Cross-border clearing and settlement linkages have been expanding in recent years, both to satisfy growing demand and in anticipation of future liberalisation.

I am sure readers who often visit the Mainland will have observed the improvements in the physical infrastructure linking the Mainland and Hong Kong. The improvements are clearly necessary for coping with the heavy cross-border traffic in people and goods arising from the rapid economic integration between the Mainland and Hong Kong. What they may not notice are the quiet and rapid developments in the infrastructure linking the financial systems of the Mainland and Hong Kong. These developments have not been motivated so much by existing demand but more by foresight. They were organised ahead of time, in anticipation of, and also in the hope of generating, more traffic of money between the two economies.

Whether we are talking about cross-border trade in goods and services, or cross-border financial intermediation, all cross-border transactions involve cross-border payments, and possibly cross-border clearing and settlement if financial instruments are transacted. Although there are still many restrictions on the Mainland on cross-border and cross-currency flows of funds, these restrictions are likely to be progressively removed. This is the declared intention in the reform and liberalisation of the Mainland, and we can expect free cross-border flows of funds in the fullness of time. It is of strategic importance for Hong Kong, as the international financial centre of China, and hopefully also aspiring to be a domestic financial centre of China, to prepare ourselves well for attracting the monetary traffic our way. I have often emphasised the need to pay attention to the financial infrastructure, to the extent of actively engaging ourselves in the HKMA in designing, building and operating the financial roads and bridges that, for a while, may not have significant traffic at all.

Readers are familiar with the use of cash as a payment medium, particularly for transactions involving small amounts. And this does not require any sophisticated financial infrastructure, other than a mechanism for getting the cash in the two currencies safely back into the respective financial systems, and to uphold the integrity of the banknotes. But there is a clear need for transactions involving large-value payments to be effected in a safe and efficient manner. The use of cheques and, if there is concern about the cheques not being honoured, direct transfers through banks are essential elements in the payment system of any jurisdiction. The cheque clearing lead-time in Hong Kong is among the shortest in the world. Money from cheques presented today will be available for use tomorrow. The direct transfer of funds through the banking system of Hong Kong is also among the most efficient in the world. Since the end of 1996, we have been operating Real-Time Gross Settlement (RTGS), which enables Hong Kong dollars to be transferred and used in real time. (US dollar RTGS was introduced in 2000 and euro RTGS in 2003.)

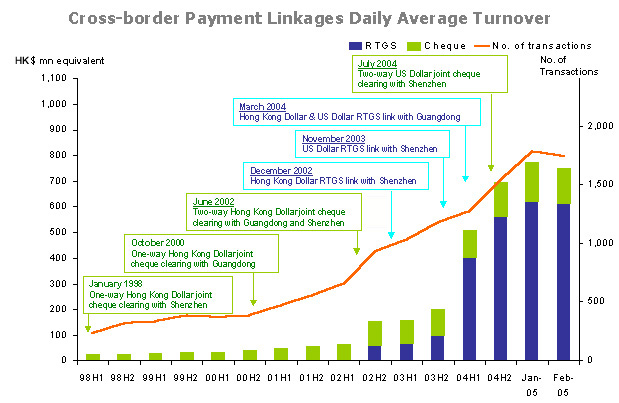

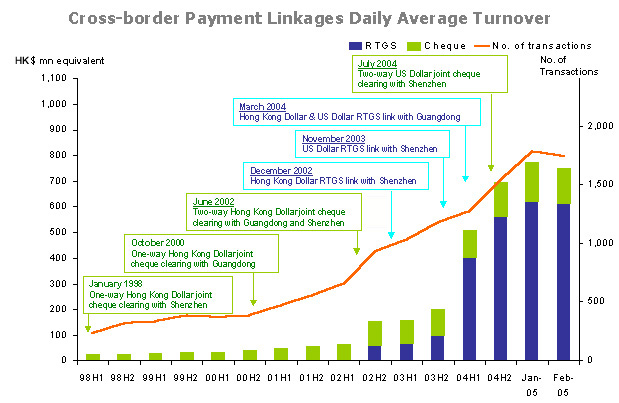

Our priority has therefore been to promote and facilitate the use of these well-established payment methods to effect cross-border large-value transactions between the Mainland and Hong Kong, starting modestly with cheque clearing and extending to Hong Kong dollar and US dollar RTGS. We now have

(a) Hong Kong dollar and US dollar two-way joint cheque clearing between Shenzhen and Hong Kong;

(b) Hong Kong dollar two-way joint cheque clearing between Guangdong Province and Hong Kong;

(c) Hong Kong dollar and US dollar two-way RTGS linkages between Shenzhen and Hong Kong ; and

(d) Hong Kong dollar and US dollar two-way RTGS linkages between Guangdong Province and Hong Kong.

And there is substantial traffic, as the following chart illustrates. The traffic will grow as reform and liberalisation on the Mainland continue and as our offer of similar linkages to other cities is taken up.

Joseph Yam

7 April 2005

Related Information:

Click here for previous articles in this column.

Document in Word format