The Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA) announced today that an agreement has been reached with Standard Chartered Bank (Hong Kong) Limited (Standard Chartered) in relation to the bank's distribution of equity linked structured notes issued and guaranteed by Lehman Brothers (LB ELNs) (Notes 1 & 2).

Without admitting liability, Standard Chartered has agreed to make a repurchase offer to eligible customers (Note 3) holding an outstanding LB ELN distributed by Standard Chartered. The total value of the repurchase offer is estimated to be approximately HK$1.48 billion and will cover over 95% of the outstanding transactions in LB ELNs by Standard Chartered customers.

Following an investigation by the SFC and the HKMA, both regulators were concerned that Standard Chartered may have exposed LB ELN customers to higher levels of risk than were suitable for them by not adequately considering concentration risk when assessing the suitability of LB ELNs for customers (Note 4).

"Intermediaries have an obligation to ensure suitability when making a recommendation or advising on securities. Assessing the right level of concentration is a necessary part of the suitability assessment," said the SFC's Chief Executive Officer, Mr Martin Wheatley.

"For example, a person who invests most of his assets in a single investment runs the risk of losing nearly all his money if the investment fails. If the investment is already high risk, this degree of exposure may well be unsuitable," he explained.

"Regulated persons must adopt an appropriate approach to give careful consideration to a customer's concentration risk as well as a number of other factors specific to the customer when assessing customer suitability," said the HKMA's Deputy Chief Executive, Mr Arthur Yuen.

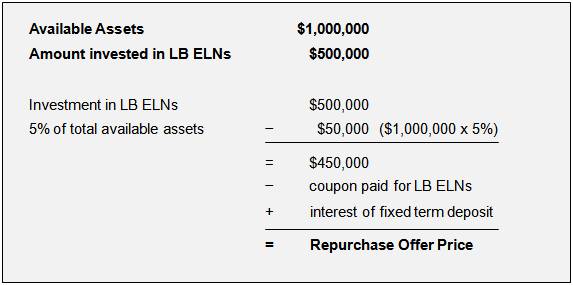

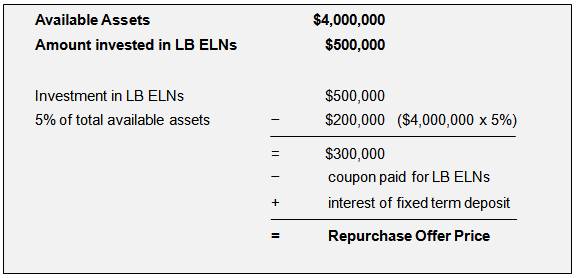

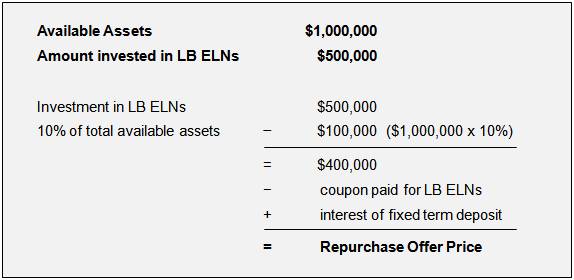

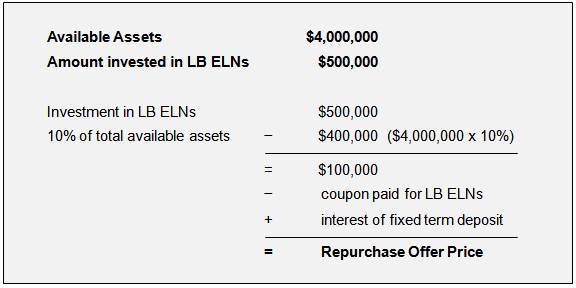

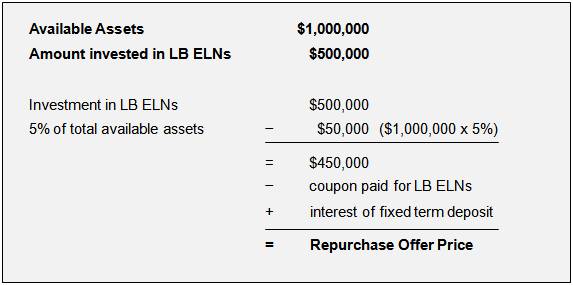

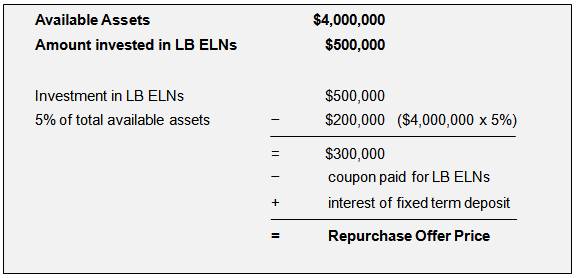

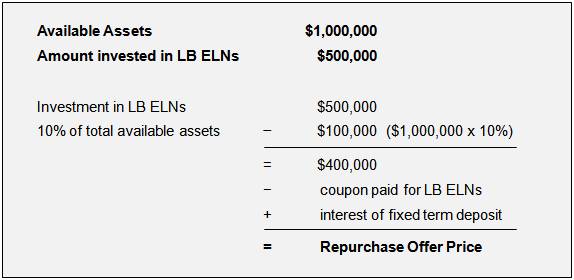

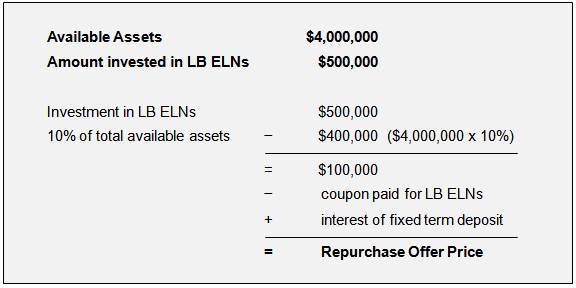

Under the repurchase scheme, Standard Chartered has agreed to make the repurchase offer at a price equal to the total value of each eligible customer's investment in outstanding not principal protected LB ELNs less 5% (or less 10% in the case of customers holding principal protected LB ELNs) of each customer's total assets held at or with Standard Chartered at the end of the month immediately preceding the date of the purchase of the outstanding LB ELNs or , the amount invested in LB ELNs (whichever is higher) (Available Assets)(Note 5).

The repurchase offer price will exclude the amount of coupons already paid to the customer but include an additional amount representing the interest that would have been earned if the amount invested in LB ELNs that is over 5% or 10% of the customer's Available Assets (as the case may be) had been invested with Standard Chartered on a fixed term deposit instead of being invested in LB ELNs (Note 6).

Under the repurchase scheme, Standard Chartered will also pay top up payments to those customers with whom Standard Chartered has already entered into settlement agreements but would otherwise have been eligible to receive a repurchase offer to the extent that such payments are needed to ensure those customers are treated in the same way as other customers participating in the repurchase scheme.

Under the agreement, Standard Chartered will notify customers of their eligibility within 10 calendar days from today's date and send the repurchase offer or the offer of a top-up payment to each eligible customer within five weeks of that first letter. Eligible customers will have 60 days to accept the repurchase offer and Standard Chartered will make the repurchase payment within 30 days of each eligible customer's acceptance of the repurchase offer.

In entering into this agreement under section 201 of the Securities and Futures Ordinance, the SFC took into account that:

- the total value of the repurchase offers under the repurchase scheme that will be made available to eligible customers who invested in LB ELNs at levels in excess of 5% or 10% of their Available Assets;

- although LB ELNs were high risk products, they were less complex than Minibonds and likely to have been suitable products for most customers as part of a diversified portfolio;

- unlike Minibonds, there is no distributable collateral for the LB ELNs;

- as unsecured creditors there is little chance LB ELN holders will receive a substantial payment or dividend in the Lehman Brothers bankruptcy so the payments from Standard Chartered may be the only possible return for eligible customers (Note 7).

- the repurchase offer will enable the vast majority of Standard Chartered's LB ELN customers to obtain a reasonable recovery without the costs and associated risks of separate litigation;

- the agreement will bring the LB ELN matter to an appropriate end for the benefit of Standard Chartered and its customers who participate in the repurchase scheme;

- a result on these terms could not have been achieved through disciplinary action by the SFC against Standard Chartered and/or its officers and employees; and

- Standard Chartered has undertaken to engage an independent reviewer, to be approved by the SFC and HKMA, to review its systems and processes relating to the sale of unlisted structured investment products, to report to the SFC and the HKMA and will commit to the implementation of all recommendations of the independent reviewer.

The SFC and the HKMA consider that Standard Chartered's repurchase scheme is reasonable and appropriate in light of their regulatory concerns and the agreement is in the public interest.

"The obligation to ensure suitability when advising or recommending a securities product to a customer is a cornerstone of investor protection in Hong Kong. This outcome serves as an important reminder that concentration risk is a necessary element in assessing suitability," Mr Wheatley said.

"The HKMA welcomes the resolution. The HKMA believes that this resolution is a reasonable and practical one and is in the interests of investors and in the public interest. Eligible customers are encouraged to consider the offers positively," Mr Yuen said.

In view of the repurchase scheme, the SFC will not take disciplinary action against Standard Chartered and its current or former officers or employees in relation to the distribution of LB ELNs, save for any acts of dishonesty, fraud, deception or conduct that is criminal in nature. The HKMA has also informed Standard Chartered that it does not intend to take any enforcement action against their executive officers and relevant individuals in connection with the sale of LB ELNs to customers who have accepted the repurchase offers or the top-up payments under the repurchase scheme, except for any acts of dishonesty, fraud, deception or conduct that is criminal in nature.

Securities and Futures Commission

Hong Kong Monetary Authority

1 March 2011

Notes:

- Standard Chartered is an institution registered under the Securities and Futures Ordinance to carry on business in Type 1 (dealing in securities), Type 4 (advising on securities), Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activities.

- LB ELNs were unrated structured notes that paid fixed and variable coupons in reference to the price of a stock or a basket of stocks and pursuant to a formula set forth by the issuer. Maturities ranged from six months to three years. The value of the LB ELNs would increase or decrease based upon the performance of the reference stocks. In certain instances based upon the performance of a referenced stock, an investor might be required to accept physical delivery of the worst performing referenced stock in redemption of the note resulting in a full or partial capital loss.

LB ELNs were also subjected to the credit risks of Lehman Brothers and one of its subsidiaries as guarantor and issuer.

The value, if any, of the outstanding LB ELNs is fully dependent on the outcome of bankruptcy proceedings concerning Lehman Brothers and its subsidiaries, which commenced in September and October 2008 and are ongoing. Accordingly, no current assessment can be made as to the prospects for payment to holders of the outstanding LB ELNs.

Standard Chartered sold over HK$5 billion worth of LB ELNs between August 2006 and June 2008 of which HK$2.19 billion worth remains outstanding. The 2,515 outstanding LB ELNs are held by 2,234 individual customers.

- The repurchase offer is targeted at retail customers. The repurchase offer is available to all Standard Chartered customers holding outstanding LB ELNs who invested more than 5% of their Available Assets in not principal protected LB ELNs or 10% of their Available Assets in principal protected LB ELNs at the time of the purchase of the LB ELNs. The offer will exclude corporations (other than a corporation where the suitability assessment was based on an individual's circumstances rather than the corporation's, charities and not for profit organisations), professional investors, customers of The Standard Chartered Private Bank (the private banking division of Standard Chartered) and those who did not purchase the LB ELNs from Standard Chartered.

- Concentration risk is the risk that a customer's available assets for investment are overly-exposed to the same set of risks, with the result that, if the investment fails, the total loss for the customer is much heavier than would be the case if the customer's investments were more suitably diversified.

Most customers who will be eligible to receive a repurchase offer are holding not principal protected LB ELNs. Only about 3% of eligible customers are holding principal protected LB ELNs.

- In the case of not principal protected LB ELNs, the repurchase price will be calculated as follows:

In the case of principal protected LB ELNs, the repurchase price will be calculated as follows:

- The calculation of the interest is based on the value of the customer's total investment in outstanding LB ELNs less the coupon payments and less the relevant concentration risk limits, using the average of interest rates actually paid by Standard Chartered on a 12-month fixed term deposit, which are the highest rates across different maturities for fixed term deposits, for the period between the date of purchase of the relevant LB ELNs and 31 January 2011, to be paid up to 31 March 2011.

- In the unlikely event that it is determined at a later date that a customer accepting a repurchase offer would have received a greater amount as an unsecured creditor in the Lehman Bankruptcy, Standard Chartered will pay the difference to that customer, such that no customer shall be disadvantaged by participating in the repurchase scheme.

- Please follow this link for a set of questions and answers about the proposed repurchase scheme by Standard Chartered.