Norman T.L. Chan, Chief Executive, Hong Kong Monetary Authority

(Translation)

Distinguished Guests,

When central banks, such as the US Fed, cut short-term policy interest rates to near zero and created money on a massive scale to purchase bonds and other financial assets, we called it quantitative easing (QE).

2. It has been more than six years since the launch of QE in 2009. After spending a total of US$3.9 trillion to purchase bonds, the Fed wrapped up its asset purchase programme in October 2014. In 10 days’ time, the Fed will decide whether to lift interest rates. If it does, it will signal the beginning of the normalisation of US interest rates.

“QE” Ineffectual?

3. At the end of 2009, I initiated a guessing game with several chief economists from major commercial and investment banks. The question I asked was when they expected the Fed to exit from QE. Most bet on the second quarter of 2010 or earlier. The most dovish of them said Q3 2010. As we all know now, these guesses were wildly off the mark. To be fair, I don’t think anyone expected the US recovery to be so slow and sluggish.

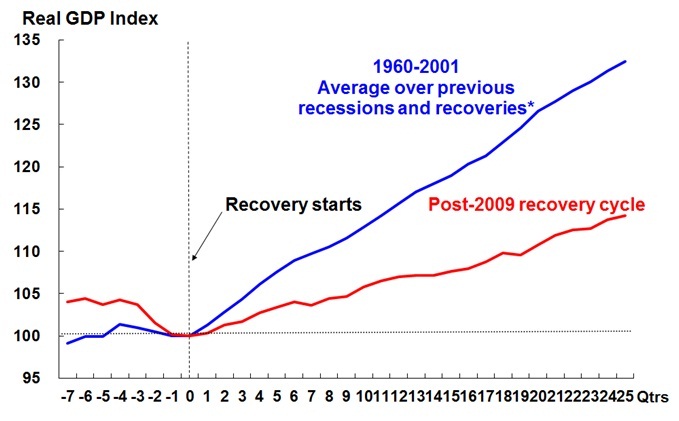

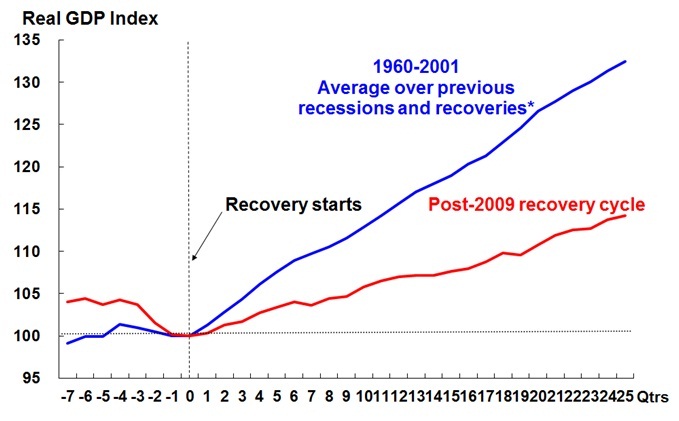

4. Indeed, after the Global Financial Crisis, the US suffered its worst recession since the Great Depression of the 1930s. In a desperate bid to stave off the recession, the US literally moved mountains, including introducing the unprecedented QE policy and splashing out US$1.8 trillion between 2008 and 2010 to cut taxes and implement other fiscal policy measures to prop up the economy. However, as we can see from Chart 1, the current recovery has been the weakest of all the economic cycles in the past 55 years. The average growth rate is just 2.2%, half the average rate of 4.6% in the previous recovery cycles.

Chart 1: Comparison of US economic recovery strength

* Excluding the 2001, 1970, 1974 and 1980 double-dip recessions.

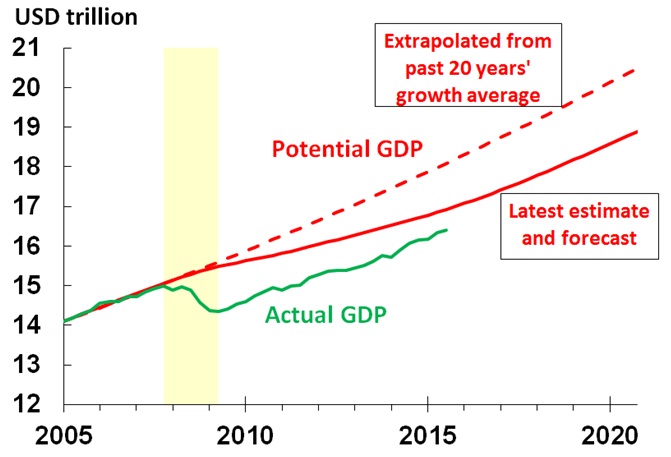

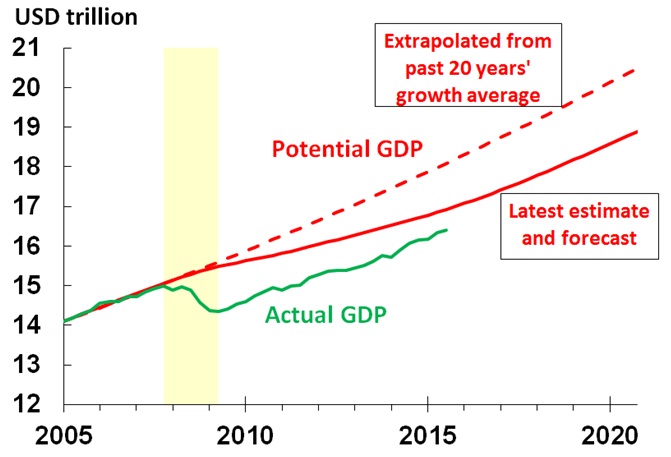

5. As for employment, the US has lost a total of 8.7 million jobs during the financial crisis and recession, with the unemployment rate peaking at 10%. Although employment bottomed out in 2010, and some 13 million jobs have been created since then, this only represents 4.3 million more jobs compared with the peak eight years ago in early 2008, and way behind the 8.8 million people who have been added to the labour force over the same period. In other words, while the US unemployment rate has declined to 5% recently, it does not mean the labour market has fully recovered. One of the main reasons for the faster-than-expected drop in the unemployment rate is the dwindling labour force participation rate, from an average of 66% in 2007 to the current 62.4%, the lowest since 1977. This partly explains the feeble economic recovery and declining potential GDP growth trend in the US (Chart 2).

Chart 2. Decline in US potential GDP

6. The weak recovery in the US in recent years fell outside the expectations of many economists at the Fed. Because of the lacklustre growth, QE was extended and expanded, feeding an addiction from “low for long”, to “low for longer” and then to “low forever”, and developing a dependence on QE by the market. When the then Fed Chairman Ben Bernanke hinted at the possibility of scaling down the asset purchase programme in May 2013, the market panicked in an episode we later called the “Taper Tantrum”.

7. So, why is the present recovery weaker than in previous cycles? This is a complicated and controversial subject. I believe that both cyclical factors and structural factors, such as household de-leveraging, the high home inventory levels after the bursting of the housing bubble and structural changes in the population and labour market, are at play. External factors are also involved, including the European sovereign debt crisis in 2011. However, due to time constraints, I will focus on how QE may have supported US economic recovery and affected the global financial environment.

8. The prevailing mainstream view, including the major advanced economies such as the US, Europe and Japan, as well as the International Monetary Fund, is that QE is the right policy response to prop up the economy and stave off deflation. They think that pushing down the interest rates to near zero and pumping large amounts of money into the banking system will give rise to the following positive chain effects –

(a) the interest expenses of borrowers, including individuals, corporations and governments, will be reduced;

(b) with lower interest rates and central banks scooping up low-risk sovereign bonds, investors can only resort to equities, properties and other assets in search of higher yields;

(c) asset prices will rise as a result, creating a positive wealth effect which will spur consumption and investment; and

(d) consumption and investment will, in turn, stimulate employment.

9. Since the consensus was that in a zero interest rate environment QE was the right prescription, when the recovery proved weaker than expected, the natural diagnosis was that the treatment was too short and the dosage was insufficient, which led to expansion of QE and for a longer period. Indeed, in the case of the European Central Bank, the treatment went as far as introducing negative interest rates.

Is QE a panacea with no side effects?

10. While there are benefits, there is a flip side to QE. I share the view of some economists that the effectiveness of QE is partly offset by the adverse side effects of zero interest rates and its prolongation. Here are six side effects that may possibly arise.

11. First, and foremost, zero interest rates and QE have inflicted big losses on the savers and individuals, funds and institutions reliant on interest incomes. Deposit rates in the US have dropped by 3 percentage points from an average of about 3.5% in 2007. As interest incomes approach the zero mark, many depositors, especially low- and medium-income households and retirees have had to cut their spending. And, while it can be said that “a saver’s loss is a borrower’s gain”, this has not been the case for every borrower. For example, because of negative equity or bad credit scores, many US families are stuck with hefty mortgage rates. In Hong Kong, deposit rates have also dropped by about 2 percentage points since 2007. With total deposits of about HK$10 trillion currently in our banking system, you may wish to think about the potential loss to savers.

12. Secondly, most US families are still in the process of de-leveraging after the global financial crisis and as a result, growth in consumer demand remains lukewarm. On the corporate front, notwithstanding low borrowing costs, many US companies have been reluctant to invest domestically in expanding capacity and enhancing productivity. In fact, annual growth in business investments in the US has averaged only 3.7% since 2009, well below the average of 5.8% in the past economic expansion cycles. At the same time, many US corporations have spent their cash pile to buy back their own shares. In 2014 alone, US$550 billion was spent in share buyback, bringing the cumulative amount to US$2,500 billion since 2009. As we all know, share buyback may buoy share prices and boost earnings per-share in the short run, but will not improve a company’s productivity and competitiveness, nor create any new jobs.

13. Thirdly, with the US financial system awash with liquidity from QE and with feeble domestic demand, excess liquidity soon found its way to emerging market economies (EMEs), such as China, Brazil and Russia, in pursuit of higher returns. Between the outbreak of the global financial crisis and the peak in 2014, total inflows to EMEs were estimated to be some US$2.7 trillion, with roughly US$1.6 trillion of it destined for Asia. In the face of the massive inflows, EMEs experienced currency appreciation, an increase in money supply, an expansion of the credit bubble, overheating in the economy and asset markets, etc.

14. Fourthly, the tide will eventually turn. Currently, with a strong US dollar and the imminent normalisation of US interest rates, EMEs are confronted with capital outflows, currency depreciation, and sharp falls in energy and commodity prices. Their economies and asset markets are coming under varying degrees of downward pressure, which will adversely affect the US and other advanced economies. EMEs have grown much larger in the past decade or two. In particular, China’s GDP ballooned from US$1 trillion in 2000 to US$10 trillion in 2014. More importantly, while EMEs accounted for about 55% of global GDP since 2009, their contribution to global economic growth was as high as 80%. So, a slowdown in EMEs will be an impediment to recovery in the US and other advanced economies.

15. Fifthly, zero interest rates and QE have indirectly widened the income gap. Because of ultra-low interest rates and excess liquidity seeking better returns, stock and property markets rallied in many parts of the world. This is especially true in places with more promising growth prospects like Mainland China, Hong Kong and Singapore. However, low-income groups, with little if any stocks and properties, have missed out altogether. And their savings in deposit accounts have earned next to nothing. This has exacerbated inequality, resulting in negative implications for social stability and harmony.

16. Sixthly, zero interest rates and QE have changed the global investment environment. Yields on the traditionally more conservative bonds and fixed income investments have declined. For example, 10-year US Treasuries’ yield has fallen from 5% to about 2%, and some sovereign bond yields in the Eurozone have even plunged into the negative. At the same time, both the exchange rates and bond prices in EMEs have experienced sharp swings recently. With the soon-to-start normalisation of US interest rates, and distorting low-returns and high-volatility in the bond markets, the investment environment will become even more complex and difficult.

17. While the mainstream thinking recognises that zero interest rates and QE are not without side effects, they still believe that the benefits outweigh the costs. Only history will tell.

How should Hong Kong adjust to the US exit from QE?

18. Let me offer my two cents on the future outlook. The US interest rate will quite possibly start to normalise next week. The US economy will continue to grow at a moderate pace, and the US dollar should remain strong for a period of time. However, it is hard to predict how interest rates, bond yields, fund flows and asset markets will react as we are again entering uncharted waters, much the same as when QE was first launched. Moreover, economies interact with each other and respond to external factors differently, thus making it more difficult to predict market responses. Nevertheless, one thing is certain: a period of difficult adjustment lies ahead for EMEs. Energy and commodity prices will continue to be suppressed. EMEs will continue to witness capital outflows, currency depreciation, economic slowdown and downward pressure on their asset markets. And, Hong Kong will not be immune. We should be prepared to face a period of capital outflows, rising interest rates and slower growth. Asset markets, including the property market, will also face downward pressure. However, if there is an orderly adjustment to asset and property prices, this could provide a respite for prospective homebuyers and business owners squeezed by hefty rents. Now, I would like to take the opportunity to respond to some concerns that under our Linked Exchange Rate system, the Hong Kong dollar will appreciate alongside the US dollar, thereby weakening the competitiveness of our economy, in particular the tourism industry, and dealing a blow to the wobbly retail and tourism sectors. I wish to point out that there is no evidence to suggest a direct linkage between the recent decline in visitor numbers and expenditure, and the exchange rate of the Hong Kong dollar. The Nominal Effective Exchange Rate (NEER) of the Hong Kong dollar rose by 6.6% year-on-year in the third quarter this year, but price levels for tourism-related merchandise and services fell by a greater magnitude. For example, prices for jewellery, clocks and watches fell by 8.2%, while the average room rate for hotels fell by 15.3%, which more than offset the effects of a stronger Hong Kong dollar. This clearly shows that Hong Kong’s economy is sufficiently flexible to adjust speedily to changing markets.

19. In addition, Hong Kong is different to other EMEs. We have sound and robust monetary, banking and financial systems. In response to the large capital inflows over the past few years, we have got ourselves well-prepared by introducing seven rounds of counter-cyclical macroprudential measures on property mortgages to enhance the resilience of the Hong Kong banking system. We should be able to withstand the shocks from a reversal of the capital flows and economic adjustments as long as we remain level-headed. We are endowed with a strategic position with the “Hinterland of Mainland China and Interface with the World” under the “One Country, Two Systems” principle. It is true the Chinese economy is experiencing a slowdown, but this reflects a structural shift from unbalanced growth at a breakneck speed to a high-to-moderate growth rate on a more sustainable basis. Indeed, sustainable and healthy development will become the “new normal” in China if it can reap the “reform dividends” by remaining committed to reform and liberalisation, and moving towards a modern and market-based economy.

20. Against such a backdrop, there is vast potential for Hong Kong’s intermediary role for trade and commerce as well as fund flows between China and the world. To fortify our role, we must, with support from the central government, foster more links with the Mainland. In the financial sector, we should strengthen our soft power by attracting, nurturing and retaining professionals. We should also encourage financial innovation while keeping a firm grip on risk management. In short, we must trump other financial centres in every way to continue our position as the most vibrant and competitive international financial centre in Asia. Thank you.