In recent years, Hong Kong has further consolidated its position as the global offshore renminbi (RMB) business hub, with various market indicators attesting to its thriving development. The Connect Schemes related to bonds, stocks, and wealth management, to name a few, have seen continuous upgrading and enhancements, offering great business opportunities to banks, investors, and corporates. Notably, the market demand for the RMB as a funding currency has increased substantially, as reflected in the remarkable growth in the RMB loan-to-deposit ratio in the banking sector from around 20% in September 2022 to over 90% in June 2025. Corporates are increasingly seeking RMB loans with longer tenors.

To address the increasing liquidity needs of the expanding offshore RMB business sector, the HKMA introduced the RMB Trade Financing Liquidity Facility (TFLF) in February this year. The facility offers banks a relatively stable source of offshore RMB funding for their provision of trade finance-related services to corporate customers (details can be found in the relevant inSight). The facility has been well received by participating banks who were enabled to extend RMB trade financing to a wider array of corporate customers. With the positive feedback and operational experience gained, we are taking the initiative to the next phase by broadening the scope of eligible RMB business and lowering the facility rate, while maintaining the facility’s total size of up to RMB100 billion. Separately, we will also enhance the existing RMB Liquidity Facility to ensure sufficient market liquidity for the expansion of offshore RMB business and further facilitate the use of offshore RMB in the real economy. This enhancement package is made possible by the HKMA-PBoC Currency Swap Agreement between the HKMA and the People’s Bank of China (PBoC). We are very grateful to the PBoC for their strong and unwavering support.

- Introduction of the RMB Business Facility (RBF)

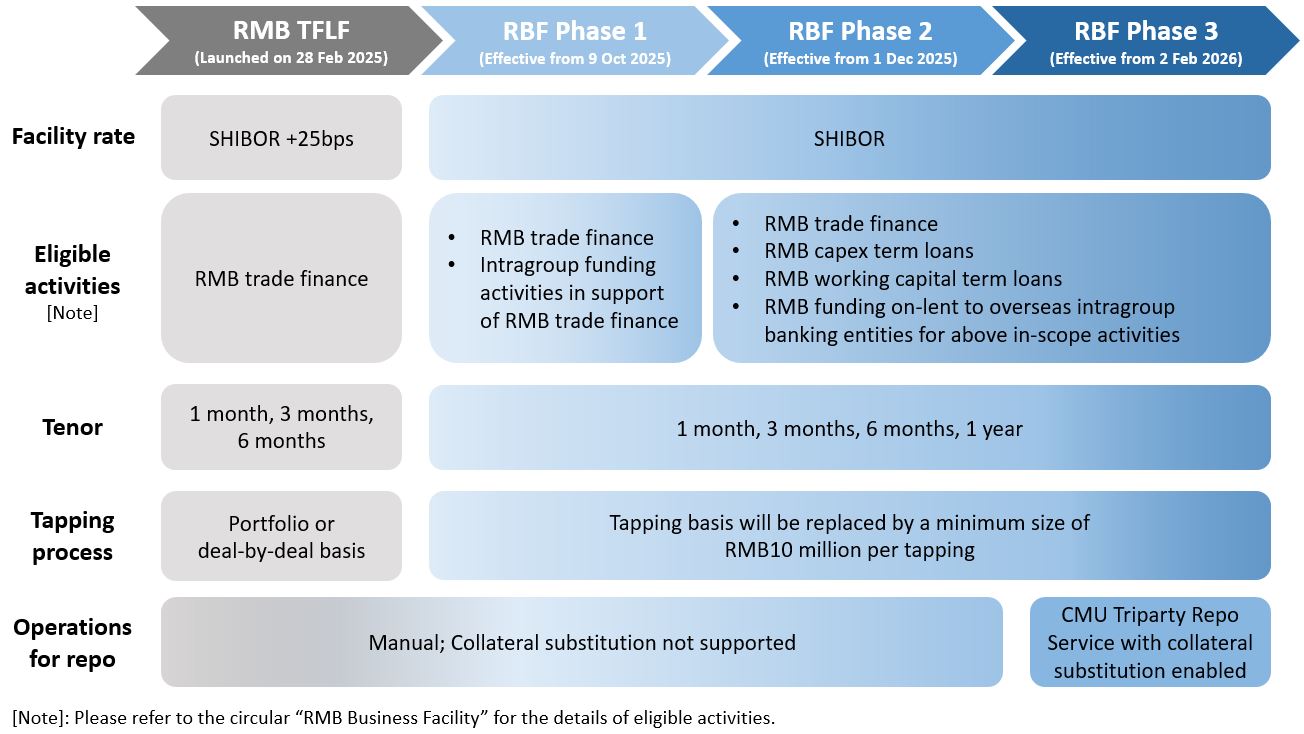

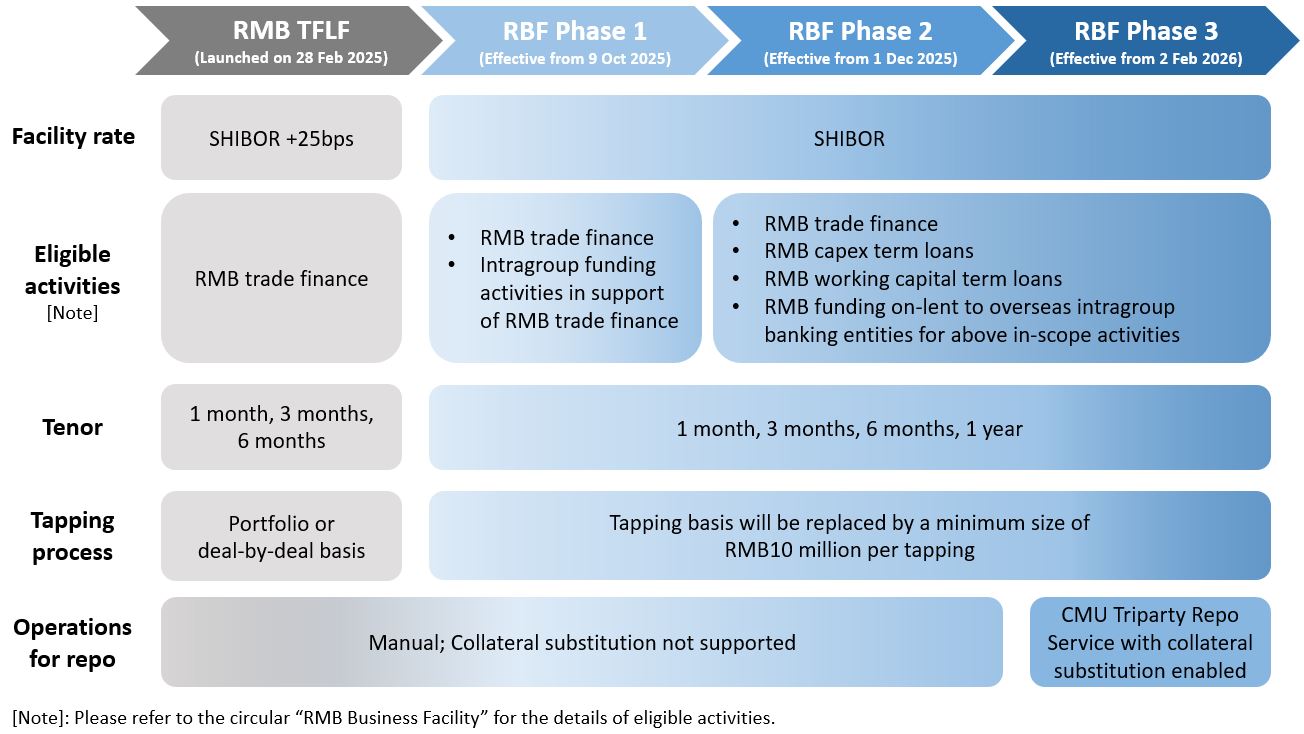

Starting from 9 October this year, the HKMA will introduce the RMB Business Facility (RBF) to replace the existing RMB TFLF, with enhanced terms and an extended scope of eligible RMB financing activities. The RBF will be rolled out in three phases (see diagram below), with details set out in a circular on the RBF that has been issued to banks earlier today (link). In summary:

- Phase 1 – Starting from 9 October, banks which have been assigned a quota under the RMB TFLF (i.e. Participating Authorized Institutions, or Participating AIs) will see a reduction in the facility’s interest rate, with the existing spread of 25 basis points removed, thus tracking the Shanghai Interbank Offered Rate. These Participating AIs will also be allowed to on-lend RMB funds obtained from the RBF to their overseas intragroup banking entities to support the provision of RMB trade finance to the entities’ overseas corporate customers. This will further anchor Hong Kong’s role in radiating offshore RMB funds to global markets. The tapping process will also be streamlined by replacing the current portfolio basis and deal-by-deal basis with simple minimum tapping threshold of RMB10 million. To support RMB loans of longer tenors, facility tenors will also be extended to include one year from the current one month, three months, and six months.

- Phase 2 – With effect from 1 December, the scope of eligible RMB financing activities will be broadened to cover certain RMB capital expenditure (capex) and working capital term loans, increasing the types of potential use cases of the RBF for Participating AIs and their overseas intragroup banking entities significantly. Banks will be able to access a more predictable and stable source of RMB funds that enables them to better support the operational and investment needs of their corporate clients.

- Phase 3 – With effect from 2 February 2026, the HKMA will introduce the use of the CMU Triparty Repo Service in support of the repo operations of the RBF, effectively migrating collateral management from manual processing to a more automated solution. Collateral substitution in repo transactions under the RBF will also be enabled. With these enhancements, the lifecycle management of collateral and settlement of repo transactions -- including the selection and transfer of securities, collateral substitution and other relevant processes such as settlement, repayment and return of coupon payments -- will be automatically processed under the Service. This will make collateral management more convenient and efficient for Participating AIs, and in turn improve the liquidity of collateral and contribute to Hong Kong’s bond market development. Consequently, collateral haircut and margin maintenance arrangements will also be refined.

Similar to the RMB TFLF (and hence Phase 1 of the RBF), a quota will be assigned to AIs interested in participating in Phases 2 and 3 of the RBF. Interested AIs, regardless of whether they have participated in Phase 1, are invited to submit an application by 31 October to the HKMA for consideration.

- Enhancement of the existing RMB Liquidity Facility

The RMB Liquidity Facility was first introduced in June 2012 to address potential short-term liquidity tightness in the offshore RMB market and has been running smoothly since inception. The HKMA has made various refinements to the facility over the years to meet market demand for short-term liquidity. With effect from 9 October, the following enhancements will be implemented:

- Reallocation of the intraday and overnight funds – The HKMA currently offers intraday and overnight RMB funds, each for up to RMB20 billion, through the RMB Liquidity Facility with a total size of RMB40 billion. Having considered the facility’s overall usage and banks’ liquidity needs, we will adjust the allocation of funds, raising the size of intraday RMB funds to RMB30 billion, and reducing that of overnight RMB funds to RMB10 billion. With the expanding offshore RMB activities, this enhancement will optimise the utilisation of the RMB40 billion facility to support the growing need for intraday RMB funding for the settlement of cross-border RMB payments.

- Introduction of a two-week and a one-month repo for T+1 settlement – In addition to intraday and overnight RMB funds, the existing facility also provides funds of one-day and one-week tenors on T+1 basis via repo transactions. To provide banks with more flexibility in managing their funding, we will extend the facility to cover two-week and one-month tenors on T+1 basis.

Details are found in the attached circular on the RMB Liquidity Facility (link).

As a global offshore RMB business hub, Hong Kong is well-positioned to seize the opportunities for nurturing RMB business in the offshore market. We will continue to collaborate with Mainland authorities and market participants to explore and advance the development of the offshore RMB market in Hong Kong.

Eddie Yue

Chief Executive

Hong Kong Monetary Authority

26 September 2025