(Translation)

Ms Carmen Chu (Carmen), Executive Director (Banking Conduct) of the Hong Kong Monetary Authority (HKMA), previously shared with us some smart tips on using autopay services. On this occasion, she explains to our ‘Smart Ambassador’ (SA) the chargeback protection mechanism of credit cards and the measures introduced by the HKMA in recent years to enhance public awareness of chargeback protection.

- SA:

- Carmen, the closure of a fitness centre earlier raised consumer concerns about credit card chargeback protection again. Can you please tell us briefly what this is all about?

- Carmen:

- Credit card chargeback protection is a protection mechanism provided by international credit card associations to consumers. Generally speaking, where consumers use credit cards to make lump-sum payments upfront, and if the purchased service is not available because the merchant has gone out of business, or the goods do not match the description, consumers can request card-issuing banks to assist in applying for refunds of the payments.

- SA:

- So it’s not the responsibility of card-issuing banks to make refunds to consumers, is it?

- Carmen:

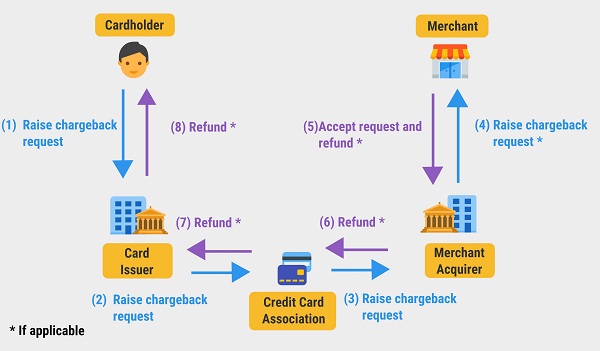

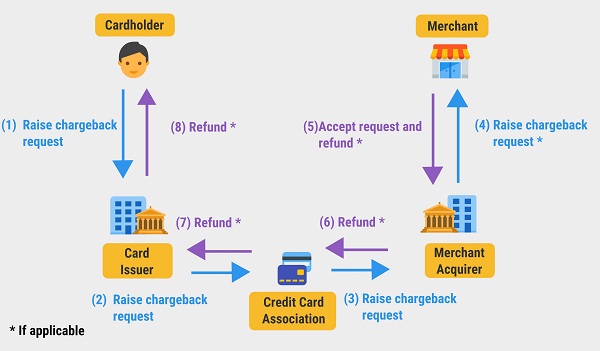

- After using credit cards for purchase, consumers settle payments with their card-issuing banks. However, the merchants concerned do not receive the payments directly from card-issuing banks, but from their merchant acquirers (such as banks) via the credit card associations. Once you understand the credit card transaction flow, you will see why card-issuing banks are not responsible for making refunds to consumers. Rather, the card-issuing banks assume the role of middlemen and, through the credit card associations, raise the chargeback requests with the merchant acquirers on behalf of their customers. If the merchant acquirers or merchants concerned accept the chargeback requests and refund the transaction payment, the card-issuing banks will in turn return the money to the consumers. Let’s look at the diagram below for the process flow of the chargeback mechanism:

- SA:

- If the handling process of the merchant acquirers is slow, will it delay the consumers from receiving the refunds?

- Carmen:

- No. The merchant acquirers must handle consumers’ chargeback requests in accordance with the procedures and time limits set by the credit card associations. The HKMA also requires the card-issuing banks, once a chargeback request is successful, to return the money to the consumer concerned as soon as possible.

- SA:

- Who makes the refund if the merchant goes out of business?

- Carmen:

- As long as a chargeback application meets the rules of the chargeback protection, the merchant acquirer concerned is liable for making the refund to consumers, even though the merchant has gone out of business.

- SA:

- What else do consumers need to know when applying for credit card chargeback?

- Carmen:

- Consumers should first understand the chargeback rules of the respective credit card associations, including the chargeback time limits, and when the limits start counting (for example, the processing date of the transaction, or the date that a consumer expects to receive the goods or service, or any other date(s)). Once the chargeback time limits expire, chargeback applications will not be accepted. In addition, when applying for chargeback, consumers may be required to provide the card-issuing banks with the relevant information, including the transaction receipts and any agreements signed with the merchants so that the card-issuing banks can ascertain that the transactions fulfil the rules of the credit card associations.

- SA:

- Now that you mention this, it’s clear that consumers should not check the chargeback rules only when they need to apply for refund, but should thoroughly understand the chargeback rules before making any credit card payments, and also keep their transaction receipts after every credit card transaction in case they need them for chargeback applications. Can you tell us how consumers can learn more about the chargeback rules and the application procedures?

- Carmen:

- The HKMA has always been committed to ensuring that banks treat their customers fairly. The Code of Banking Practice, which was issued years ago, requires banks to provide customers with information about credit card dispute resolution processes (such as chargeback applications). Banks are also required to enhance the transparency of the chargeback protection. Recently, the HKMA has further required all card-issuing banks to upload to their official websites information about chargeback protection (including the chargeback process flow, the chargeback time limits, etc.) and the application form. Consumers can browse their respective banks’ websites or contact their banks directly for any enquiries.

- SA:

- Are there other ways for consumers to learn more about credit card chargeback in addition to the information provided by card-issuing banks?

- Carmen:

- You can refer to the relevant inSight articles and pamphlets issued by the HKMA and related educational messages broadcast on the radio. The HKMA webpage, “Consumer Corner”, also contains various tips about using financial services, including “What is credit card ‘chargeback protection’?". We will also enhance the information about credit card chargeback protection in our consumer education programme this year and disseminate the related educational messages to the public.

- SA:

- Some consumers who have applied for credit card chargeback have indicated that the frontline staff of card-issuing banks seem to have different interpretations of the arrangements for chargeback applications.

- Carmen:

- We agree that banks should strengthen staff training. Indeed, in light of recent cases, the HKMA has reminded banks to provide appropriate training and guidance to their staff to ensure that they handle chargeback applications expeditiously and respond to customers’ enquiries about chargeback in a reasonable and consistent manner.

- SA:

- Carmen, do you have any other tips for the public?

- Carmen:

- For prepayment transactions, whether they are lump-sum payments by credit cards or in cash, consumers still need to face the risk of the merchants not being able to provide the services they’ve paid for yet failing to recover the prepaid amount from the merchants. Consumers should think twice before entering into prepayment transactions, particularly for transactions with a relatively long prepayment period or involving a relatively large amount of money.

Written by Smart Ambassador

Smart Ambassador, a staff member of the HKMA, is inquisitive and from time to time will share with you tips on using banking and financial services in a smart and responsible manner.