In my inSight article last week, I shared some views on our “Fintech 2025” work in promoting the adoption of fintech among banks and nurturing fintech talents and companies. For Hong Kong’s digital economy to thrive, not only do we need the above-mentioned “soft infrastructure”, robust financial “hard infrastructure” is equally crucial.

Financial infrastructure is like a highway, enabling capital and financial assets to travel safely and efficiently through our economy. “Digital bridges”, on the other hand, connect various parts of our financial system. They can prevent the formation of isolated “digital islands” that would hinder efficiency and stifle innovation. A robust financial infrastructure is therefore essential for a secure, efficient, and inclusive financial system in Hong Kong.

We have strengthened this “transportation network” of finance under “Fintech 2025”. Let me elaborate on two critical pillars: exploring central bank digital currencies (CBDCs) and building a next-generation data infrastructure. Together, they achieve synergies and form the backbone of Hong Kong’s future of finance.

Reimagining Money in the Digital Age

Hong Kong already has a sophisticated payment system, being the only financial centre in the world with Real Time Gross Settlement (RTGS) systems supporting four currencies. The launch of the Faster Payment System (FPS) in 2018 has made retail payments even more seamless, and FPS has since become part of our everyday life, enabling instant transfers across banks and e‑wallets. FPS has also connected with its counterparts in Thailand and Chinese Mainland in recent years to offer additional means for cross-border payment.

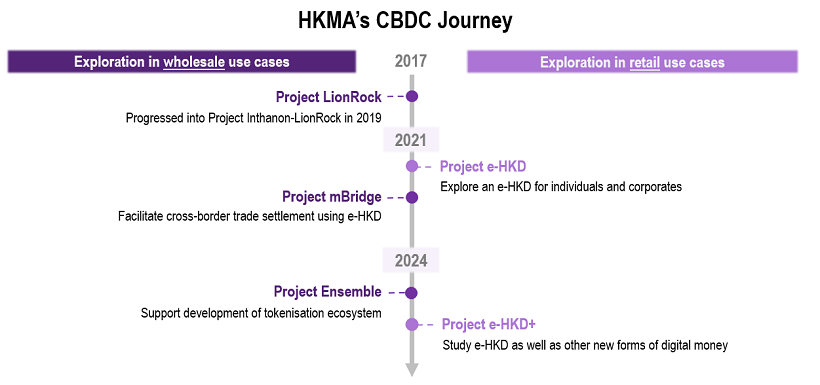

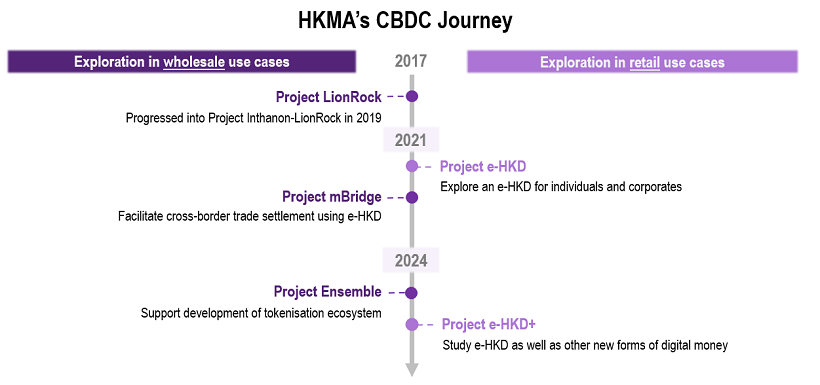

Building on the strengths of this foundation, we began exploring a new form of digital money based on distributed ledger technology (DLT) — a CBDC, i.e. an e-HKD — as early as 2017. Under “Fintech 2025”, we accelerated these efforts, moving from experimentation to implementation. Issued by the HKMA, the e-HKD carries no credit risks, and hence the initial focus is on wholesale payments, particularly between financial institutions for international trade. Project mBridge, which links the e-HKD with the CBDCs of Chinese Mainland, Thailand and the UAE, has reduced the time required for cross-border transaction from days to just seconds. With the project reaching the Minimum Viable Product (MVP) stage in 2024, this new financial “highway” has significantly boosted efficiency for corporate cross-border payments.

Our exploration of DLT further led us to investigate how tokenisation can improve our financial system. Much like upgrading to a smart highway, tokenisation turns real-world assets, such as money or stocks, into digital tokens for faster and smoother transactions. That was why we launched Project Ensemble last year to facilitate the development of the tokenisation ecosystem in Hong Kong. The project has swiftly gained significant momentum domestically and internationally; we have collaborated with the central banks of Brazil, France and Thailand on cross‑border tokenisation use cases and also explored 20 tokenisation use cases in sandbox experiments with the industry to explore real-world use cases of settling digital asset transactions using tokenised deposits, with the e-HKD as a monetary anchor for the ecosystem. These advances help businesses move funds faster and manage liquidity more effectively, lowering costs and paving the way for smoother financial services for companies and consumers alike.

What makes Project Ensemble particularly powerful is Hong Kong’s unique positioning, which combines regulatory clarity with market depth, bringing together central banks and private sector innovators in an environment where experiments can be transformed into viable solutions. This synergy between us and the industry, underpinned by Hong Kong’s robust financial market and a comprehensive suite of financial providers, creates an ideal well-established testing ground where tokenisation concepts are refined through real market feedback.

We have also explored the possibility of extending the use of the e-HKD to retail scenarios for the general public. Drawing on the insights from the recently completed e-HKD Pilot Programme, we will lay the necessary foundations from the policy, legal and technical perspectives by the first half of next year, so as to ensure Hong Kong is well-prepared for such a potential extension of an e-HKD to retail usage in the future.

These e-HKD and tokenisation initiatives are part of a broader vision: a comprehensive digital money framework that allows for the complementary coexistence of different forms of tokenised money — the e-HKD, tokenised deposits, and regulated stablecoins — to support financial innovation in the private sector, and create a dynamic and innovative digital money ecosystem in Hong Kong.

Building Bridges to Connect Digital Data Islands

Just as islands need bridges to avoid isolation, our financial system also needs “digital bridges” connecting the “digital islands”. That is why another key pillar of “Fintech 2025” is the development of a next‑generation data infrastructure designed to create secure and interoperable “bridges” enabling data to travel from one shore to another with data owners’ consent.

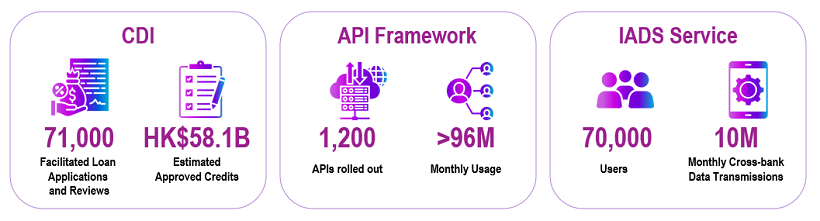

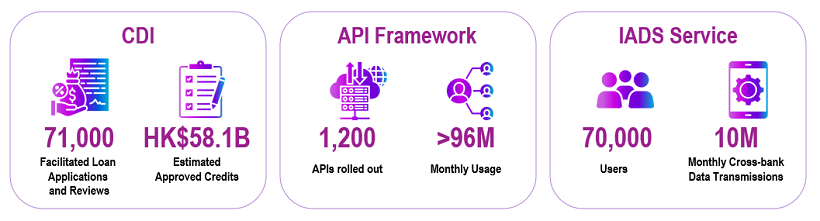

This is precisely the area that the Commercial Data Interchange (CDI) was designed to focus on. Launched in 2022, CDI serves as a secured “bridge” connecting banks with multiple data providers. In just three years, CDI has formed robust partnerships with 26 banks and 17 data providers, starting with payments, e‑commerce records and import/export declarations and expanding to government data. By September 2025, CDI had facilitated over 71,000 loan applications and reviews, with an estimated over HK$58.1 billion in approved credit. From cookie shops and dessert houses, to pet supply stores and frozen food importers, numerous small and medium-sized enterprises (SMEs) have leveraged CDI to successfully overcome challenges in securing bank loans.

Such “digital bridges” benefit individuals and larger corporates as well. Through the launch of Hong Kong’s Open Application Programming Interface (API) framework and Interbank Account Data Sharing (IADS) service, customers only need to provide authorisation and consent to securely share their banking data across institutions and platforms, enabling faster and more convenient banking services. The numbers tell the story: over 1,200 APIs have been rolled out and monthly usage exceeds 96 million. The consent‑based IADS service has been adopted by 15 banks, attracting over 70,000 users and processing more than 10 million cross-bank data transmissions monthly.

Lastly, connectivity between governments, banks, and other cross-border partners simplifies the verification of official records and streamlines financial services. With CDI now linked to golden sources like the Companies Registry and Land Registry, over 1.5 million searches are now automated each month. Connectivity has also expanded to the Shenzhen–Hong Kong cross-boundary data validation platform, providing banks with a trusted method to verify cross-boundary borrower and enterprise information. Together, these initiatives reduce paperwork, minimise delays, and enhance financial services across the ecosystem.

Fintech 2025 and Beyond

As we reflect on “Fintech 2025”, the financial “highways” and “digital bridges” we have built are already delivering tangible benefits––faster and more cost-effective payments, smoother financing, and robust data infrastructures connecting banks, businesses, and governments. But good infrastructure is never truly completed. Just like real-world highway network, financial “hard infrastructure” must be continuously optimised and integrated with emerging technologies to meet users’ ever-evolving needs.

These achievements have also gained global recognition. In a recent major ranking of international financial centres, Hong Kong secured the top spot in the fintech category. This reflects that our financial infrastructure is not only technologically advanced but also robust, enabling the financial market to explore new frontiers and further cementing Hong Kong’s position as a leading fintech hub and international financial centre.

As we draw near the conclusion of “Fintech 2025”, it is clear that the past few years have laid strong foundations for Hong Kong’s digital financial future. Yet the journey does not stop here. At the upcoming Hong Kong FinTech Week, celebrating its tenth anniversary, we will chart the next steps in our fintech strategy, ensuring that Hong Kong continues to lead the way in fintech innovation. Stay tuned!

Eddie Yue

Chief Executive

Hong Kong Monetary Authority

30 October 2025