(Translation)

The Bank for International Settlements (BIS) announced the results of the triennial survey on foreign exchange and derivatives market turnover last week. The results showed that the average daily turnover of foreign exchange transactions and over-the-counter (OTC) interest rate derivatives in Hong Kong increased by 18.2% to US$302.5 billion in April 2013 as compared with US$256.0 billion in the previous survey conducted in April 2010.

It is worth noting that among the foreign exchange activities, trading between the renminbi and other currencies grew significantly in the past three years and accounted for 17.8%1 of total average daily turnover, close to the 18.2% share2 of trading between the Hong Kong dollar and other currencies. The increase in foreign exchange transactions involving the renminbi is mainly driven by the rapid development of Hong Kong’s offshore renminbi market. However, some commentators have suggested that this is an indication of the Hong Kong dollar being marginalised. Perhaps these commentators have overlooked some of the characteristics of Hong Kong as an international financial centre. In an inSight article published in May 2011, I pointed out that currency “marginalisation” occurs when residents, for whatever reasons, lose confidence in their own currency. As a result, residents would prefer to use a foreign currency as a means of payment in domestic transactions, such as daily spending, salary payments and property transactions. Therefore, it is inappropriate to conclude that the Hong Kong dollar is being marginalised just by looking at changes in foreign exchange turnover.

Hong Kong is a small economy. Although the Hong Kong dollar is a freely convertible currency, its use in international trade and its turnover in the foreign exchange market is linked to the size of our economy. Therefore, the growth of foreign exchange turnover involving the Hong Kong dollar hinges on the growth of our real economy. However, as an international financial centre, trades involving other foreign currencies can increase at a faster pace. As Hong Kong has developed into the world’s largest offshore renminbi centre in the past few years, the turnover of foreign exchange trades involving the renminbi and its share in our total foreign exchange turnover continue to grow. This is a great achievement, and should not be mistaken as marginalisation of the Hong Kong dollar. The situation in other international financial centres with a relatively small economy is similar. For example, in London, the trading of the pound sterling against other currencies only accounted for 14%3 of its total foreign exchange turnover. And in Singapore, the trading of the Singapore dollar against other currencies only accounted for 8.2% of its total foreign exchange turnover. As in the case of the Hong Kong dollar, the pound sterling and the Singapore dollar saw their shares of turnover in their respective local foreign exchange market decrease over the past three years. Yet we cannot say that these two currencies are being marginalised.

Whether a currency has been marginalised in its own jurisdiction actually hinges upon the confidence of the local residents. In other words, are they willing to continue to use it as a means of payment and storage of value? In this connection, the confidence of Hong Kong people in the Hong Kong dollar is very strong. Alongside an expansion in our renminbi banking business, renminbi deposits in Hong Kong banks have grown an impressive 11 times since the end of 2008, reaching RMB695 billion at the end of July 2013. They now account for about 10% of the total deposits in the local banking system. But during this period, Hong Kong dollar deposits also rose 38% to HK$4,179 billion, or about 50% of total deposits, which is an average ratio for the past 20 or 30 years. This suggests that the renminbi deposits are not growing at the expense of Hong Kong dollar deposits. In fact, our foreign currency deposits have always accounted for around 50% of the total deposits in our banking system, which is similar to situations in other international financial centres such as the UK and Singapore.

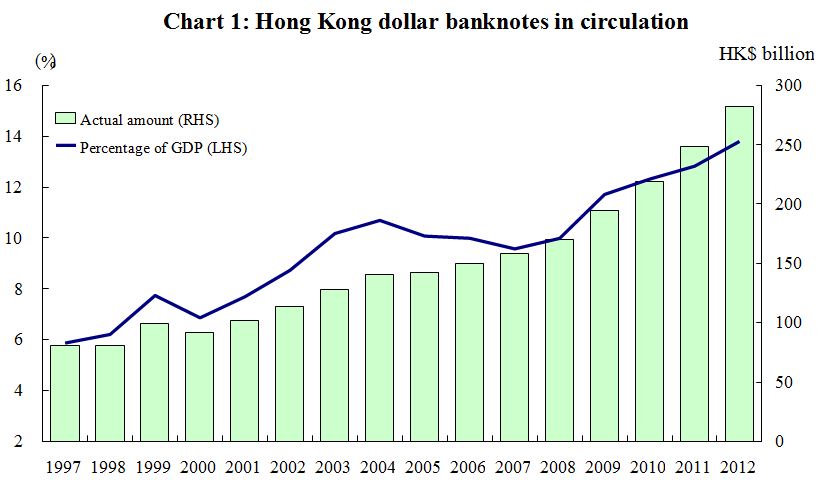

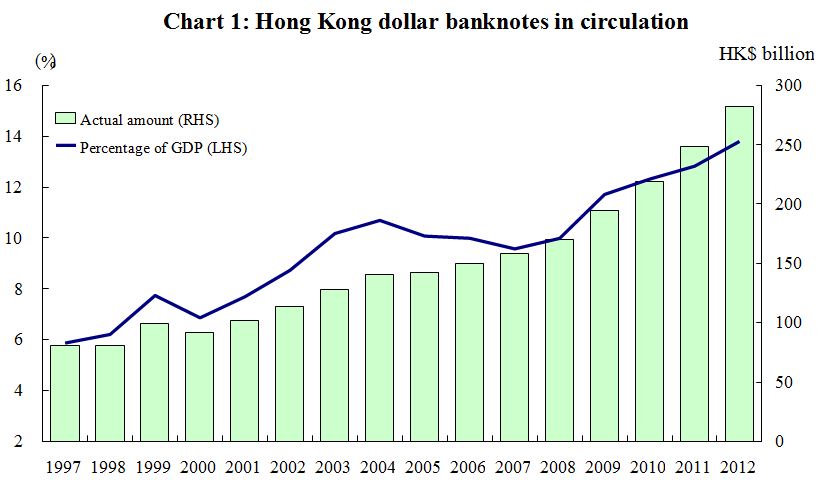

While the circulation of renminbi currency in Hong Kong increases as we receive more and more visitors from the Mainland, the demand for the Hong Kong dollar has continued to grow in the past 12 years. Even with the growing use of various means of electronic payment, the circulation of Hong Kong dollar currency rose from HK$108 billion at the end of 2001 to HK$292 billion at the end of 2012. The ratio of Hong Kong dollar currency in circulation to Hong Kong’s GDP also grew from 8% to 14% (Chart 1) in the same period. This clearly shows that the use of the Hong Kong dollar is not shrinking at all. Indeed, Hong Kong’s currency-to-GDP ratio was higher than some other international financial centres such as the UK and Singapore, which stood at 4% and 8% respectively. This reflects a strong external demand for the Hong Kong dollar. We believe that it has much to do with the increasing economic integration between Hong Kong and the Mainland, which results in a higher demand from Mainland people for the Hong Kong dollar currency.

In an international financial centre such as Hong Kong, market participants may choose any currency for their financial transactions. At the HKMA we have strived to facilitate transactions in various currencies by building the necessary US dollar, euro and renminbi real-time gross settlement systems. As Hong Kong consolidates its position as a global hub for offshore renminbi business, it is only natural that more financial transactions will involve the renminbi and other foreign currencies. But we do not need to be overly concerned about this trend. After all, foreign exchange transactions are but one of the many types of financial activities. The volume of foreign exchange transactions alone tells little about the overall competitiveness or success of an international financial centre. We should be mindful of this when we look at the relevant figures.

Norman T.L.Chan

Chief Executive

Hong Kong Monetary Authority

13 September 2013

1 The figure included the turnover of renminbi against the US dollar and Hong Kong dollar. The turnover of renminbi against other currencies was negligible.

2 The figure included the 17.2% share of the trading between the Hong Kong dollar and the US dollar and the 1% share of the trading between the Hong Kong dollar and other foreign currencies.

3 The figure included the turnover of pound sterling against US dollar and euro only. The data on the turnover of pound sterling against other foreign currencies were not released but should be relatively small.