The rapid evolution of financial technology (fintech) is transforming financial services, bringing new opportunities and challenges. The Hong Kong Monetary Authority (HKMA) has taken proactive steps through our “Fintech 2025” to drive Hong Kong’s banking sector towards a more innovative and resilient future. As the journey enters its next chapter, it is timely to reflect on the key pillars that underpin the strategy. This article looks at the first three pillars, namely “All Banks Go Fintech”, building a fintech-savvy workforce, and nurturing a dynamic ecosystem through funding and supportive policies, while another inSight article next week will look at the remaining two pillars related to Central Bank Digital Currency and data infrastructure. Together, these pillars are solidifying Hong Kong’s position as a leading international financial centre and propelling the city further along its path of digital transformation.

From “All Banks Go Fintech” to “All Banks Gone Fintech”

The “All Banks Go Fintech” initiative aims to transform the banking sector through comprehensive digitalisation of their operations, from front-end to back-end. As part of this initiative, the HKMA has led a series of efforts to encourage banks to adopt fintech across different areas:

- Digital Banks – New players in the digitalisation journey

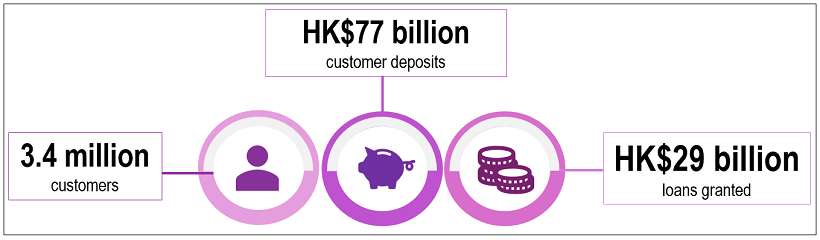

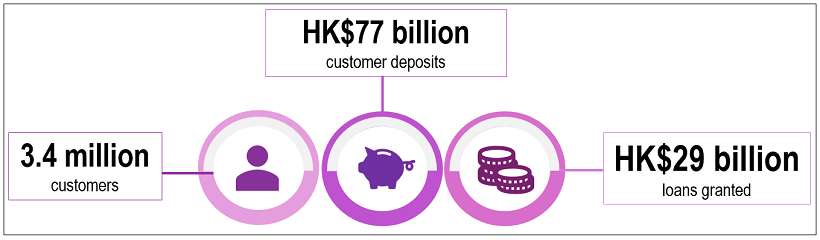

Since their launch, the eight Digital Banks (DBs), formerly known as Virtual Banks, have rapidly expanded their customer base, particularly among younger users and small and medium-sized enterprises. Their digital-native business models, which centered on core services of deposit and lending, with some also extending to investment and insurance options, have prompted traditional banks to accelerate their own digital transformation efforts.

Figure 1. DBs’ number of customers, customer deposits and loans granted as of June 2025

- Regtech – A focus on risk management and compliance

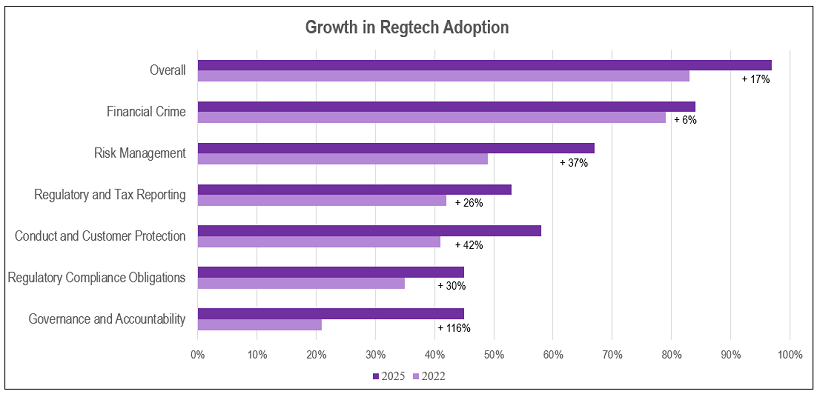

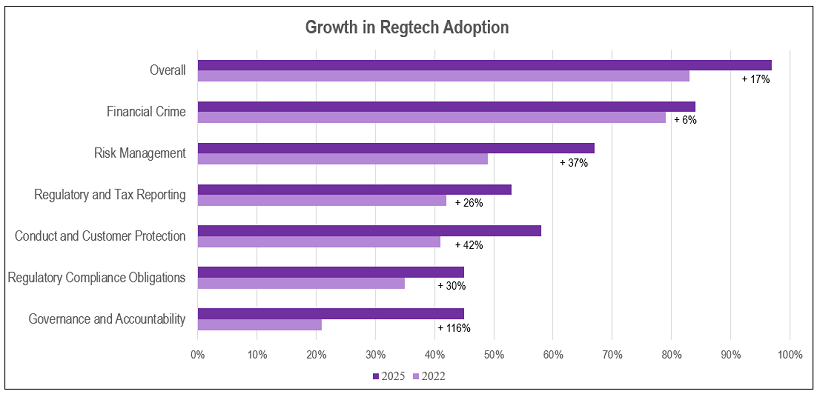

Banks’ Regtech adoption is one of the HKMA’s supervisory priorities. We have published a series of practice guides, use case bulletins, and videos to showcase how Regtech works in real banking operations. Thanks in part to these efforts, all retail banks in Hong Kong have now adopted Regtech, with overall adoption reaching 97%1. With an increase in sophistication, Regtech has also deepened its penetration in the industry across various risk areas.

Figure 2. Growth in Regtech Adoption (2025 vs. 2022)

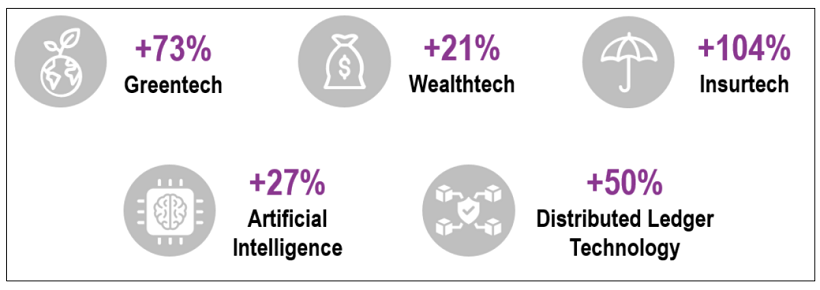

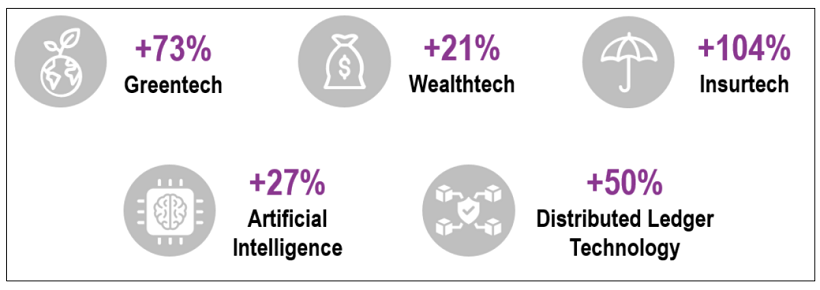

- Insurtech, Wealthtech and Greentech – Business-focused adoption

Our 2022 Tech Baseline Assessment identified Insurtech, Wealthtech, and Greentech as high-potential fintech areas warranting further support from the HKMA. The launch of the Fintech Knowledge Hub and the Fintech Connect matching platform has accelerated uptake, with growth rates ranging from 20% to over 100%.

Figure 3. Growth in Adoption of Greentech, Wealthtech, Insurtech, Artificial Intelligence and Distributed Ledger Technology (2025 vs. 2022)

In just a few years, banks in Hong Kong have moved from merely exploring fintech to embedding it into their end-to-end operations, with a 95% adoption rate according to the HKMA’s 2025 Tech Maturity Stock-take. Customers are already reaping the benefits: from mobile apps that enable remote account opening, to lending processes that are streamlined through the use of alternative data, and to the adoption of Artificial Intelligence (A.I.)-powered deepfake detection for enhanced security.

The shift from “go fintech” to “gone fintech” shows innovation is delivering real value to the public. These developments highlight Hong Kong’s proactive drive to create a digitally advanced, customer‑centric banking ecosystem that delivers more choices, a higher level of security and more seamless user experience.

Extra Miles: Responsible Innovation

With the rapid evolution of fintech both globally and locally, the HKMA has introduced a range of more targeted initiatives to promote responsible innovation in Hong Kong’s financial sector, beyond “All Banks Gone Fintech”.

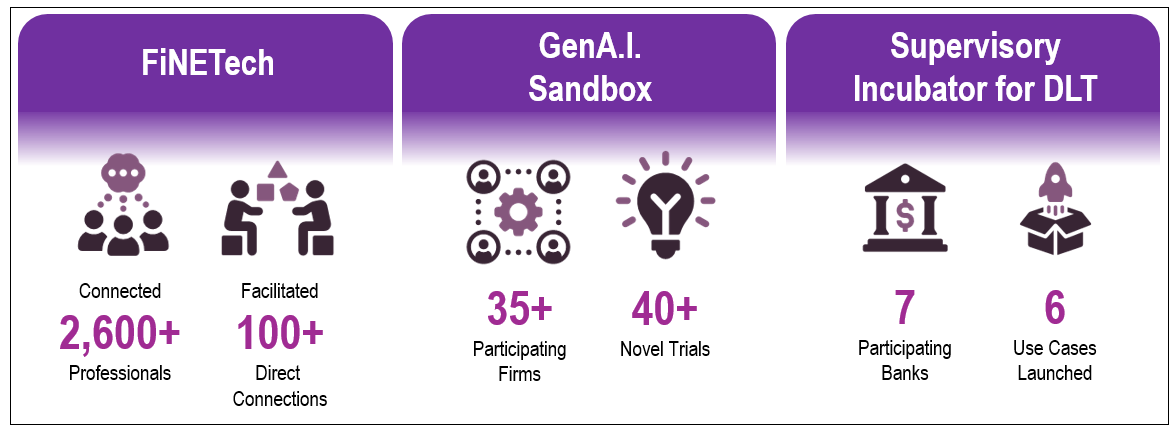

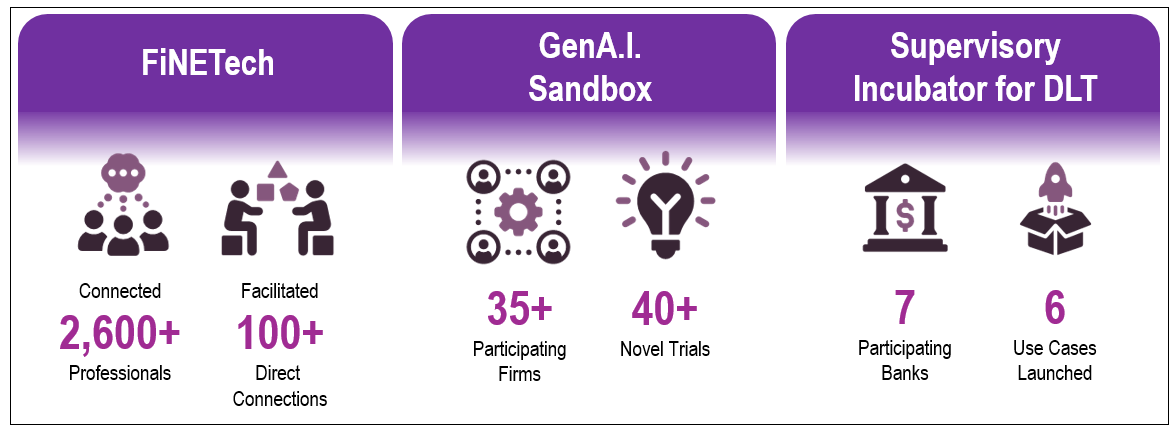

Figure 4. Initiatives to promote responsible innovation

- FiNETech – Where “Fin” and “Tech” communities connect

We began by strengthening connections across Hong Kong’s financial landscape, bringing together financial institutions, fintech providers and market participants to break down barriers and unlock synergies. The creation of platforms like the FiNETech series and various industry events have brought together professionals in the ecosystem to explore next-level collaboration. Together with the Fintech Connect matching platform, these initiatives have facilitated over 100 direct partnerships, accelerating idea generation and turning ideas into action.

- GenA.I. Sandbox – Where ideas and safeguards are validated

A.I. has become a key enabler driving further digitalisation across a wide range of banking operations. The HKMA supports the adoption of A.I. through research and training, which has led to significant uptake: 75% of surveyed banks have integrated A.I. into their operations, up from 59% in 2022. To instil the responsible innovation mindset, the HKMA established the Generative A.I. (GenA.I.) Sandbox with Cyberport to enable exploration of novel technologies while maintaining robust safeguards against emerging risks.

Not only does the GenA.I. Sandbox provide a risk‑managed environment and targeted supervisory feedback, it also offers free computing resources to banks. The access to state-of-the-art computing power helps overcome the high processing demands of verifying accuracy, explainability, consistency, and security before committing investment. A wide range of use cases have been piloted, from risk management and customer service to anti‑fraud solution and deepfake detection. A particularly novel trial has been “A.I. vs A.I.” — using A.I. tools to counter the risks and challenges posed by A.I. itself.

- Supervisory Incubator for DLT – where traditional finance and tokenisation meets

Distributed Ledger Technology (DLT) is another key driver of digitalisation, with DLT adoption surging 50% in recent years, driven by growing interest in the potential of tokenisation. The HKMA has therefore introduced the Supervisory Incubator for DLT (Incubator), which aims to enable banks to bridge traditional finance with emerging tokenised ecosystems. By creating an effective interface between the two, institutions can leverage and adapt their risk management capabilities to new digital instruments. Six banks have already launched tokenised deposit services through the Incubator, demonstrating how responsible experimentation can turn concepts into production‑ready solutions.

Going the extra mile with initiatives like FiNETech, the GenA.I. Sandbox and the Incubator reflects our agile supervisory philosophy that embraces innovation while remaining vigilant to potential risks.

People are key: Nurturing fintech-savvy talent and a dynamic ecosystem

- Expanding the Fintech-savvy workforce

The sustainable development of fintech cannot be undertaken without talent. To empower banking professionals, we launched fintech-specific training and certifications under the Enhanced Competency Framework for Banking Practitioners. For the younger generation, we launched the Fintech Career Accelerator Scheme (FCAS) nearly a decade ago to expand the fintech talent pool, providing over 1,300 students with hands-on internships. Since 2022, the Industry Project Masters Network (IPMN) Scheme has also provided more than 360 postgraduate students with the opportunity to participate in real-world fintech projects offered by around 30 financial institutions.

Our efforts are bearing fruit, with a sustainable talent pool steadily taking shape. Over 25,000 professionals are now employed in Hong Kong’s fintech sector2 and there is also growing enthusiasm among the younger generation, reflected in the continuous expansion of fintech-related programmes offered by local universities.

Figure 5. Initiatives to expand the fintech-savvy workforce and latest landscape of Hong Kong’s fintech talent

- Nurturing the ecosystem with funding and policies

The continuous growth of the fintech ecosystem is also underpinned by funding and supportive policies. The HKMA rolled out the Fintech Supervisory Sandbox (FSS) 3.0 and 3.1 Pilot to provide funding support for innovative fintech solutions, accelerating commercialisation and promoting wider adoption in the banking industry. Launched in November 2021, FSS 3.0 enabled local technology firms to leverage the Innovation and Technology Commission’s Public Sector Trial Scheme, bridging the gap between research and development, and prototype production. To take it to the next level, we partnered with Cyberport to launch two editions of the FSS 3.1 Pilot to provide development-stage funding support to leading fintech solutions that align with the HKMA’s regulatory mandate, fostering a culture of innovation and encouraging collaboration between fintech companies and banks. To date, the two schemes have collectively approved 18 projects, injecting more vitality into the fintech ecosystem.

Journey Ahead

These targeted efforts not only enable new banking services, but also cultivate a more innovative, inclusive, and resilient ecosystem.

Building on the strong and positive momentum, we are poised to advance to the next phase of our fintech strategy. The “All Banks Go Fintech” journey has achieved success through a blend of targeted initiatives and supervisory guidance. By going the extra mile, we are accelerating responsible innovation, fostering fintech-savvy talent and nurturing a dynamic ecosystem, enabling banks to adopt cutting-edge technologies while maintaining the stability and integrity that define Hong Kong’s financial system.

Our fintech journey has cemented Hong Kong’s position as a global fintech leader3. As technology continues to transform global finance, Hong Kong is ready to spearhead the next wave of innovation, elevating banking to new heights.

Eddie Yue

Chief Executive

Hong Kong Monetary Authority

24 October 2025