKMA, I decided in 2010 that a two-pronged approach should be adopted for the HKMA’s banking supervision work. The first involves the monitoring of the asset-liability risk of banks, which includes our participation in discussions on the reform of international supervisory standards and the implementation of these standards in Hong Kong. But more importantly, what I called the second prong, has been the establishment of two new permanent departments, namely the Banking Conduct Department and the Enforcement Department, to supervise banks’ business conduct and practices. (Please refer to the organisation structure at Chart 2.) The Banking Conduct Department is mainly responsible for formulating the principles and standards governing banks’ dealings with customers and regulating banks’ conduct when carrying out activities in the market. It also reviews banking licence applications and appointments of directors and senior management of banks. The Enforcement Department is responsible for the investigation and follow-up actions of cases of mis-selling and other bank misconduct. The work of the Enforcement Department is important. While the Banking Conduct Department formulates, and monitors banks’ compliance with standards and requirements, non-compliant practices or behaviour manifest themselves through complaints from customers or other sources. Of course, the HKMA must investigate these cases in an impartial and professional manner and derive findings based on facts and evidence. Although the complainant or the bank concerned may not always be agreeable to the outcome of the HKMA’s investigations, we must understand that disputes between banks and customers are generally civil or commercial in nature (provided no criminal element is involved). Apart from seeking help from the HKMA, the complainant may also approach the Consumer Council, or seek to resolve the case through mediation, arbitration or the courts, if he is not happy with the findings of the HKMA.

Rights and Obligations of the Consumers

I need to emphasise here that the concept of rights and obligations apply equally to banks and their customers. While banks are endowed with the trust of their customers, they must adopt a customer-centric approach with due regard to customers’ needs and interests. On the other hand, while bank customers enjoy the convenience of “financial supermarkets”, they must also ensure that they make adequate effort to understand the risks, costs and suitability of the myriad banking products and services available. They cannot simply put the blame on the banks whenever they suffer an investment loss or get into financial difficulty after excessive borrowing. As such, the Banking Conduct Department and the Enforcement Department have been actively engaging the banking industry in promoting the Treat Customers Fairly Charter. We have also launched a series of financial education programmes during the past two years, highlighting the need for smart and responsible consumer behaviour when using banking services.

In conclusion, the HKMA’s two-pronged approach to banking supervision allows us to monitor the robustness of banks at the balance-sheet level and the integrity of banks’ business conduct – two distinct tasks requiring different skills and experience. That was the reason behind the establishment of the Banking Conduct Department and the Enforcement Department. This is an important reform of the HKMA’s organisational structure and helps to strengthen our regulatory oversight of the banking industry. It also sends a clear and important message to banks: apart from ensuring the robustness and safety of their balance sheets, the ethical business practices and professional integrity of their employees are equally important. We believe this approach suitably addresses the need for increased protection for consumers and investors alike under the universal banking model. Hong Kong banks have grown into a very big and competitive industry and have been the major providers of wealth management services. Our financial platform serves both local customers and a rapidly rising number of international customers in Asia and Mainland China, and copes with a huge volume of financial transactions conducted with hundreds of thousands of customers each day. Therefore, Hong Kong banks and their employees must, in accordance with the HKMA’s supervisory requirements, conduct business in a professional, customer-centric manner. Only then can we strive to attain sustainable development and consolidate our position as the premier financial hub of Asia.

Chart 1

Chart 2 (click here for larger image)

Norman T.L. Chan

Chief Executive

Hong Kong Monetary Authority

21 July 2014