The Hong Kong Monetary Authority (HKMA) announced today that the Central Moneymarkets Unit (CMU) will launch a Securities Lending Programme for private sector debt securities on 1 December 1997. The Programme aims to enhance the liquidity and settlement efficiency of CMU private sector debt securities, and increase their attractiveness to investors by enhancing the yields for the lenders.

Drawing on the success of the market-making system for the Exchange Fund paper, the Programme allows CMU members who are prepared to act as market-makers of private sector issues to borrow securities from other CMU members to cover their short positions. The market-makers will be required to quote two way prices at a reasonable spread during money market hours. The operational framework for the Programme (see technical note at Annex A) has been finalized after consultation with the Hong Kong Capital Markets Association and the Programme will commence operation on 1 December 1997.

"The Programme will enhance the liquidity of CMU private sector debt securities by providing an efficient mechanism to utilise securities held by long term investors for short-term use by the more active market participants," said Mr Joseph Yam, Chief Executive of the HKMA.

The HKMA also announced today that the bilateral linkages between the CMU and the securities depositories in Australia (the Reserve Bank Information and Transfer System for government securities and AustraClear for private sector debt securities) will commence operation on 1 December 1997. Besides helping market development, these bilateral linkages will also help to reduce settlement risk by facilitating cross border delivery versus payment arrangements (see Annex B).

"This is a major step forward for cross border securities linkages in the Region. The linkage of domestic depositories will facilitate the clearing of cross border trades in debt securities in Asia. It will enlarge the investor base and broaden domestic debt markets. It is our objective to set up more of such linkages with other systems in the Region," added Mr Yam.

Besides Australia, the HKMA is discussing with the People's Bank of China and the Reserve Bank of New Zealand on establishing similar linkages with the central securities depositories in the mainland of China and New Zealand.

Hong Kong Monetary Authority

16 October 1997

Annex A

Back to top

SECURITIES LENDING PROGRAMME

Objectives

- To improve settlement efficiency by reducing settlement failures

- To further enhance the liquidity of CMU instruments through the market making process

- To increase the attractiveness of CMU instruments by enhancing yields for lenders

Eligible Securities

- Private sector CMU instruments with minimum issue size of HK$500m or more (102 issues, HK$130bn)

- With at least 1 Market Maker

Participants

Market Makers

Risk Management

- Collateral

- Haircut applied to collateral

- Daily marking to market of loaned securities and supporting collateral

Eligible Collateral

- CMU instruments eligible for Repo under LAF ($195 bn, 1.5 times of eligible securities)

- Except securities issued by borrower or company in the same group

- Cash - to be considered at a later stage

Collateral - Haircut

A haircut of 2% p.a. of remaining maturity subject to:

- a minimum of 10% for Exchange Fund Bills/Notes, Specified Instruments and AAA instruments

- a minimum of 20% for non-AAA instruments

Marking to Market

- Daily mark to market for all loaned securities and eligible collateral

- In case of shortfall, borrowers are required to top up the Collateral by transferring additional eligible securities to the CMU Collateral Account

Operational Framework

Lender:

- Signs the Agreement of Securities Lending and Borrowing Programme

- Opens a Securities Lending Account

- Transfers the lendable securities to its Securities Lending Account via CMT

- Becomes an "automatic lender' - no further consent is required before lending

Borrower:

- Applies to become a market maker

- Signs the Agreement of Securities Lending and Borrowing Programme

- Borrowing request will be processed on a first come first served basis

- Minimum borrowing limit - Nil

- Borrowing limit - 20% of the issue size

Role of CMU as an Administrator:

- Locate the lendable securities

- Collateral management

- Collect income and redemption proceeds from borrowers and reimburse the proceeds to lenders

Return of securities

- Borrower transfers the loaned securities to HKMA's Suspense Account

- Borrower informs CMU the termination of borrowing

- Upon receipt of returned securities, CMU transfers the collateral back to the borrower's main account from the HKMA Collateral Account

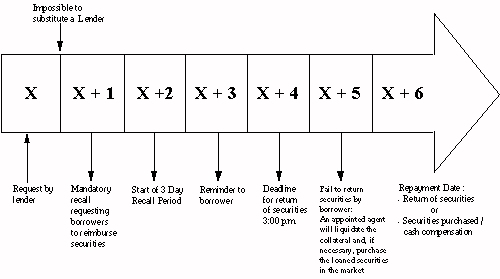

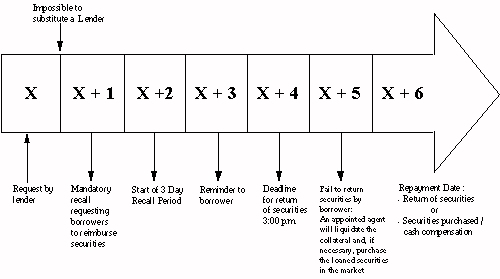

Recall of Loan

- On recall of loan by the lender, CMU will first look for replacement lender(s)

- CMU will recall the loan from the borrower, if no replacement can be found.

- If the borrower fails to return the loaned securities, the lender will have the discretion to:

- ask CMU to liquidate the collateral and use the sale proceeds to purchase the same amount of loaned securities; or

- to accept an equivalent value in cash; or

- to use the equivalent value in cash to purchase Exchange Fund Bills/Notes

Fee

Charge on Borrowers : 2%

Income to Lenders : 1.5%

Income to CMU : 0.5%

Implementation Date

1 December 1997

Enquiries :

Mr. Esmond Lee Tel. 2878 8198

Head (Market Systems)

Hong Kong Monetary Authority

Annex B

Back to top

BILATERAL SECURITIES LINKAGES

Objectives

- To facilitate cross-border holding and trading of debt securities

- To reduce settlement risk of cross-border securities trade by facilitating DvP settlement for cross-border securities transactions

Bilateral Linkage with Australia

- CMU has become a member of Reserve Bank Information and Transfer System (RITS) operated by RBA. RITS provides clearing services for government securities in Australia

- HKMA will become a member of AustraClear by the end of October. AustraClear provides clearing services for private sector debt securities in Australia

- Linkages with RITS and AustraClear will commence operation starting from 1 December 1997

CMU becoming a Member of RITS/AustraClear

- CMU Members can trade and hold Australian debt securities

- CMU will act as custodian of Australian debt securities for CMU Members

Bilateral Linkage with other Systems

- HKMA is discussing with the People's Bank of China and the Reserve Bank of New Zealand on establishing similar bilateral securities linkages with the mainland of China and New Zealand

Enquiries :

Mr. Esmond Lee Tel. 2878 8198

Head (Market Systems)

Hong Kong Monetary Authority