(Translation)

Following the commencement of the Payment Systems and Stored Value Facilities Ordinance (Ordinance) in November last year, work pertaining to the licensing of stored value facilities (SVFs) is currently in full swing. “Smart Ambassador” interviewed Mr Henry Cheng, Executive Director (Monetary Management) of the HKMA, on the philosophy behind the supervision of the SVFs.

H: Henry

S: Smart Ambassador

- S:

- Henry, can you tell us about the progress of the licensing of payment facilities?

- H:

- First of all, I would like to clarify that not all payment facilities have to obtain licence from the HKMA. The HKMA is responsible for the supervision of the SVFs, and the first batch of SVF licences will be announced soon.

- S:

- Why does the HKMA only supervise the SVFs?

- H:

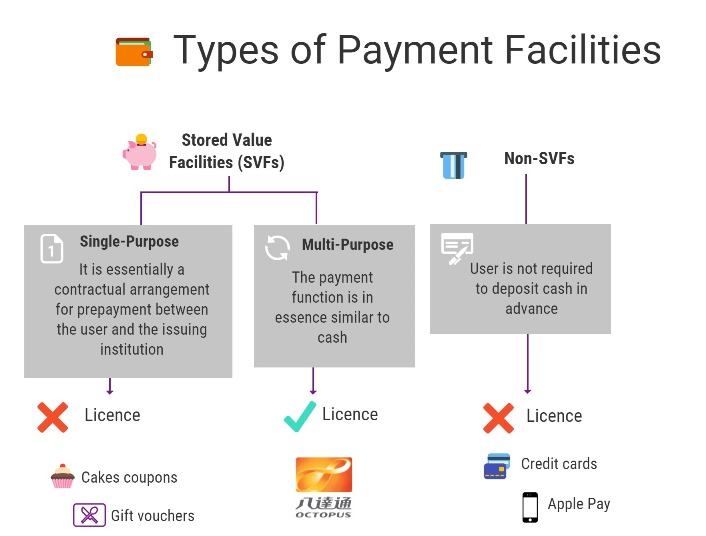

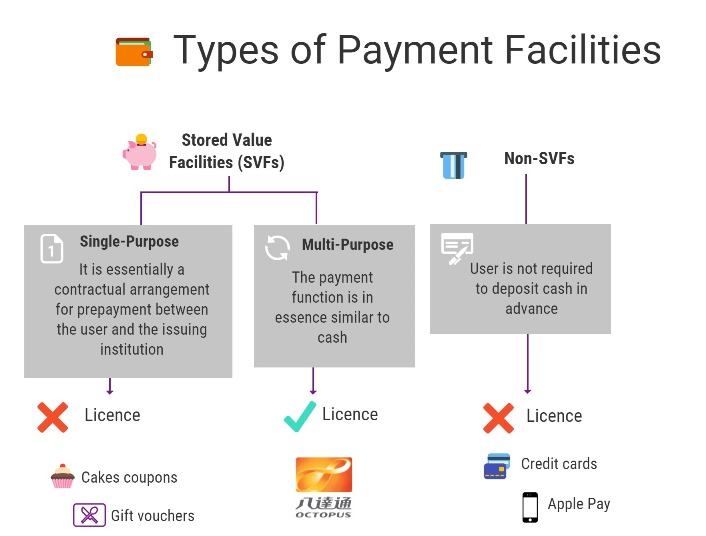

- Currently, there is a wide range of electronic payment facilities available on the market, but they can be broadly classified into two types, namely stored value and non-stored value (see diagram). For SVFs, consumers have to deposit money into their SVF accounts in advance for subsequent deduction of money in any transaction using the SVFs. Unused portion of the money in the accounts will be held by the SVF operators. Octopus card is an example under this category. As for non-stored value payment facilities such as credit cards and Apple Pay, consumers are not required to deposit money in advance.

- S:

- So Apple Pay is not within the scope of HKMA’s supervisory regime?

- H:

- Many people may be under the impression that Apple Pay is an SVF requiring a licence from the HKMA. However, referring to my earlier explanation about the classification of various types of payment facilities, Apple Pay users make payment by transmitting their encrypted credit card information to the merchants via their mobile phones, without performing any stored value function, so Apple Pay is not required to obtain an SVF licence from the HKMA.

- S:

- I see. That means the HKMA’s supervisory focus is on the payment facilities’ stored value function. Why is there such philosophy?

- H:

- Let me ask you a question first – why does the HKMA supervise banks?

- S:

- It is because one of the basic functions of banks is deposit taking. The HKMA has the responsibility to promote the stability and safety of the banking system to protect bank deposits.

- H:

- You are right. SVF operators may not specify the term “stored value” directly but if you carefully think about it, SVF customers have to deposit money into their SVF accounts with the operators before using the SVFs. This is similar to depositing money into banks. Therefore, it is important to ensure the safety of the float and the soundness of the operators.

- S:

- But SVF operators are not banks after all. If the HKMA supervises SVFs in the same way as it supervises banks, won’t the development of fintech in Hong Kong be hindered?

- H:

- We attach great importance to promoting fintech development in Hong Kong, and are minded to avoid over-regulation in order not to stifle the further development of the industry. Let’s take the SVFs as an example. Although the stored value function of SVFs is similar to deposit taking by banks, ultimately SVFs are just a means of payment but not a savings account. The public’s expectations towards the SVFs and banks are therefore different. Let me ask you, Smart Ambassador – will you put as much cash in your wallet as in your safety vault?

- S:

- Of course not! I will only bring an amount of cash that meets my actual needs. I never carry a lot of cash in my wallet. After all, wallet is one of my personal belongings that may be stolen or lost easily. Although a safety vault is not risk-free, it is more secure and I can place more valuable items in it.

- H:

- In fact, many people would take banks as their personal safety vaults, depositing most of their savings into the banks. The banks would make use of the deposits for lending to others. This mode of operations would involve risks including credit risk and interest rate risk. Any signs of trouble in a bank may shake public confidence in the banking system. Any major disruptions to the operation of the banking system would affect the whole society. As for SVFs, they are like our wallets. While carrying money, everyone should be like you that the amount of money to be placed with the SVFs should depend on the actual payment needs. When supervising “wallets”, the HKMA would seek to strike a reasonable balance between security and convenience to consumers.

- S:

- The HKMA’s supervisory approach in relation to fintech is “risk-based” and “technology-neutral”. How does this apply to the supervision of SVFs?

- H:

- In developing and implementing our regulatory policies on the SVFs, we adopt a “risk-based” principle to ensure that the licensees will put in place appropriate risk management systems to commensurate with the risk nature and operations of their businesses. The “technology-neutral” principle means that we will not specifically require SVF operators to use or not to use a particular technology for the operation of the payment facilities.

- S:

- Why can’t high-tech products be subject to less stringent regulations?

- H:

- Suppose there’s one of the world’s most cutting-edge SVFs but it is poorly run and goes bust, with the float of consumers all gone. Will you, Smart Ambassador, consider NOT claiming back your money or complaining on the grounds that SVFs are high-tech products?

- S:

- Of course not!

- H:

- Well, striking a balance between promoting financial technological innovation and protecting interests of consumers is an important policy objective in our supervision of the SVFs. In considering the licence applications of SVFs, our key focus is to ensure that the relevant systems are operated in a safe and efficient manner. The technology adopted is not a major consideration.

- S:

- Now that I understand the philosophy for the supervision of the SVFs, can you tell me how you are going to implement the supervision of SVFs?

- H:

- Let’s look at the protection of users’ float as an example. We require the operators to keep the float separate from their own funds and put in place effective internal control measures and procedures, so as to prevent the float from being affected by any operational risk.

- S:

- Can operators invest the float of users?

- H:

- Yes, but prior approval must be obtained from the HKMA for using those sums for investment. Besides, the float may only be invested in liquid and low-risk assets. SVF operators are also prohibited from offering interest or interest-like incentive schemes to lure their users to depositing excessively large sums of float.

- S:

- Apart from the float, what other aspects have to be supervised?

- H:

- On risk control and management, operators should have in place adequate security measures and internal controls to ensure the confidentiality and completeness of payment information, as well as the safety and effectiveness of their operating systems. Besides, they have to comply with the relevant requirements on anti-money laundering and counter-terrorist financing.

- S:

- The transitional period of the Ordinance will expire on 12 November. What should consumers pay attention to?

- H:

- If SVF operators withdraw from the market before the end of the transitional period due to commercial or other reasons, they must return the float to their customers. The HKMA will maintain close contact with the operators to minimise any inconvenience caused to their customers. Meanwhile, users need to figure out whether their SVFs are legally operated in order to protect their own rights and benefits. More importantly, in any case, they should avoid loading too much money onto their payment facilities.

Written by Smart Ambassador

Smart Ambassador, a staff at the HKMA, is inquisitive and will share with you from time to time the tips on using banking and financial services in a smart and responsible manner