(Translation)

As part of the design of Hong Kong’s Linked Exchange Rate System (LERS), the weak-side Convertibility Undertaking (CU) was first triggered during London trading hours on 12 April. In line with the LERS mechanism, the Hong Kong Monetary Authority (HKMA) purchased Hong Kong dollars at the rate of HK$7.85 to US$1 to maintain the currency peg. In this connection, I would like to address several frequently asked questions on this subject in the past few days.

Q1: How has the weak-side CU mechanism been functioning since the first triggering?

- Lately we have seen continual capital outflows. Since the weak-side CU was first triggered on 12 April, the HKMA has bought Hong Kong dollars 13 times upon request from banks, totalling HK$51.3 billion. As a result of these purchases, which ranged from HK$800 million to HK$10 billion in size each time, the Aggregate Balance of the banking system has been reduced from HK$179 billion to about HK$128.5 billion.

- The reduction of HKD supply has pushed up local interest rates. As of 23 April, overnight Hong Kong dollar interbank interest rates (HIBOR) rose to 0.15%, up by 9 basis points (0.09%) from 12 April, while one-month HIBOR also rose by 26 basis points (0.26%) to 1.05%. This is exactly how the LERS is designed to operate and is a necessary process in the normalisation of local interest rates. Although the 7.85 weak-side CU was triggered for the first time since its introduction in 2005, the CU transactions were conducted in an orderly manner. The market was functioning normally, reflecting its confidence in the LERS, a regime that is clear, transparent and proven to work well. The HKMA’s repeated communications with the market earlier have also helped market players prepare for the triggering of the weak-side CU.

Q2: Should it be a concern when some HK$50 billion have flown out of the HKD within such a short period of time?

- There’s no need to be worried. In terms of scale, the outflows of some HK$50 billion so far represent only 5% of the total inflows of HK$1 trillion recorded over the past few years. In terms of pace, frequent CU transactions were also seen in the past when the strong-side CU was triggered by capital inflows. For example, the HKMA sold Hong Kong dollars for twelve days in October 2009 upon request from banks, selling as much as HK$26.4 billion in one single day.

- It is understandable that people tend to feel more positive about fund inflows but a bit uneasy when it comes to outflows. We should however recognise that Hong Kong is a fully open economy and financial hub, so it is only natural that funds flow in and out freely. The HKD may strengthen or weaken because of capital inflows or outflows. What really matters is the orderly operation of the LERS as designed, so that the HKD exchange rate remains within the range of 7.75 to 7.85 against the USD, thus maintaining market confidence in the robustness of the monetary and financial systems of Hong Kong.

Q3: That said, people may still worry that continuous outflows will drain the Aggregate Balance of the banking system, sending interest rates higher rapidly.

- Again, there’s no need to be worried. Every time the weak-side CU is triggered and the HKMA buys HKD from the market, the Aggregate Balance will contract by the same amount and local interest rates will go up. The HKD-USD interest rate spreads will gradually narrow, hence reducing the incentive and scale of funds flowing out of the HKD.

- On the other hand, the Aggregate Balance – funds used by local banks to settle daily payments – is only part of the HKD liquidity of the banking system in Hong Kong.

- Currently banks hold about HK$1 trillion worth of Exchange Fund Bills and Notes (EFBNs). The highly liquid EFBNs are part of the Monetary Base in Hong Kong. There is a standing arrangement for banks to use the EFBNs as collaterals to borrow HKD funds at a pre-set discount rate from the HKMA to meet their settlement and payment obligations as needed. The huge amount of EFBNs held by the banking system therefore provides ample buffer that helps reduce excessive volatility in local interest rates.

- As we have explained repeatedly, the HKMA can also increase HKD liquidity in the market by adjusting the issuance size of EFBNs taking into account market conditions and needs. For example, the HKMA can opt to roll over only part of maturing EFBNs. The amount not rolled over will in effect become funding released back to the banking system, adding to the Aggregate Balance and boosting HKD liquidity.

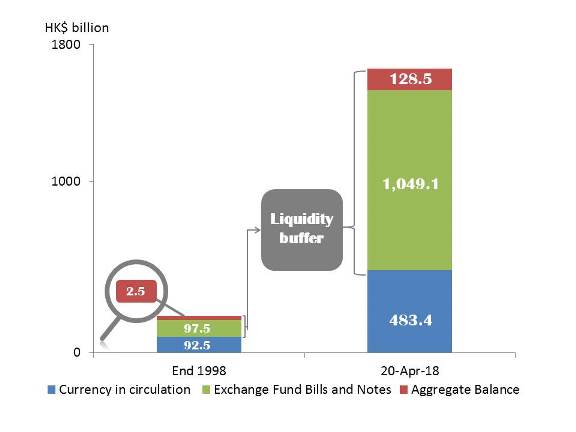

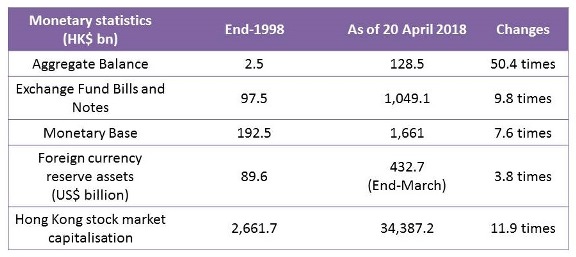

- As at 20 April, the Monetary Base amounted to about HK$1,660 billion, of which the Aggregate Balance accounted for less than 10% while the EFBNs (worth about HK$1,049 billion) accounted for 63%. They provide a strong liquidity buffer that the banking sector can utilise following fund outflows (see Chart 1).

Chart 1: Changes in the Monetary Base

Q4: The HKMA has indicated on several occasions that the Aggregate Balance reduction and fund outflows provide the necessary condition for the normalisation of local interest rates. By how much the Aggregate Balance has to reduce before banks will lift their deposit rates and lending rates?

- In fact before the weak-side CU was triggered, one-month HIBOR had already increased gradually from about 0.2% to 0.8%. Following the triggering, the rate has further increased from 0.8% to 1.05%. However, the timing for local banks to lift their deposit and lending rates will hinge on the future direction of fund flows and changes in the global financial environment. In line with the US Federal Reserve’s indication that it will lift interest rates gradually, the market generally expects a gradual pick-up in US interest rates. Under the mechanism of the LERS, we should expect that local interest rates will follow their US counterparts but its pace should not be too rapid. However, we should also be prepared that local interest rates could experience short-term surge as a result of sharp increases in demand for the HKD owing to month-end or quarter-end effects or large-scale initial public offerings.

Q5: Do the current fund outflows involve any attacks by major international speculators? Has a war in defence of the HKD been started?

- We believe the current outflow of funds from the HKD is mainly driven by carry trades in view of the HKD-USD interest rate differentials. There is no sign of large-scale short-selling of the HKD or attacks of any sort. The HKMA’s recent purchases of the HKD are part of the normal operations under the LERS and should not be taken as a fight with speculative short-sellers. However, the HKMA will continue to monitor the market situation closely and stand ready to take action as appropriate to address any abnormal situations.

Q6: Can Hong Kong cope with any attempts to create havoc in our currency market?

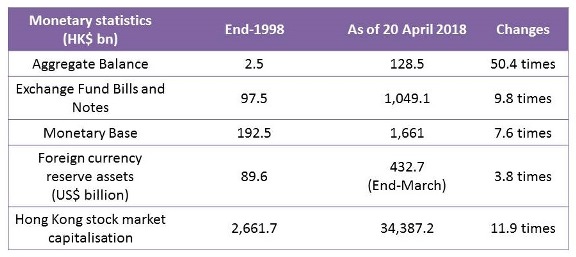

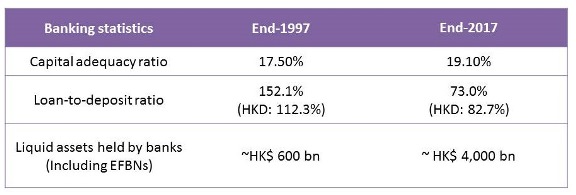

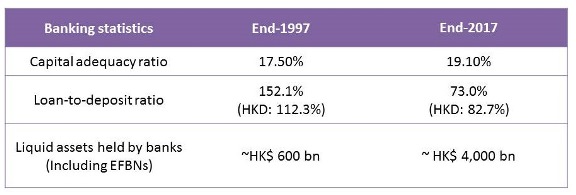

- Many people still have fresh memories of the severe impact and the hard lessons the Asian financial crisis in 1998 had for Hong Kong’s economy and society. However, the Aggregate Balance of the banking system, the HKD Monetary Base, and the foreign currency assets of the Exchange Fund are now multiple times bigger than those 20 years ago (see Chart 2).

- Besides, international financial reforms and more rigorous supervision have been put in place after the global financial crisis in 2008. Under Basel III and various regulations, speculators will find it much harder to borrow as much HKD liquidity as they did 20 years ago in a bid to short-sell the HKD. The Hong Kong stock market is now twelve times bigger than it was back then. To repeat their previous “double play” in the currency and stock markets, speculators will have to be armed with hundreds of billions of Hong Kong dollars. While our resilience to shocks has been significantly enhanced, we will stay vigilant as always to ensure Hong Kong’s monetary and financial stability.

Chart 2: Hong Kong’s resilience significantly enhanced

Norman Chan

Chief Executive

Hong Kong Monetary Authority

24 April 2018